Fantom price is dependent on its investors to prevent another potential downtrend

- Fantom price is hovering above $0.2949, an important support level, falling below which has triggered huge losses in the past.

- FTM holders that exited in bulk last month are recovering at an exceptional pace, building the foundation for a bounce.

- Fantom also shares a high correlation of 0.81 with Bitcoin, further preventing a decline as the latter trades around $30,500.

Fantom price was on a path of recovery as the altcoin was slowly but consistently painting green on the charts. This was interrupted over the past 24 hours when the broader market cues reached the cryptocurrency, leaving FTM now reliant on its investors, who are making a comeback.

Fantom price nears a critical level

Fantom price trading at $0.2987 is standing just above the support level at $0.2949 after testing the 50-day Exponential Moving Average (EMA) as resistance on Wednesday. This support level is crucial to FTM, as a failed defense in the past has resulted in a steep drawdown.

FTM/USD 1-day chart

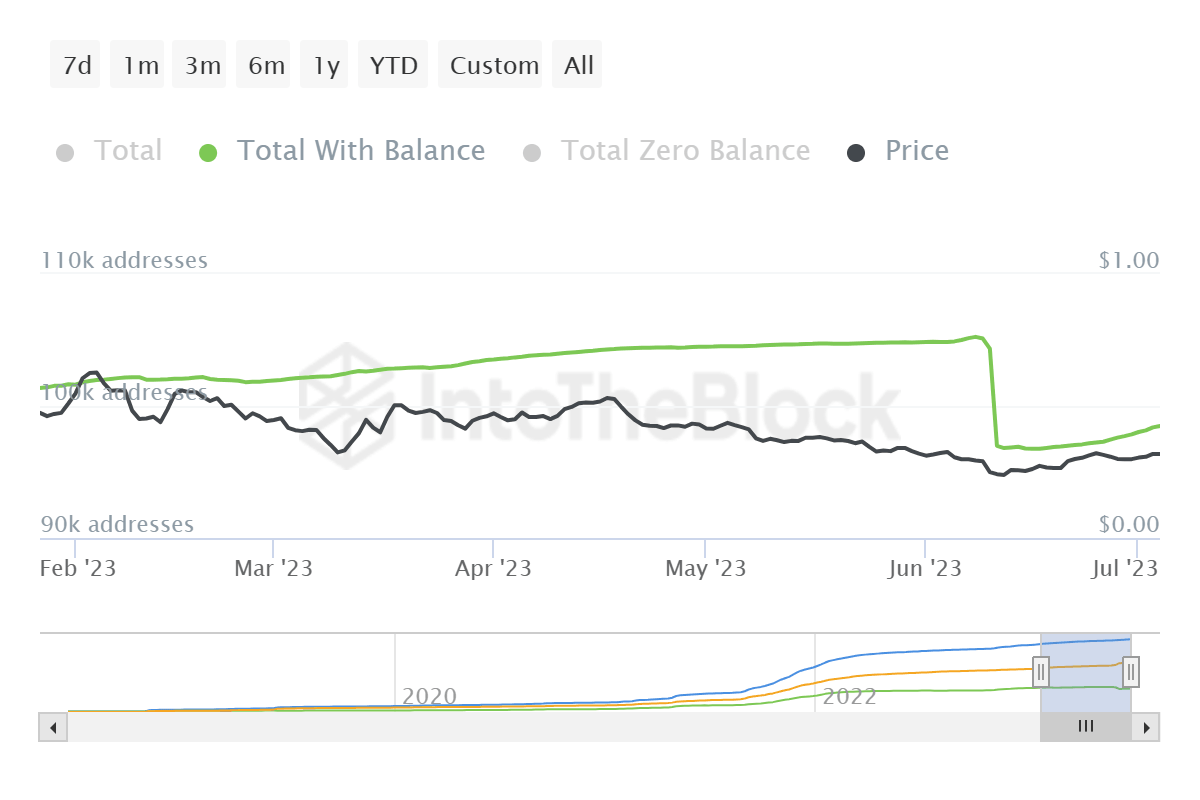

Thus it is necessary for Fantom price to not only prevent a decline below $0.2949 but also to bounce above. Since the broader market is not presenting any clear direction for the altcoin, the price action is now reliant on its investors. FTM holders noted a stark fall in their numbers at the beginning of June when over 9k addresses exited the market within 24 hours.

The recovery right after was slow initially but picked up pace in the second half of June and has since registered the addition of more than 2k new addresses. To put this rate into perspective, throughout Q1, Fantom’s total addresses grew by just 3k in 3 months, whereas the network added over 2k addresses in less than a month.

Fantom total addresses

Thus a quick recovery in investor numbers would also result in a rise in transactions conducted across the network. Furthermore, since traders and analysts are expecting a bullish outcome from the crypto market at the moment, investors could be looking at accumulation.

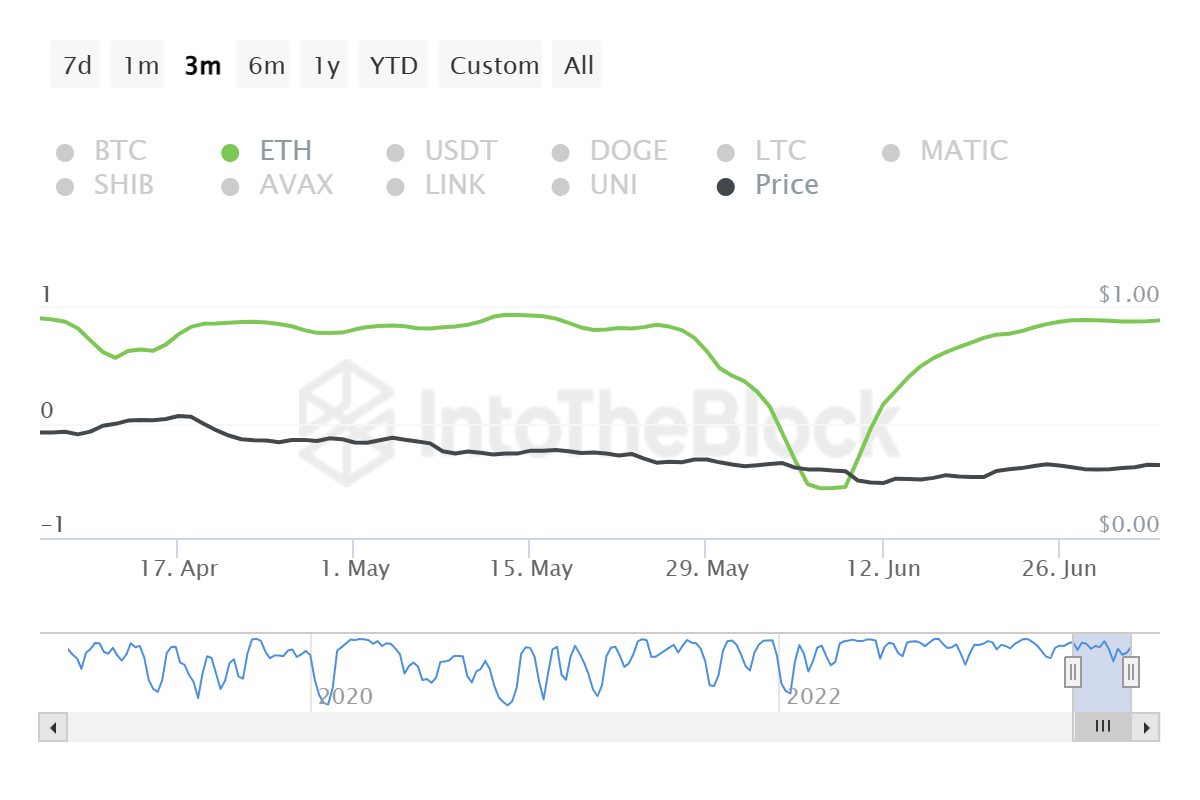

This would consequently be bullish for the price, keeping the cryptocurrency from observing any major correction. Additionally, the altcoin shares a high correlation of 0.81 with the leader of cryptocurrencies, Bitcoin.

Fantom correlation with Bitcoin

A high correlation would act in favor of Fantom price as Bitcoin price is currently cemented above $30,000. As long as this crucial support level is maintained, BTC is safe from sudden declines and also more likely to bounce above $31,000, in turn potentially enabling recovery for FTM as well.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.