Fantom price action mixed but bulls still in control, FTM targets $4

- Fantom price is trading over 23,000% higher from November 2020.

- Fantom has traded higher by as much as 254% between September and November 2021.

- Consolidation of Fantom price could be a continuation setup.

Fantom price is one of the biggest surprises of 2021. Nothing seems to be in the way of Fantom continuing to push on towards new all-time highs. The current consolidation likely shows a market that is moving into equilibrium with time instead of price. The overall trend remains bullish, despite some short-term selling pressure.

Fantom price likely to continue its outperformance of the broader cryptocurrency market

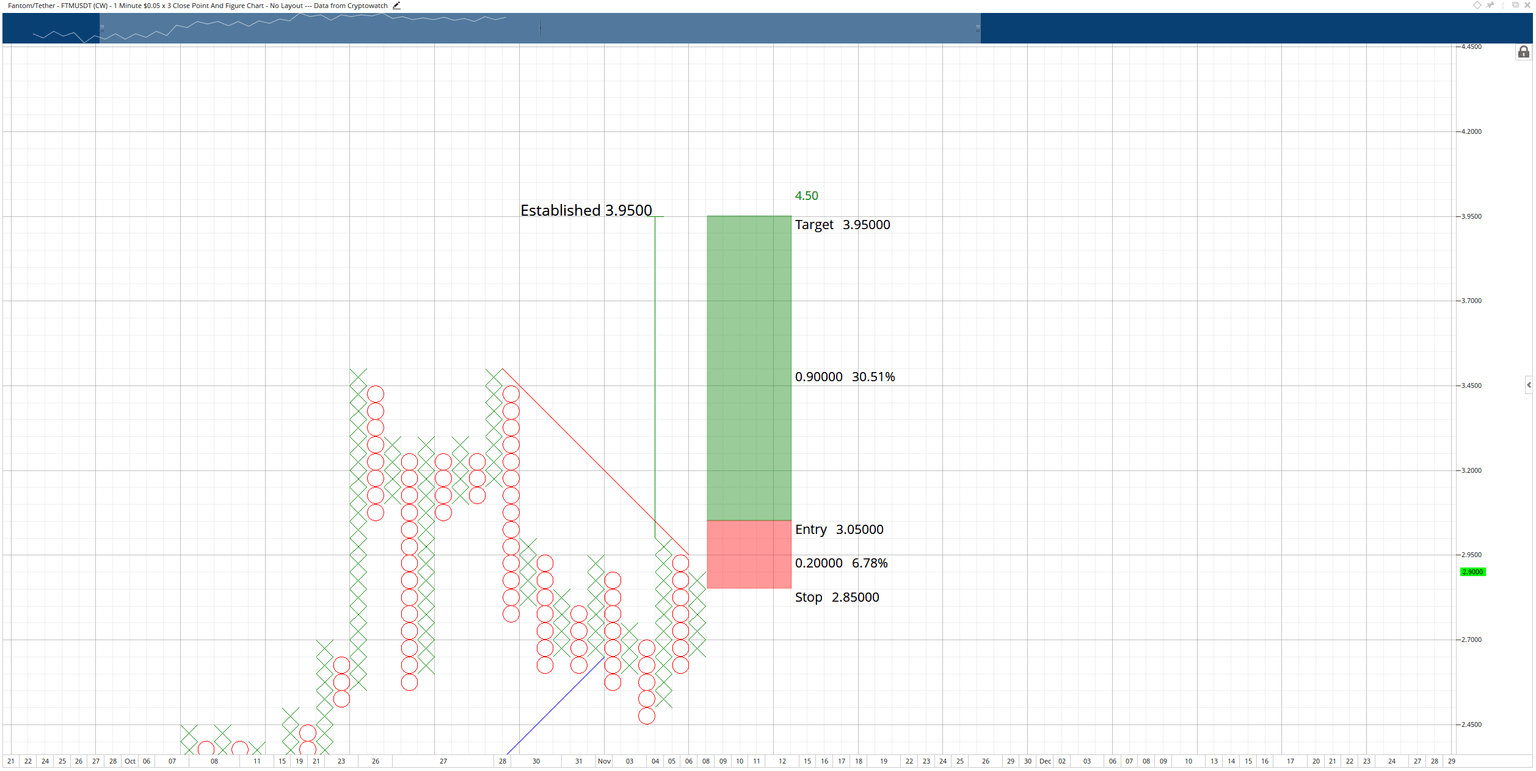

Fantom price has two trade opportunities, one for the long side of the market and one for the short side. On the long side, the theoretical trade idea is a buy stop order at $3.05, a stop loss at $2.85 and a profit target at $3.95. The entry would simultaneously confirm the break of a split triple-top as well as a break of the bear market trendline (red diagonal line). The profit target is based on the Vertical Profit Target Method from the previous column of Xs.

FTM/USD $0.05/3-box Reversal Point and Figure Chart

Invalidation of the long setup would occur if the following short trade idea were activated.

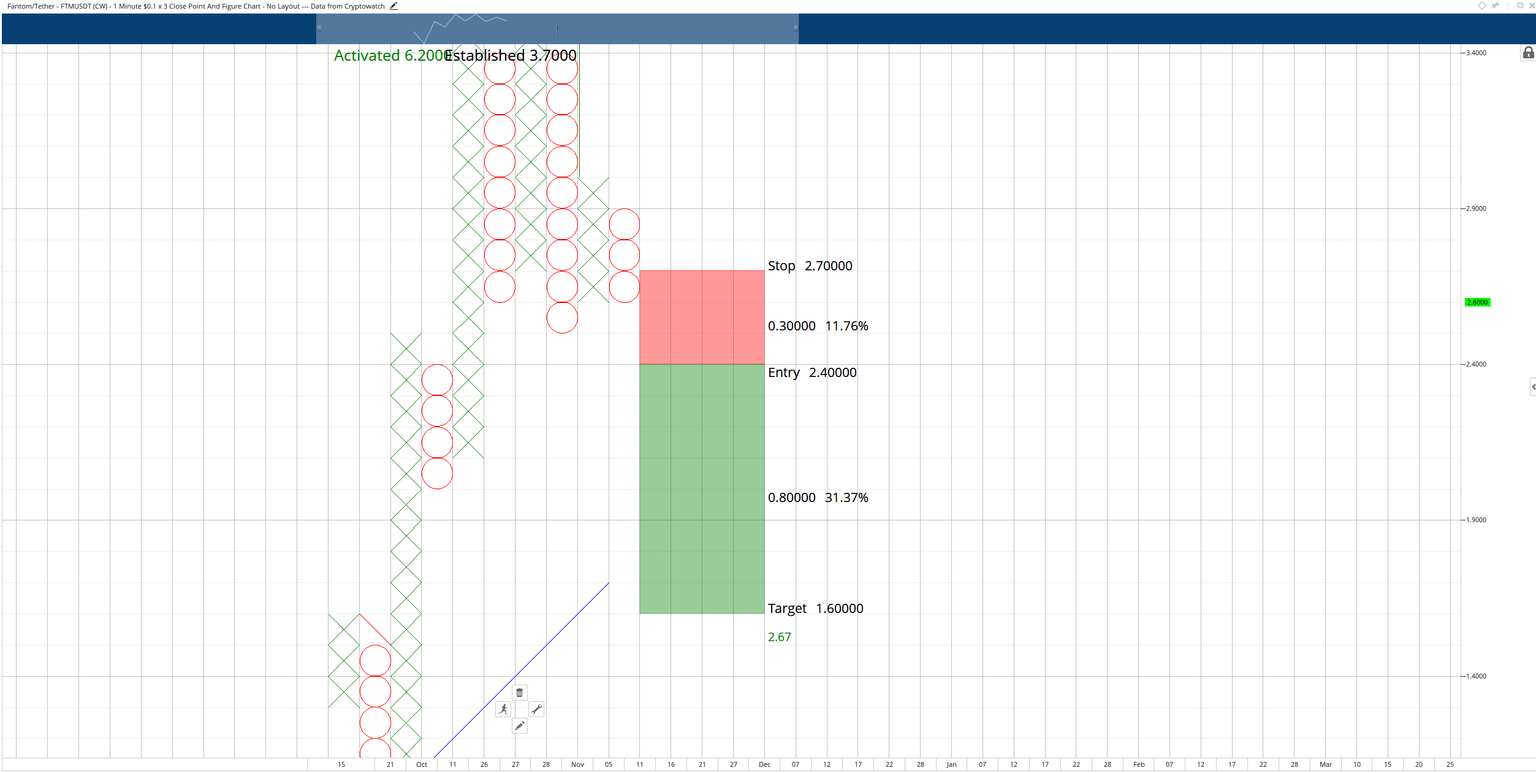

On the short side of the market, the hypothetical trade setup is a sell stop order at $2.40, a stop loss at $2.70, and a profit target at $1.60. The short setup is the least likely to occur. While the Vertical Profit Target Method does imply a low below the $1.60 level, there is a high volume node and the bull market trendline near $1.60, which will likely act as support.

XRP/USD $0.10/3-box Reversal Point and Figure Chart

Invalidation of the short entry would occur if a new column of X's formed and moved above $3.40.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.