- Fan tokens of football clubs like Barcelona and Manchester have made a comeback with 262% weekly gains in OG coin.

- Lawyer Liu Yang told Chinese journalist Wu Shuo that Hong Kong-based trading circles are likely driving the price rally in fan tokens.

- Similar traders were involved in the release of OKLink’s stablecoin USDK and Tornado Cash’s TORN price rally.

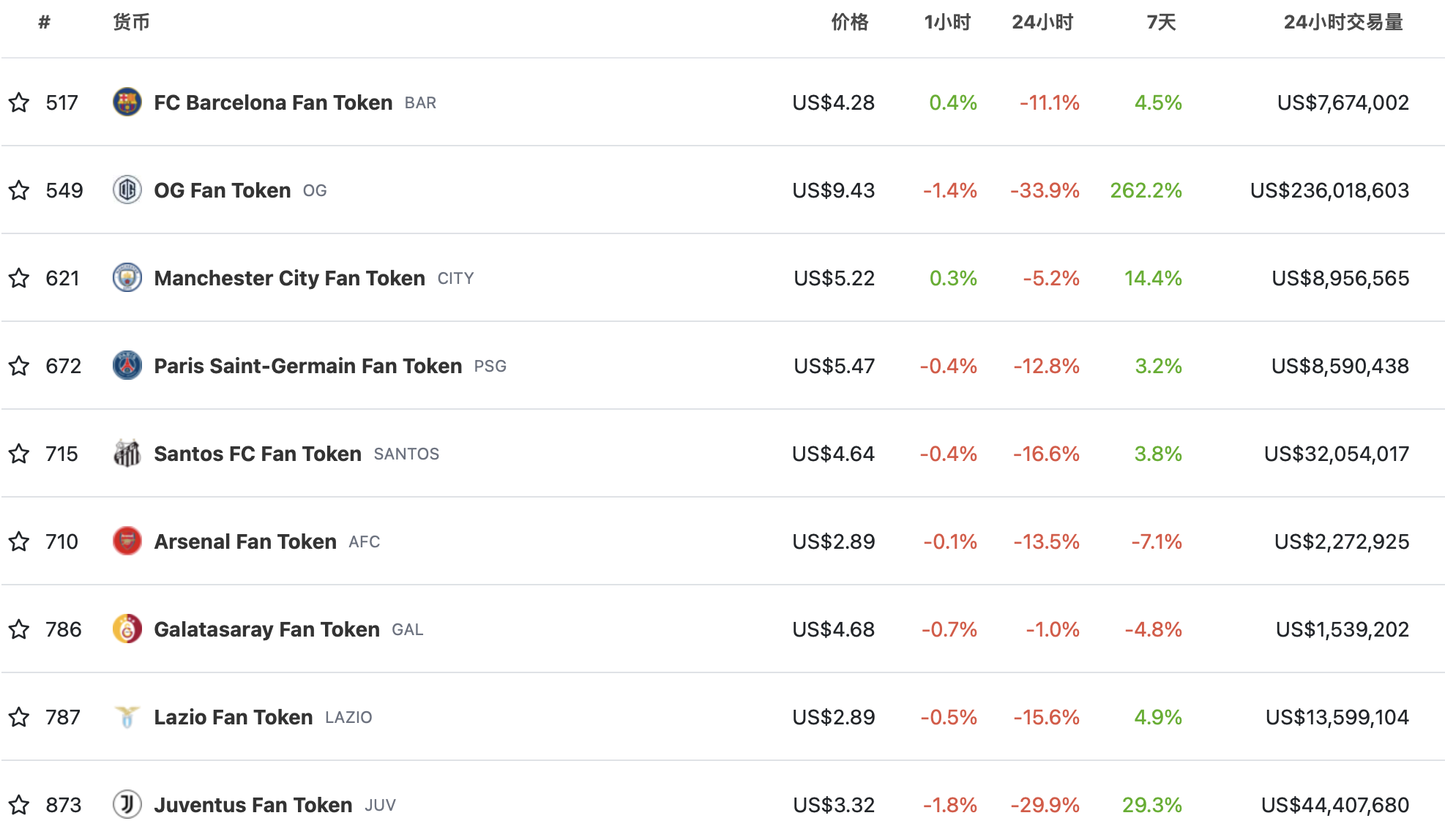

Fan tokens or digital assets that offer exclusive benefits to fans of football clubs have yielded double-digit gains to holders over the past week. OG Fan token (OG) offered 262% gains to holders over the past week alongside Manchester City Fan Token (CITY), FC Barcelona Fan Token (BAR) and Juventus Fan Token (JUV).

Lawyers believe the price rally in fan tokens can be attributed to trading circles based in Hong Kong and these gains are likely to be unsustainable in the long-term.

Also read: Ethereum Shapella upgrade is less than two days away, here's where ETH price is headed

Fan tokens yield double-digit gains for holders led by OG coin

Wu Shuo, a Chinese journalist reported on the massive price rally in OG Fan Token that yielded 262% gains for holders over the past week. The rally in OG triggered a large-scale interest spike in fan tokens of Football clubs, such as CITY, BAR, and JUV among others.

Fan Tokens

The total market valuation of these tokens increased by 16.2% over the past week, based on CoinGecko data.

What is driving the price rally in fan tokens?

Lawyer Liu Yang told journalist Wu Shuo that the rally may be related to the behavior of trading circles. Yang noted that the people involved in the trading circle are related to the platform OKLink that was engaged in releasing the stablecoin USDK of the platform.

吴说获悉,近期粉丝币 OG 的上涨引发粉丝类 Token 的大面积普涨,Coingecko 数据显示,此类 Token 总市值近 7 天上涨 16.2%。刘扬律师分析认为,可能与盘圈行为有关,起盘的人搭建了平台,并且发布了平台的稳定币 USDK,类似操盘手还操作过 TORN PEOPLE 等。用户需谨防风险。

— 吴说区块链 (@wublockchain12) April 10, 2023

Similar traders operated Tornado Cash’s TORN token and lawyers warned users to be aware of risks involved in short-lived price rallies. The gains in fan tokens are likely to be unsustainable with the involvement of a small group of traders that fuel rallies in different tokens.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin Weekly Forecast: Slow but positive start

Bitcoin edges slightly lower, trading around $96,500 on Friday after an over 2.5% recovery this week, with historical data showing modest average January returns of 3.35%. On-chain metrics suggest the bull market remains intact, indicating a cooling-off phase rather than a cycle peak.

Stellar bulls aim for double-digit rally ahead

Stellar extends its gains, trading above $0.45 on Friday after rallying more than 32% this week. On-chain data indicates further rally as XLM’s Open Interest and Total Value Locked rise. Additionally, the technical outlook suggests a rally continuation projection of further 40% gains.

BTC, ETH and XRP eyes for a rally

Bitcoin’s price finds support around its key level, while Ethereum’s price is approaching its key resistance level; a firm close above it would signal a bullish trend. Ripple price trades within a symmetrical triangle on Friday, a breakout from which could signal a rally ahead.

Could XRP surge to new highs in January 2025? First two days of trading suggest an upside bias

Ripple's XRP is up 7% on Thursday, extending its rally that began during the New Year's Day celebration. If long-term holders (LTH) continue their recent accumulation, XRP could overcome the $2.9 resistance level and aim for a new all-time high.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.