- The latest development in the ongoing SEC vs. Ripple lawsuit is that documents are classified as privileged and blocked for public viewing.

- Though institutional investors are yet to take big bets on the altcoin in 2021, retail investors are actively trading in XRP.

- One veteran trader expects XRP price to climb higher in the long-term.

The Securities and Exchange Commission's case against Ripple is drawing to a close. The latest development in the proceedings has nearly 13 documents being pulled out of public view.

Outcome of SEC v. Ripple case may trigger a rally in XRP

The SEC has filed a motion to protect documents requested by Ripple from public viewing.

The XRP Army, proponents and supporters of XRP, have unearthed one of the 13 entries that count as internal SEC documents in the case.

A speech draft of William Hinman, former SEC director of Corporation Finance, is enclosed as an entry in an email submitted for review and comment by SEC officials.

Pseudonymous XRP proponent @digitalassetbuy believes that Hinman's speech came from a collection of people's opinions.

Here it is @JohnEDeaton1 The Hinman speech came from this. It looks like a whole collection of people’s personal opinions. https://t.co/3JPoJ316uw

— Digital Asset Investor Researcher/Wild Speculator (@digitalassetbuy) September 16, 2021

Hinman's speech is considered critical to the outcome of the case since he declared that Ether is not a security, in June of 2018. Back then, Hinman argued that he had warned Ripple about XRP and advised the company to halt its sales.

On the contrary, when asked about Hinman's statement, Gary Gensler, the current SEC Chair, refused to comment.

With the ongoing investigation of the world's second-largest cryptocurrency exchange, Coinbase, and the firm behind the sixth-largest cryptocurrency, XRP, the XRP Army asks why the SEC is picking winners and losers in the industry.

The argument dates back to Hinman's 2018 speech and the SEC's proceedings against Ripple since December 2020.

Charles Gasparino of Fox Business Network shared the SEC's response to "choosing winners and losers", on September 15.

BREAKING (1/2): @SEC_Enforcement sources tell @FoxBusiness the logic of the agency's case v @Ripple is that the company's infrastructure is STILL being built out so XRP -- the token which was used to finance the thing -- is considered a security. @ethereum infrastructure is

— Charles Gasparino (@CGasparino) September 15, 2021

The founder of Crypto-Law.us, lawyer and XRP proponent John Deaton believes Ripple will win based on its current defense.

This is why the memo and evidence tweeted out below by @digitalassetbuy helps @Ripple’s Fair Notice Defense.

— John E Deaton (@JohnEDeaton1) September 17, 2021

It’s an OBJECTIVE standard. Ripple could have bad intent and still win.

But don’t take my word for it. Here is Judge Netburn: #xrpwins https://t.co/sTa57B2JRR pic.twitter.com/88e4IWApH0

With XRP's largest public holder under investigation by the SEC, institutional investors have not made big moves in the altcoin since December 2020.

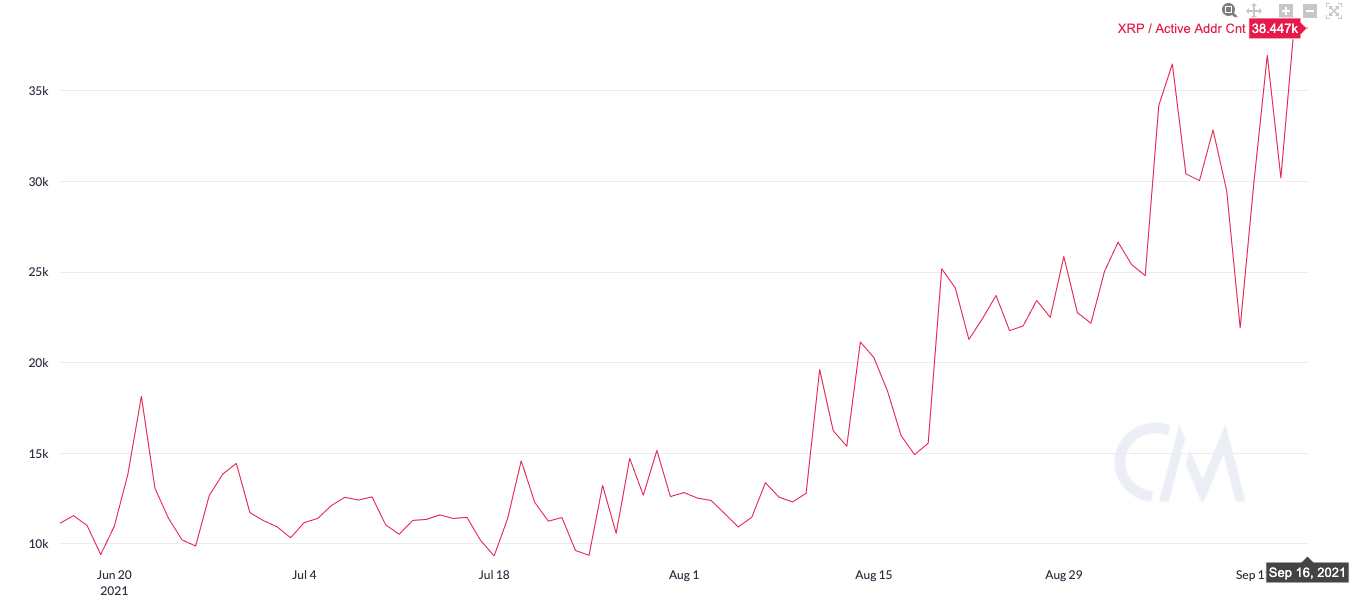

However, it is interesting to note that the number of active XRP wallet addresses has increased by over 200% in the past three months. Retail traders are adopting XRP despite recent delisting across several spot exchanges, this is bullish for XRP price in the long-term.

XRP active wallet addresses over the past three months

The legendary trader and analyst Peter Brandt shared a potentially constructive long-term chart, analyzing the XRP/USD pair.

This is potentially a constructive long-term chart pic.twitter.com/byqGQOCfvc

— Peter Brandt (@PeterLBrandt) September 15, 2021

The veteran trader Brandt considers that the altcoin's price chart shows a head-and-shoulders pattern.

FXStreet analysts predict that the altcoin must hold support at $1.06 to avoid a 30% crash; XRP is likely to hit resistance at $1.27 before rallying further.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Polygon joins forces with WSPN to expand stablecoin adoption

WSPN, a stablecoin infrastructure company based in Singapore, has teamed up with Polygon Labs to make its stablecoin, WUSD, more useful in payment and decentralized finance.

Coinbase envisages listing of more meme coins amid regulatory optimism

Donald Trump's expected return to the White House creates excitement in the cryptocurrency sector, especially at Coinbase, the largest US-based crypto exchange. The platform is optimistic that the new administration will focus on regulatory clarity, which could lead to more token listings, including popular meme coins.

Cardano's ADA leaps to 2.5-year high of 90 cents as whale holdings exceed $12B

As Bitcoin (BTC) gets closer to the $100,000 mark for the first time — it crossed $99,000 earlier Friday — capital is rotating into alternative cryptocurrencies, creating a buzz in the broader crypto market.

Shiba Inu holders withdraw 1.67 trillion SHIB tokens from exchange

Shiba Inu trades slightly higher, around $0.000024, on Thursday after declining more than 5% the previous week. SHIB’s on-chain metrics project a bullish outlook as holders accumulate recent dips, and dormant wallets are on the move, all pointing to a recovery in the cards.

Bitcoin: Rally expected to continue as BTC nears $100K

Bitcoin (BTC) reached a new all-time high of $99,419, just inches away from the $100K milestone and has rallied over 9% so far this week. This bullish momentum was supported by the rising Bitcoin spot Exchange Traded Funds (ETF), which accounted for over $2.8 billion inflow until Thursday. BlackRock and Grayscale’s recent launch of the Bitcoin ETF options also fueled the rally this week.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.