- The latest development in the ongoing SEC vs. Ripple lawsuit is that documents are classified as privileged and blocked for public viewing.

- Though institutional investors are yet to take big bets on the altcoin in 2021, retail investors are actively trading in XRP.

- One veteran trader expects XRP price to climb higher in the long-term.

The Securities and Exchange Commission's case against Ripple is drawing to a close. The latest development in the proceedings has nearly 13 documents being pulled out of public view.

Outcome of SEC v. Ripple case may trigger a rally in XRP

The SEC has filed a motion to protect documents requested by Ripple from public viewing.

The XRP Army, proponents and supporters of XRP, have unearthed one of the 13 entries that count as internal SEC documents in the case.

A speech draft of William Hinman, former SEC director of Corporation Finance, is enclosed as an entry in an email submitted for review and comment by SEC officials.

Pseudonymous XRP proponent @digitalassetbuy believes that Hinman's speech came from a collection of people's opinions.

Here it is @JohnEDeaton1 The Hinman speech came from this. It looks like a whole collection of people’s personal opinions. https://t.co/3JPoJ316uw

— Digital Asset Investor Researcher/Wild Speculator (@digitalassetbuy) September 16, 2021

Hinman's speech is considered critical to the outcome of the case since he declared that Ether is not a security, in June of 2018. Back then, Hinman argued that he had warned Ripple about XRP and advised the company to halt its sales.

On the contrary, when asked about Hinman's statement, Gary Gensler, the current SEC Chair, refused to comment.

With the ongoing investigation of the world's second-largest cryptocurrency exchange, Coinbase, and the firm behind the sixth-largest cryptocurrency, XRP, the XRP Army asks why the SEC is picking winners and losers in the industry.

The argument dates back to Hinman's 2018 speech and the SEC's proceedings against Ripple since December 2020.

Charles Gasparino of Fox Business Network shared the SEC's response to "choosing winners and losers", on September 15.

BREAKING (1/2): @SEC_Enforcement sources tell @FoxBusiness the logic of the agency's case v @Ripple is that the company's infrastructure is STILL being built out so XRP -- the token which was used to finance the thing -- is considered a security. @ethereum infrastructure is

— Charles Gasparino (@CGasparino) September 15, 2021

The founder of Crypto-Law.us, lawyer and XRP proponent John Deaton believes Ripple will win based on its current defense.

This is why the memo and evidence tweeted out below by @digitalassetbuy helps @Ripple’s Fair Notice Defense.

— John E Deaton (@JohnEDeaton1) September 17, 2021

It’s an OBJECTIVE standard. Ripple could have bad intent and still win.

But don’t take my word for it. Here is Judge Netburn: #xrpwins https://t.co/sTa57B2JRR pic.twitter.com/88e4IWApH0

With XRP's largest public holder under investigation by the SEC, institutional investors have not made big moves in the altcoin since December 2020.

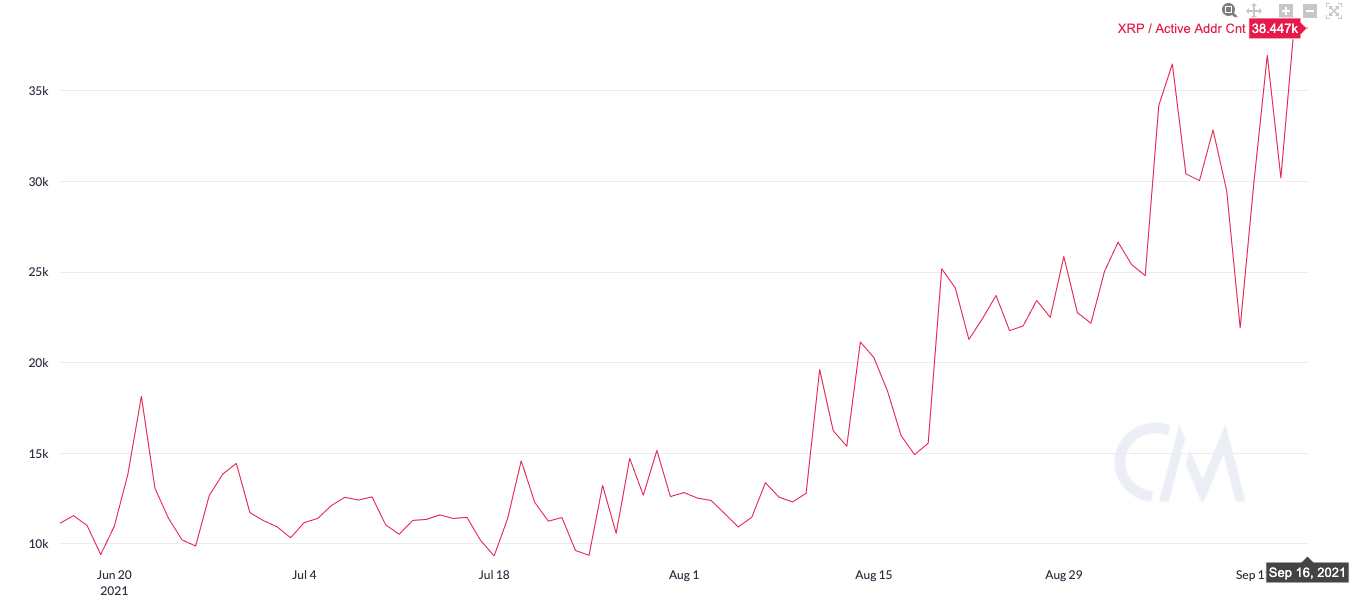

However, it is interesting to note that the number of active XRP wallet addresses has increased by over 200% in the past three months. Retail traders are adopting XRP despite recent delisting across several spot exchanges, this is bullish for XRP price in the long-term.

XRP active wallet addresses over the past three months

The legendary trader and analyst Peter Brandt shared a potentially constructive long-term chart, analyzing the XRP/USD pair.

This is potentially a constructive long-term chart pic.twitter.com/byqGQOCfvc

— Peter Brandt (@PeterLBrandt) September 15, 2021

The veteran trader Brandt considers that the altcoin's price chart shows a head-and-shoulders pattern.

FXStreet analysts predict that the altcoin must hold support at $1.06 to avoid a 30% crash; XRP is likely to hit resistance at $1.27 before rallying further.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Top gainers Virtuals Protocol, Floki, Hyperliquid: Altcoins extend gains alongside Bitcoin

The cryptocurrency market sustains a market-wide bullish outlook at the time of writing on Tuesday, led by Bitcoin (BTC) and select altcoins, including Virtuals Protocol (VIRTUAL), Floki, and Hyperliquid (HYPE).

Token unlocks over $625 million this week across major projects SUI, OP, SOL, AVAX and DOGE

According to Wu Blockchain, 11 altcoins with one-time tokens unlock more than $5 million each in the next seven days. The total value of cliff and linear unlocked tokens exceeds $625 million.

TRUMP meme coin on-chain activity surged following dinner announcement: Kaiko

Kaiko Research published a report on Monday highlighting the significant impact of TRUMP's team dinner announcement on the meme coin sector. The announcement triggered a surge in on-chain activity and trading volumes, with TRUMP accounting for nearly 50% of all meme coin trading volume.

Coinbase launches new Bitcoin Yield Fund, offering investors 4–8% annual returns

Coinbase has launched a Bitcoin Yield Fund, aiming to offer non-U.S. investors sustainable 4–8% returns paid directly in Bitcoin.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin (BTC) price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.