Experts blame OpenSea and NFT issuers for Ethereum price crash

- OpenSea and NFT issuers have transferred 56,300 Ether to exchanges and in royalties over the past two weeks.

- The spike in inflow of Ethereum to exchanges like Coinbase has increased the selling pressure on the altcoin.

- Experts believe that the rise in selling pressure due to OpenSea and NFT transactions fueled the drop in Ethereum price.

- Analysts have predicted that Ethereum price could continue its downtrend, hitting $2,275.

Ethereum’s recent drop in price was fueled by increasing inflows of the altcoin to cryptocurrency exchanges. Experts have blamed direct transfers from NFT marketplace OpenSea for the fall in Ethereum’s price.

Ethereum inflow to exchanges spikes, increases selling pressure

Over the past two weeks, the volume of Ethereum leaving OpenSea, a peer-to-peer NFT marketplace, increased consistently. 21,000 Ethereum was transferred directly from OpenSea’s wallet to Coinbase.

As the sale of NFTs increases, there is an increase in royalties and direct transfers from OpenSea. The NFT marketplace’s meteoric rise could increase the Ethereum inflow to exchanges like Coinbase.

An additional 35,300 Ethereum was distributed to NFT issuers as royalties from OpenSea. Colin Wu, a Chinese journalist and crypto proponent, believes that the spike in the inflow of Ethereum from OpenSea to Coinbase fueled the rise in selling pressure.

Historically, an increase in selling pressure triggers a price drop in the altcoin.

OpenSea and NFT issuers may be one of the pressures for ETH to crash. In the past two weeks, the amount of ETH transferred directly from OpenSea Wallet to Coinbase reached 21,000, and the amount of ETH transferred to royalty distributors reached 35,300. Source: @jx_block pic.twitter.com/WxuDwk3xic

— Wu Blockchain (@WuBlockchain) January 24, 2022

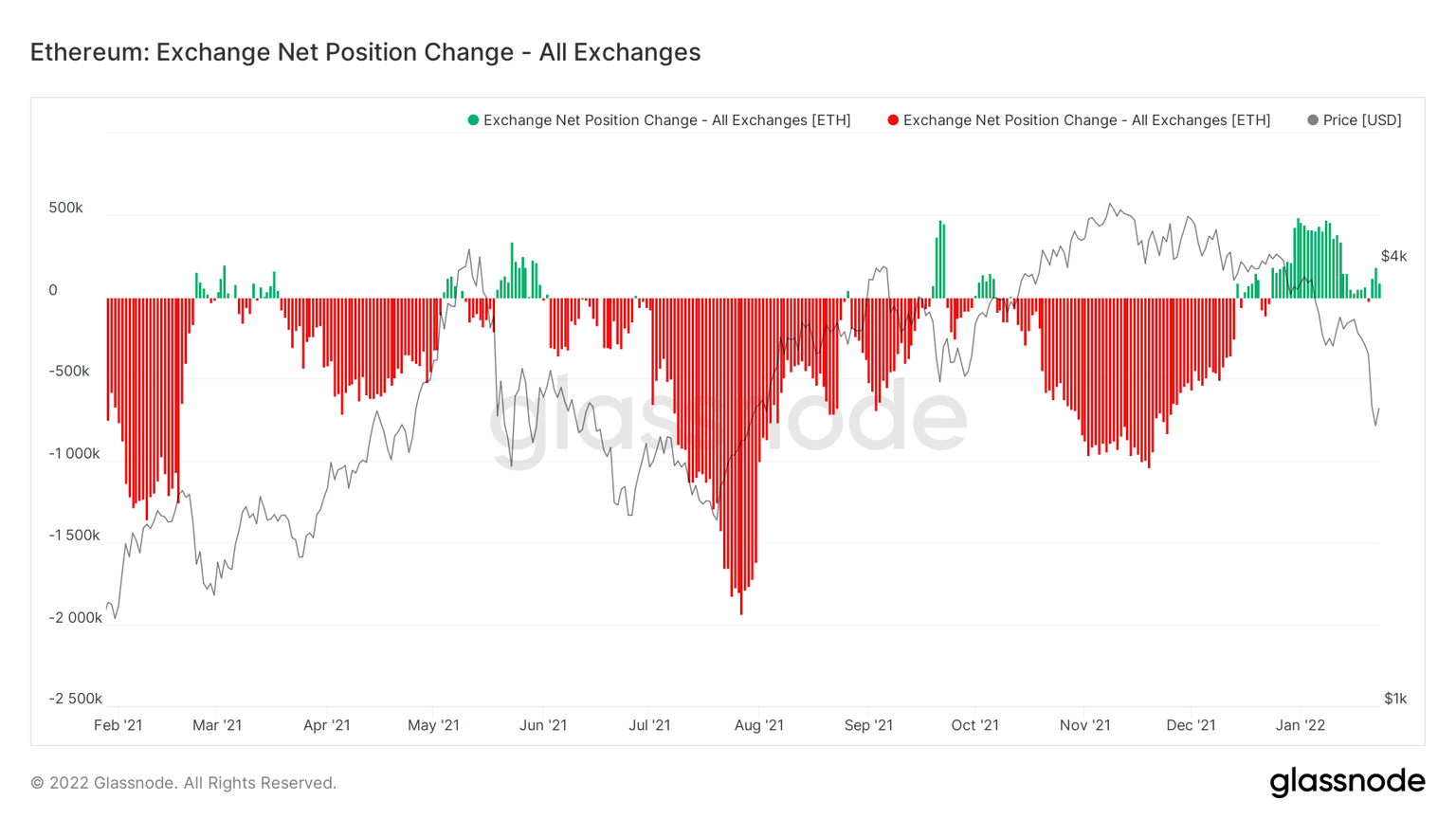

Analysts have noted that the net outflow for Ethereum was relatively high for 2021. Over the past month, the net inflow of Ethereum surged.

Ethereum Net Position Change - All exchanges

@IAmCryptoWolf, a pseudonymous cryptocurrency analyst, evaluated the Ethereum price trend and predicted that a bounce in the altcoin’s price at the $2,300 area could act as strong resistance.

$ETH.

— Wolf (@IamCryptoWolf) January 23, 2022

Working on 78.6fib, monthly 21EMA and horizontal daily and weekly support 2.2-2.3k.

Since we lost 3k key support, a bounce in this area will act as strong resistance. In the same area we will also have daily DMA50 curving down together with the WMA50 and WEMA21 resistances pic.twitter.com/ngR2YsCzqC

FXStreet analysts have predicted that Ethereum price could target $2,400, and the sell-off deepen.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.