Expect this from Bitcoin price when the Fed ends up hiking interest rates by 25 bps

- Bitcoin price consolidated around $29,000 to $30,000, with the potential to fall to $27,900.

- The Federal Reserve indicated two more interest rate hikes this year.

- Increase in interest rate could be met with some selling pressure, although investors are not indicating any pessimistic sentiment.

Bitcoin price keeps investors on their toes as they wait for the biggest cryptocurrency in the world to pick a direction. While it seemed like BTC is awaiting a trigger from the investors, the macroeconomic conditions now appear to have a shot at impacting the price action more significantly.

Bitcoin price awaits Fed meeting’s outcome

Bitcoin price has been stuck moving sideways for more than a month now, and even considering the volatility of the past three months, the cryptocurrency is still around the same price level it was in April. BTC holders have been anxiously waiting for Bitcoin to breach the $32,000 mark and initiate a bull run.

However, considering the upcoming Federal Reserve meeting scheduled for July 26, the investors might be disappointed. The Fed has been hinting towards interest rate hikes for the past two months, even though the Federal Open Market Committee (FOMC) decided to pause the hike last month.

Reports suggest that the FOMC will unanimously hike the interest rates by 25 basis points in the July 26 meeting. This would raise the target rate from 5% - 5.25% to 5.25% - 5.50%. The probability of the same is also staggeringly high, according to the CME FedWatch Tool, which places it at 98.9%.

Interest rate hike probability

Thus, the impact of the interest rate hike will likely be bearish for Bitcoin price, resulting in a potential short-term pullback. According to FXStreet analyst Akash Girimath,

“From a conservative standpoint, investors can expect a short-term pullback to $27,947. But a better buying opportunity would be a correction that retests the $25,000 psychological level. This level is critical and must be defended by bulls at all costs. A bounce from this foothold would be vital in continuing the 2023 run.

BTC/USD 3-day chart

This forecast is based on the hope that investors refrain from selling immediately should the prices decline, the chances of which are also unlikely. The Crypto Fear and Greed Index suggests that investors are relatively neutral now, which is better than being in a state of Fear.

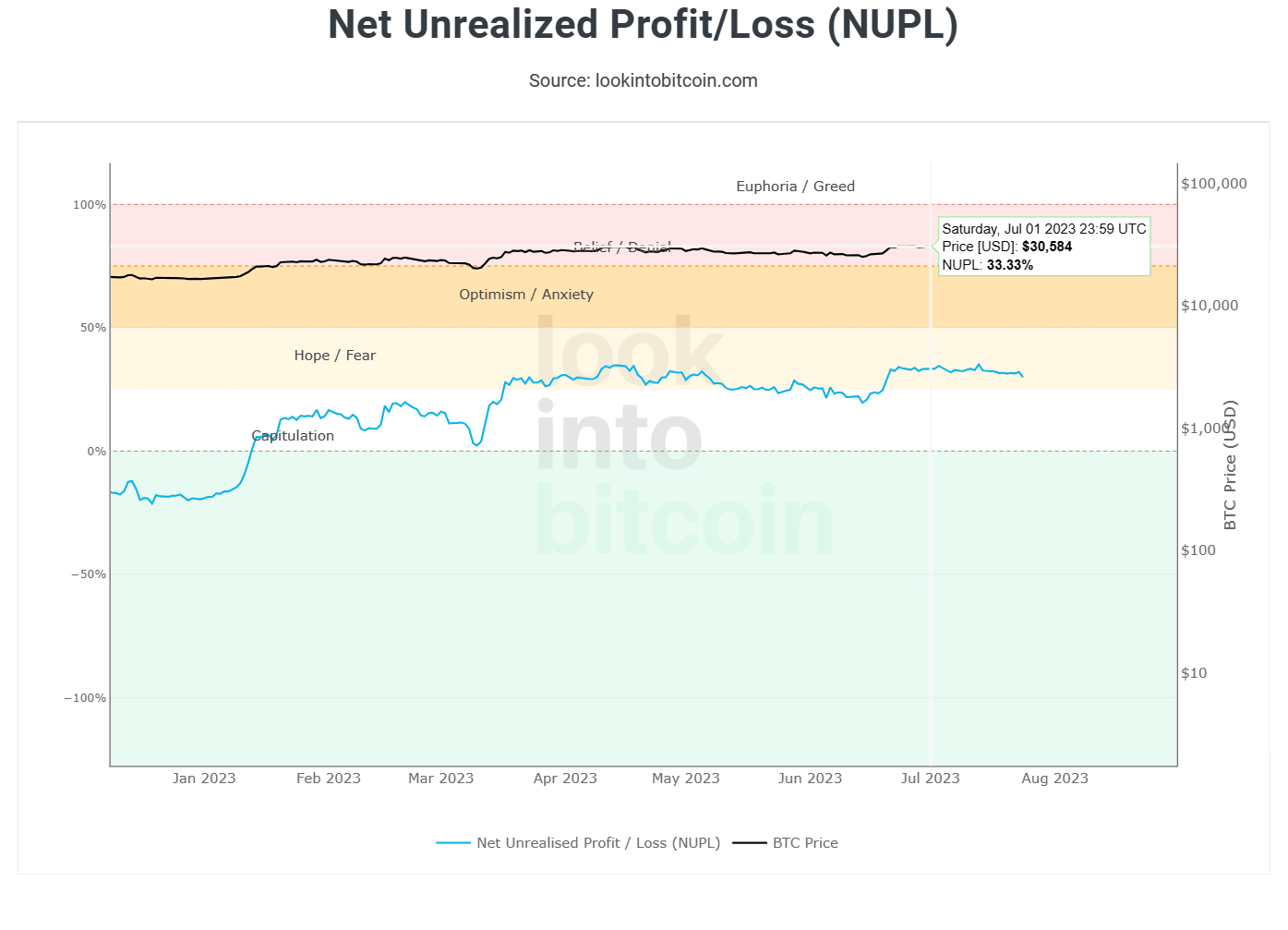

Furthermore, the Net Unrealized Profit/Loss (NUPL) indicator highlights no significant recent gains. Nevertheless, BTC holders are hopeful of a recovery rally soon, which would inevitably bring profits.

Bitcoin NUPL

To achieve that, profit-taking would need to be sidestepped for now, allowing the market to cool down and bounce back. But should the macroeconomic conditions worsen, investors can expect a larger drawdown in prices.

Read more - Bitcoin Weekly Forecast: Could spot ETF trigger BTC rally to $50,000?

Like this article? Help us with some feedback by answering this survey:

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.