Events and risks that could drive Bitcoin this week

Bitcoin is inching higher after yesterday's losses as the largest cryptocurrency struggles for direction. While October is historically a strong month for Bitcoin, that hasn’t been the case so far. Instead, Bitcoin has been range-bound in choppy trade for the past seven days, highlighting the lack of a clear, near-term trend.

Still, trading volumes are up 53% over the past 24 hours (CoinMarketCap), and several events lined up this week could drive direction.

FOMC meeting minutes

The September monetary policy meeting minutes will be released on the 9th of October. The minutes relate to the meeting where the Federal Reserve cut interest rates for the first time in four years and did so by a bumpy 50 basis points. Investors will be watching closely for further insight as to why policymakers voted for an outsized move and for further clears on possible rate cuts across the coming November and December meetings.

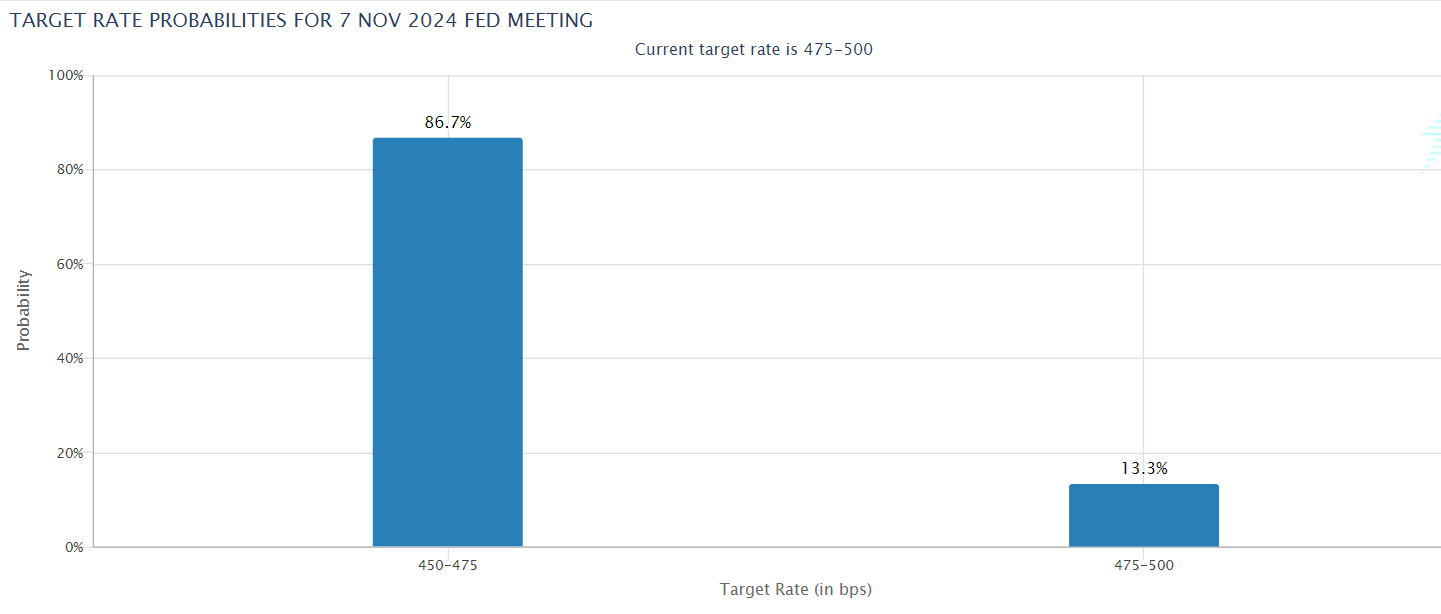

September's 50 basis point cut helped drive Bitcoin prices to a two-month high of 66.5K at the end of September. However, Bitcoin prices have since fallen away from this peak, dropping to a low of 60k as the market raised questions over whether the Fed will cut rates at all in the November meeting.

Lower interest rates improve liquidity and bode well for riskier assets such as Bitcoin, so dovish minutes could help Bitcoin rise.

US CPI

US inflation data will be released on Thursday, October 10. Inflation is expected to cool to 2.3% YoY in September, down from 2.5%. Should inflation cool more than expected, this could raise expectations of a 25 basis point rate cut in November, lifting BTC.

However, should CPI be hotter than expected, following Friday’s impressive non-farm payroll data and the recent surge in oil prices, the market could further question the Fed’s ability to cut interest rates to the extent that was initially expected. This could result in Bitcoin falling.

US earnings season

US banks kick off earnings season at the end of the week. BlackRock, an issuer of spot BTC and spot ETH ETFs, releases quarterly results on Friday. BlackRock, the world’s largest asset manager, holds 367k Bitcoin, valued at $22 billion, so strength in its Q3 earnings may exert some influence over Bitcoin’s price.

JP Morgan will also reveal Q3 earnings this week, as well as details showing its Bitcoin ETF exposure. In the previous quarter, Bitcoin posted $760k worth of Bitcoin ETFs. An increase in its holding could boost sentiment towards Bitcoin, giving gains and vice versa.

Geopolitical tensions

Geopolitical tensions hurt risk appetite last week, contributing to a selloff in riskier assets such as Bitcoin and European equities. The markets continue to watch developments in the Middle East, where a broadening out of the conflict could weigh on risk sentiment and riskier assets.

Bitcoin technical analysis

Bitcoin trades in a symmetrical triangle caught between the 50 and 200 SMAs. Buyers will look to rise above the 200 SMA at 64k to bring the falling trendline resistance, around 66k, into focus. A rise above here opens the door to 70k.

On the downside, sellers will need to break below the 50 SMA at 60.6k. A break below here opens the door to 57.5k ahead of the falling trendline support at 52k.

Start trading with PrimeXBT

Start trading with PrimeXBT

Author

Matthew Hayward

PrimeXBT

Matthew Hayward is a Senior Market Analyst at PrimeXBT, a global cryptocurrency broker. He has over five years of expertise in both Fundamental and Technical Analysis, focusing on Cryptocurrency, Foreign Exchange, Indices, and Commodities.