Bitcoin, Ethereum prices plummet after EU lawmakers agree on anti-money laundering rules for crypto

- The European Union has finalized its Markets in Crypto Assets regulation, to trace and identify crypto transfers.

- Crypto-asset service providers are now obliged entities under anti-money laundering directive, including ATMs and transactions from and to the Euro.

- Analysts predict Bitcoin price could plummet to $17,578 for the asset to collect liquidity.

With the collapse in Bitcoin and Ethereum prices, the pressure to regulate cryptocurrencies was mounting on regulators worldwide. The European Union said on Thursday, that they seek agreement on rules for regulating crypto assets and combat money laundering activities.

EU reins in crypto, traces all crypto transfers

European institutions have reached an interim consensus on a set of European Union (EU) regulations that oblige crypto firms to prevent money laundering and illicit activities. The EU has made progress through comprehensive regulation for the continent’s crypto market.

Negotiators representing the European Parliament, Council and Commission hashed out a final compromise to tighten regulations in the crypto sector, trace and identify all transfers and apply anti-money laundering directives (AML) on crypto-asset service providers.

Businesses in the crypto industry are now required to verify the identities of their customers and report suspicious transactions. In the future, Europe’s Transfer of Funds Regulation (ToFR) will cover crypto transactions.

The European Parliament and the EU Council indicated that crypto firms, exchanges, wallets, lenders, all service providers will have to assist financial authorities in efforts to crackdown on money laundering through digital assets.

Ernest Urtasun, Spanish Green Party lawmaker who was a part of the EU’s process to regulate crypto was quoted as saying:

The new rules will enable law enforcement officials to be able to link certain transfers to criminal activities and identify the real person behind those transactions.

The new legislation will be aligned closely with Markets in Crypto assets rules (MiCA), alongside a focus on anti-money laundering initiatives.

Will EU’s crypto regulation dox “unhosted” wallet owners?

The crypto regulation covers “cold” wallets in addition to service providers like exchanges, wallet services and other platforms. An unhosted wallet is a crypto wallet held by private individuals, not managed by a licensed platform. The rules regarding identification and tracing of crypto transfers will apply to transactions exceeding €1,000 in fiat value.

Quinten Fracois, a leading crypto investor and YouTuber criticized EU’s move and argued that

Hacks will happen with the collected data and people's safety will be at risk. Unhosted wallets ARE the innovation! Regulating it this way will destroy all innovation around it.

The EU has no clue what they are doing.

— Quinten | 048.eth (@QuintenFrancois) June 30, 2022

- Killing web3 innovation (after EU did the same with web2) .

- Crypto exchanges and other companies will never be able to implement all rules.

- Hacks will happen with the collected data and people's safety will be at risk.

1/ https://t.co/UBCgpU1swA

Bitcoin and Ethereum prices to see further decline

The cryptocurrency market did not respond positively to increased regulatory control. Bitcoin and Ethereum prices continued to plummet and analysts believe there is room for further downside.

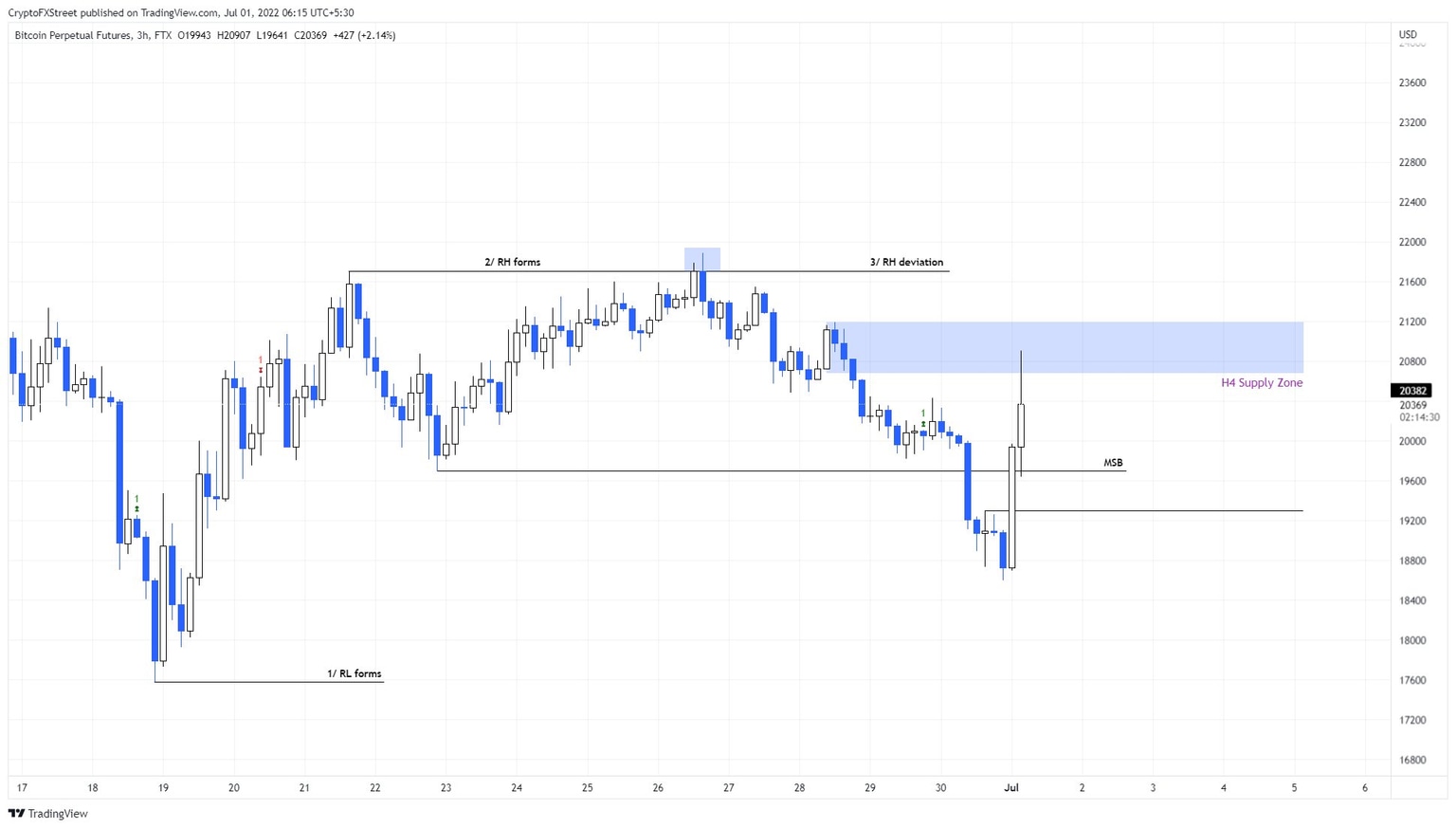

Akash Girimath, a leading crypto analyst at FXStreet believes Bitcoin price could nosedive to $17,578 to collect liquidity if the downtrend continues to play out.

Bitcoin Perpetual Futures chart

@FeraSY1, a crypto analyst and trader believes there is an “absence of sellers” rather than serious buyers kicking in. Therefore, it remains to be seen whether Bitcoin price will recover from the drop below $20,000.

$btc

— Crypto Feras (Won't DM u first) (@FeraSY1) July 1, 2022

The volume is showing it is more like "absence of sellers" than serious buyers

Will be more than happy to see massive buyers kicking in, however it's not the case "yet" pic.twitter.com/7y73bS9Og5

FXStreet analysts believe traders should approach Bitcoin price with caution, for this reason. Check this video for more information:

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.