Etheruem Classic price to see some decline before bouncing back up ahead of network upgrade

- Ethereum Classic price breaching $22 would mark a bullish signal for the altcoin, which could push it towards marking fresh year-to-date highs.

- The Ethereum Classic network is set to undergo the ‘Spiral’ upgrade, a hard fork that will set it at par with Ethereum Shanghai changes.

- Scheduled for the end of January 2024, ETC will likely witness a bullish momentum by then.

Ethereum Classic price took a hit this week, along with the rest of the market, nearly falling by 17.4% in a day. However, as the altcoin recovered slightly, it lost the bullish momentum that had been building up in the week before. This momentum will likely revive in the next year.

Ethereum Classic to undergo major upgrade

Ethereum Classic network is scheduled for a hard fork on January 31, 2024. The upgrade titled ‘Spiral’ will be activated at block 19,250,000. This upgrade will be a compatibility upgrade for the Ethereum hard fork chain, which will bring it in line with the Ethereum mainnet.

In order to be an Ethereum Virtual Machine (EVM) compatible chain, the blockchain would need to meet the EVM standards. Thus, the Spiral Upgrade will bring the ETC Network to parity with upstream EVM standards, facilitating contract development and migration.

This upgrade will most likely act as a catalyst since, for the large part, the market would already be experiencing bullishness thanks to the broader market cues.

Ethereum Classic price rise revival

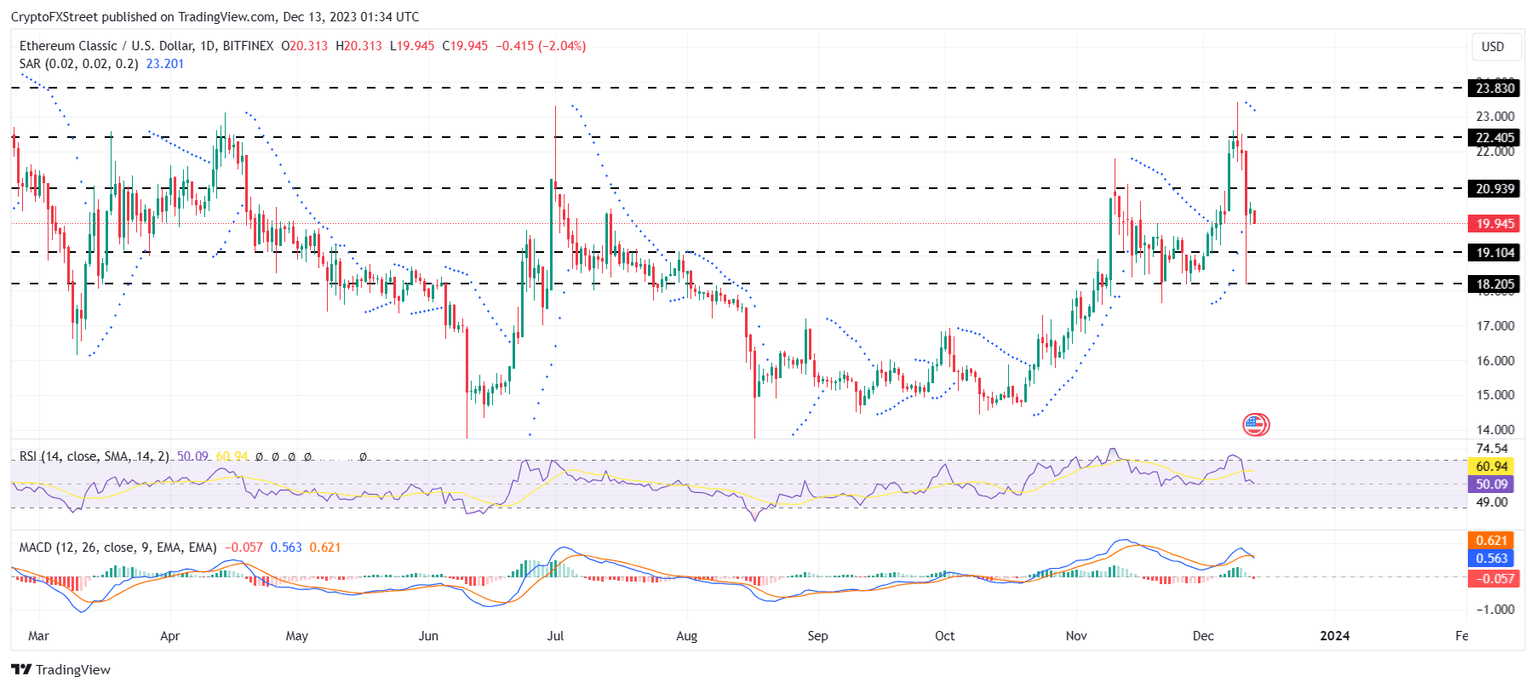

Ethereum Classic price, trading at $19.94 at the time of writing, was down by 2% over the past day, adding to the 8% decline observed this week. While ETC has lost nearly half the gains it noted towards October end, it is yet to witness a bearish momentum in full swing.

The Relative Strength Index (RSI) is still hovering above the neutral line marked at 50.0, and the Moving Average Convergence Divergence (MACD) indicator has only just marked the bearish crossover. But the chances of a rally will only arrive after ETC has first declined to $19.1.

Only after bouncing back from this line can the Ethereum Classic price note some recovery, but if the bearish cues heavily weigh the price down, the altcoin could fall to $18.2.

ETC/USD 1-day chart

However, if broader market cues and investors act bullish to prevent a price decline before the new year begins, ETC might have a shot at early recovery. Breaching the $20.9 resistance level would confirm the same and invalidate the bearish thesis, pushing the Ethereum hard fork toward $22.4.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.