- Hong Kong issuers are allegedly working toward incorporating staking into their ETH ETFs.

- ProShares submits 19b-4 application for spot ETH ETF.

- Ethereum will likely continue its range-bound movement over the weekend.

Ethereum (ETH) is down more than 3% on Friday following news that Hong Kong will allow issuers to integrate staking features into their spot ETH ETFs. ProShares also submitted a 19b-4 application for a spot ETH ETF with the Securities & Exchange Commission (SEC) on Thursday.

Daily digest market movers: Hong Kong ETFs, ProShares join the train

Ethereum ETFs are the main subject of discussions surrounding the number one altcoin. Here are the latest market movers:

- Hong Kong asset managers are allegedly working toward incorporating staking features into their spot Ethereum ETFs, according to Animoca Brands co-founder and Executive Chairman Yat Siu. Hong Kong crypto ETFs have struggled to garner investors' attention despite the excitement surrounding their initial launch.

However, with the added rewards of staking, Hong Kong ETH ETFs could be attractive to investors worldwide, especially as the SEC has signaled that it won't permit issuers to offer staking if/when spot ETH ETFs launch in the US.

Read more: Ethereum ecosystem active users spike 55% in Q1, 2x ETH ETF records impressive volume

- Asset manager ProShares submitted a 19b-4 form with the SEC on Thursday, stating intentions to issue spot Ethereum ETFs on the New York Stock Exchange (NYSE). The move puts ProShares as the latest member in the list of prospective spot ETH ETF issuers.

The SEC earlier approved the 19b-4 filings of eight issuers on May 23, including Van Eck, Bitwise, BlackRock, Fidelity, Franklin Templeton, Invesco & Galaxy, Grayscale and 21Shares. Following the approval, issuers submitted updated S-1 registration statements with the SEC, which the agency must approve before the ETFs go live.

Also read: Ethereum open interest surges by 50%, SEC Chair says ETH ETF launch will take more time

- SEC Chair Gary Gensler told Reuters on Wednesday that the timing for spot ETH ETFs to launch depended on how responsive issuers are to the SEC's comment on their S-1s.

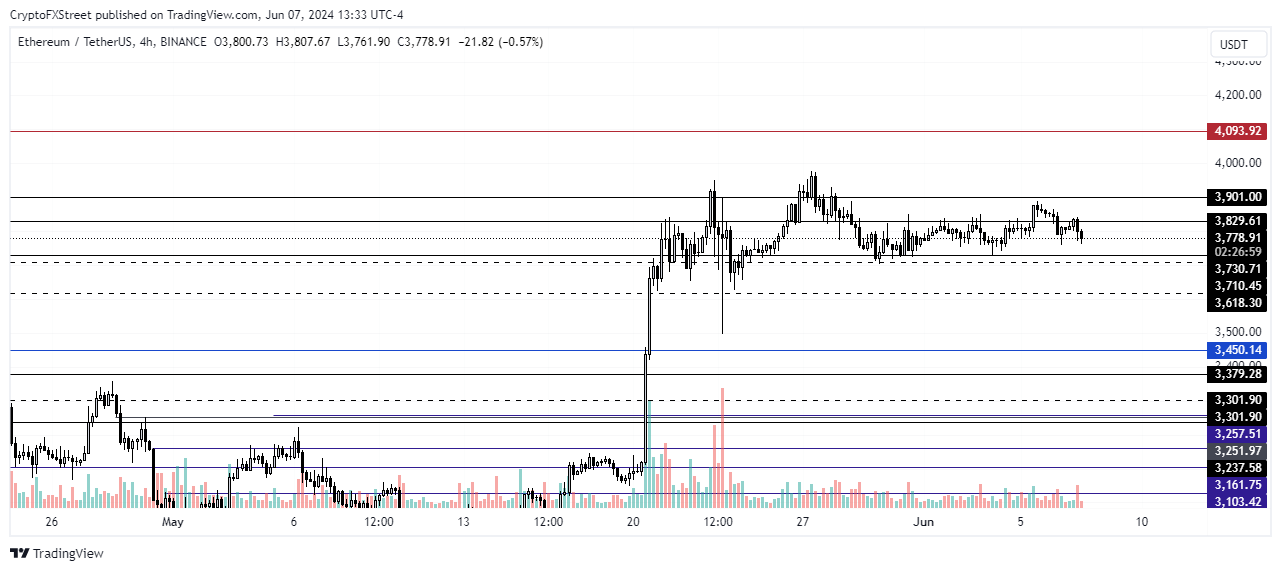

ETH technical analysis: Ethereum to sustain range-bound move over the weekend

Ethereum is trading around $3,781 as it continues its range-bound movement on Friday. The ETH long/short ratio is skewed toward shorts, with a 48% to 52% difference in the past 24 hours, according to data from Coinglass. This indicates a slight bias towards a bearish view, especially as ETH's long liquidations are at $52.14 million compared to $7.37 million of short liquidations.

Read more: Ethereum leveraged ETFs go live as price fails to react

Considering current market conditions, Ethereum will likely stay above the $3,730 support.

ETH/USDT 4-hour chart

However, higher bearish sentiment will see the $3,618 support become the next key price to watch out for. ETH may sustain the horizontal move over the weekend and before beginning another attempt toward the $3,901 resistance.

A successful move above the resistance will see ETH begin a move to tackle the $4,093 yearly high before aiming for a new all-time high.

A daily candlestick close below the $3,300 level will invalidate the bullish thesis.

Ethereum FAQs

Ethereum is a decentralized open-source blockchain with smart contracts functionality. Serving as the basal network for the Ether (ETH) cryptocurrency, it is the second largest crypto and largest altcoin by market capitalization. The Ethereum network is tailored for scalability, programmability, security, and decentralization, attributes that make it popular among developers.

Ethereum uses decentralized blockchain technology, where developers can build and deploy applications that are independent of the central authority. To make this easier, the network has a programming language in place, which helps users create self-executing smart contracts. A smart contract is basically a code that can be verified and allows inter-user transactions.

Staking is a process where investors grow their portfolios by locking their assets for a specified duration instead of selling them. It is used by most blockchains, especially the ones that employ Proof-of-Stake (PoS) mechanism, with users earning rewards as an incentive for committing their tokens. For most long-term cryptocurrency holders, staking is a strategy to make passive income from your assets, putting them to work in exchange for reward generation.

Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) mechanism in an event christened “The Merge.” The transformation came as the network wanted to achieve more security, cut down on energy consumption by 99.95%, and execute new scaling solutions with a possible threshold of 100,000 transactions per second. With PoS, there are less entry barriers for miners considering the reduced energy demands.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin Weekly Forecast: BTC remains calm before a storm

Bitcoin price has been consolidating between $85,000 and $88,000 this week, approaching the lower boundary of the consolidation range when writing on Friday. A K33 Research report explains how the markets are relatively calm and shaping up for volatility as investors absorb the tariff announcements.

Donald Trump’s tariff policies set to increase market uncertainty and risk-off sentiment

US President Donald Trump’s tariff policies are expected to escalate market uncertainty and risk-off sentiment, with the Kobeissi Letter’s post on X this week cautioning that while markets may view the April 2 tariffs as the "end of uncertainty," it anticipates increased volatility.

Ethereum Price Forecast: Whales increase buying pressure as developers set April 30 for Pectra mainnet upgrade

Ethereum developers tentatively scheduled the Pectra mainnet upgrade for April 30 in the latest ACDC call. Whales have stepped up their buying pressure in hopes of a price uptick upon Pectra going live on mainnet.

BTC stabilizes while ETH and XRP show weakness

Bitcoin price stabilizes at around $87,000 on Friday, as its RSI indicates indecisiveness among traders. However, Ethereum and Ripple show signs of weakness as they face resistance around their key levels and face a pullback this week.

Bitcoin: BTC remains calm before a storm

Bitcoin (BTC) price has been consolidating between $85,000 and $88,000 this week, approaching the lower boundary of the consolidation range when writing on Friday.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.