Ethereum extends correction as Van Eck CEO dampens chances of spot ETH ETF approval

- Van Eck's CEO says Ethereum ETFs are less likely to be approved in May because the SEC has remained silent.

- Following the crypto market correction, Ethereum is down 3.8% as ETH's long liquidations have topped Bitcoin's.

- EigenLayer's launch on Ethereum Mainnet could add momentum to DeFi's liquid restaking boom.

Ethereum (ETH) is expected to see a price increase in the coming weeks, considering the upcoming Bitcoin (BTC) halving and a potential spot ETH approval. However, on Tuesday, Jan Van Eck, CEO of investment firm Van Eck, stated that the Securities & Exchange Commission's (SEC) silence already indicates a negative outcome as the May 23 deadline for a decision approaches.

Read more: Ethereum could be set for growth as Vitalik Butein shares update on its future

Daily digest market movers: Ethereum ETF approval, low transaction fees, restaking boom

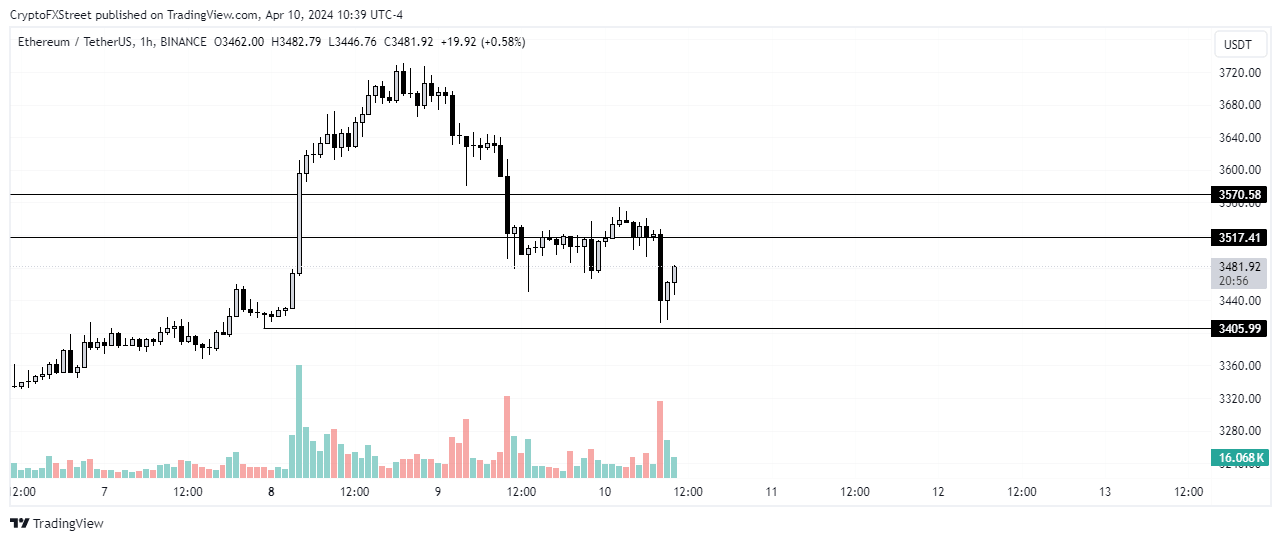

In the wake of a rally that saw ETH tagging $3,730, a general market correction has forced the largest altcoin back to a previous consolidation range formed in March. Here are the recent ETH market movers:

- Jan Van Eck, CEO of investment firm Van Eck, has said that the SEC's approval of a spot Ethereum ETF by the May deadline is unlikely as the regulator has yet to respond to filings. "We've filed our S1, and we haven't heard anything. So that's kind of a sign. It won't happen without getting the disclosure documents in order," he said to CoinDesk. The SEC faces a May 23 deadline to decide whether or not to approve Van Eck's spot Ethereum ETF filing.

Unlike Bitcoin ETF applications, which the SEC commented on and engaged institutions about before approval in January, the SEC hasn't commented on Ethereum ETF filings. As a result, other analysts like Bloomberg's Eric Balchunas and James Seyffart have also expressed similar sentiments to Jan's, lowering their odds of an ETH ETF approval in May to 25%. However, Grayscale's chief legal officer, Craig Salm, has previously stated that silence from the SEC doesn't hurt Ethereum's chances of approval.

Also read: Ethereum's price recovery looks imminent as ETF approval sees a glimmer hope

- While Ethereum ETFs have grabbed most of the headlines, Jan told CoinDesk that reduced transaction costs via Layer 2s and the Solana network is the most important story in crypto that people don't often talk about. He mentioned how these networks can scale, improve adoption, and keep costs predictable. Ethereum Layer 2s have enjoyed low fees since the Dencun upgrade on March 13.

- Following Jan's comment, restaking protocol, EigenLayer went live on the Ethereum Mainnet on Tuesday after accumulating $13.56 billion in total value locked (TVL) since its launch. With its Mainnet launch, Ethereum may experience increased restaking activity in addition to the boom of liquid restaking tokens already making waves on its blockchain. EigenLayer also launched the EigenDA, an actively validated service that aims to address Ethereum's data availability problems by "ushering in an era of cost-effective scalability."

Technical analysis: Ethereum could test the $3,406 support

Ethereum's price resumed a consolidating move on Wednesday after a bearish move that saw it shed nearly 4% of its value in the past 24 hours. The move indicates liquidity is still being collected after the bullish spike on Monday.

Read more: Ethereum on course to post weekly losses as debate over security status continues

While Ethereum's price movement mimics that of the general crypto market - as many altcoins have also been consolidating - its long traders have been affected the most by the market correction. ETH long liquidations crossed $60 million on Wednesday, higher than that of Bitcoin long traders despite lesser volume, according to data from Coinglass. As a result, long traders may exercise more caution while leaving room for bears to prevail.

ETH/USDT 1-hour chart

If this happens, ETH will likely break the $3,406 support. At the time of writing, Ethereum is trading at $3,483.

Ethereum development FAQs

After the Merge, the Ethereum community is looking at the Sharding upgrade next, which has been slated for sometime later in the year. The development can be summarized in four words, “scalability through more efficient data storage.” The software update will increase the capacity of the blockchain, widening the amount of data that can be stored or accessed. At the same time, all services running atop the Ethereum blockchain will enjoy significantly reduced transaction fees.

A fork is the splitting of a blockchain after developers agree and proceed to implement upgrades. The decision comes after these developers reach a consensus for a software upgrade. The ensuing part will see one part continue with the status as is, while the other one will proceed with new features combined with the former ones. A hard fork basically entails permanent divergence of a new side chain from the original one, while a soft fork is doing the same, only difference being that it is temporary.

EIP-4844 is an improvement proposal for the Ethereum network. The upgrade promises reduced gas fees, which is a valuable offering considering the high transaction cost that continues to daunt crypto players. It has been a long-standing concern for the Ethereum network. The proposal is also referred to as “proto-Danksharding,” with an unmatched ability to increase the speed of transactions on the Ethereum blockchain. At the same time, it helps to reduce the transaction cost as everything becomes decentralized.

Gas token is a new, innovative Ethereum contract where users can tokenize gas on the Ethereum network. This means they can store gas when it is cheap and start to deploy the gas once the market has shifted to the north. The use of Gas token helps to subsidize high gas prices on transactions, meaning investors can do everything from arbitraging decentralized exchanges to buying into initial coin offerings (ICOs) early.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi