- Ethereum's recent decline could alter predictions of ETFs sending ETH to an all-time high of around $5,000.

- ETH options worth $560 million expired on Friday amid market crash.

- Ethereum could reclaim key support level as technical indicators suggest bearish momentum is weakening.

Ethereum (ETH) is up 0.4% on Friday as ETH ETFs record another day of mild inflows. The recent market crash could also alter earlier predictions of the ETFs, boosting ETH to a new all-time around $5,000.

Daily digest market movers: Ethereum ETF Flows, Hashdex combined ETF, ETH options expiry

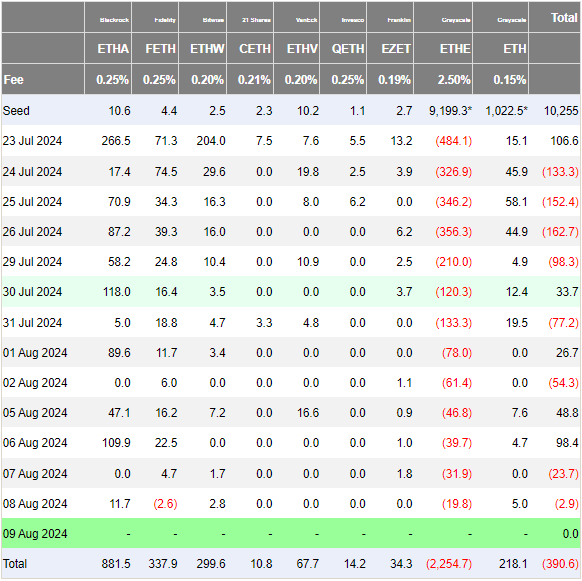

Ethereum ETFs saw mild net outflows of $2.9 million on Thursday following a 10% rally in ETH's price. BlackRock's ETHA recorded $11.7 million in inflows, while Grayscale's ETHE outflows reduced to $19.8 million.

Ethereum ETF Flows

With ETHE outflows trending toward zero, analysts expect ETH ETFs to begin recording consistent net inflows in the coming weeks.

Several analysts, including Bitwise CIO Matt Hougan, have earlier predicted that ETH ETFs could see net inflows of $15 billion in the first 18 months of launch. Most predictions suggested that such inflows could send ETH to set a new all-time high of around $5,000.

However, with the recent market crash that sent ETH to around $2,100, analysts' may need to update their predictions.

Also, on the ETH ETF front, the Securities & Exchange Commission (SEC) extended the time to decide on asset manager Hashdex's ETF that would own Bitcoin and Ethereum to September 30, according to the regulator's filing on Friday.

Meanwhile, ETH options with a notional value of $560 million, Put/Call Ratio (PCR) of 0.96 and Max pain of $2,950 expired today. The recent crash saw put (sell) options rising compared to calls (buy), as reflected in the hike in PCR from 0.55 to 0.96 in the past week, meaning most options traders turned bearish on ETH. A price reversal often follows when the PCR rises quickly.

ETH technical analysis: Ethereum could reclaim key support

Ethereum is trading around $2,600 on Friday, up 0.4% on the day. In the past 24 hours, ETH saw $41.03 million in liquidations, with long and short liquidations accounting for $18.2 million and $22.83 million, respectively.

ETH failed to overcome the $2,723 resistance level as prices quickly retraced on the daily chart after attempting a move above it.

ETH/USDT Daily chart

The Relative Strength Index (RSI) and Stochastic Oscillator have moved away from the overbought region in the past few days, meaning the bearish momentum is weakening.

If the bearish momentum continues to fade, ETH could retest the $2,723 resistance again.

A successful leg-up would see ETH aim for the $3,368 resistance, especially with a potential illiquid weekend and bulls returning to the market. This would also see ETH reclaiming the $2,800 key support that withstood bearish pressure for nearly six months before the recent market crash.

On the downside, ETH could follow a trendline to reach a swing low around the $2,000 psychological level in the coming weeks before rebounding. ETH has previously posted similar moves between August 2022 to November 2022 and July 2023 to October 2023.

In the short term, ETH could bounce around $2,548, where traders risk $24.4 million in liquidations.

Cryptocurrency prices FAQs

Token launches like Arbitrum’s ARB airdrop and Optimism OP influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence risk assets like Bitcoin, mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs. This has been observed in Bitcoin and Litecoin.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin Weekly Forecast: BTC remains calm before a storm

Bitcoin price has been consolidating between $85,000 and $88,000 this week, approaching the lower boundary of the consolidation range when writing on Friday. A K33 Research report explains how the markets are relatively calm and shaping up for volatility as investors absorb the tariff announcements.

Donald Trump’s tariff policies set to increase market uncertainty and risk-off sentiment

US President Donald Trump’s tariff policies are expected to escalate market uncertainty and risk-off sentiment, with the Kobeissi Letter’s post on X this week cautioning that while markets may view the April 2 tariffs as the "end of uncertainty," it anticipates increased volatility.

Ethereum Price Forecast: Whales increase buying pressure as developers set April 30 for Pectra mainnet upgrade

Ethereum developers tentatively scheduled the Pectra mainnet upgrade for April 30 in the latest ACDC call. Whales have stepped up their buying pressure in hopes of a price uptick upon Pectra going live on mainnet.

BTC stabilizes while ETH and XRP show weakness

Bitcoin price stabilizes at around $87,000 on Friday, as its RSI indicates indecisiveness among traders. However, Ethereum and Ripple show signs of weakness as they face resistance around their key levels and face a pullback this week.

Bitcoin: BTC remains calm before a storm

Bitcoin (BTC) price has been consolidating between $85,000 and $88,000 this week, approaching the lower boundary of the consolidation range when writing on Friday.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.