Ethereum Zhejiang testnet for staked ETH withdrawals set to go live ahead of Shanghai hard fork

- Ethereum Improvement Proposal 4895 will be tested first, which will be the focus of the testnet.

- The Zhejiang testnet came after developers discarded the Shandong testnet.

- Ethereum price is struggling to breach the immediate hurdle at $1,641, trading at $1,585.

Ethereum developers have been rapidly pushing out updates for the world’s second-biggest blockchain since the network switched to a Proof of Stake (PoS) consensus mechanism. The next major update in the line is the Shanghai hard fork. However, before it goes live, the Zhejiang testnet is set to go live on February 1.

Ethereum withdrawals are on the way

Ethereum developers will be launching a new testnet on Wednesday, where users will be able to test one of the most important updates to the network. The Ethereum Improvement Proposal (EIP) 4895 will be available to test on the Zhejiang testnet, which is also known as the staked ETH withdrawal EIP.

Part of the Shanghai hard fork, staked ETH withdrawals have been much awaited by users as Ethereum has been a PoS network for months now. The Shanghai hard fork initially also included the EIPs focusing on EVM Object Format (EOF).

As a result, the previous testnet, known as the Shandong testnet, also included the EOF EIPs. But since the latter was removed from the Shanghai upgrade and rescheduled for a separate hardfork in Q3 2023, the Shandong testnet was shut down.

Set to go live on Wednesday, the Zhejiang testnet will allow users to participate in simulated withdrawals where one can deposit ETH to validators on the testnet and withdraw them the week after.

The Zhejiang public testnet is going live tomorrow (1st of Feb 15:00 UTC, 2023). Shanghai+Capella will be triggered 6 days later (at epoch 1350). You will be able to deposit validators, practice BLS change and exit without risk. All links are here: https://t.co/XNlsDIG0cm pic.twitter.com/sKKDJmolt2

— Barnabas Busa (@BarnabasBusa) January 31, 2023

Ethereum price nears breakout

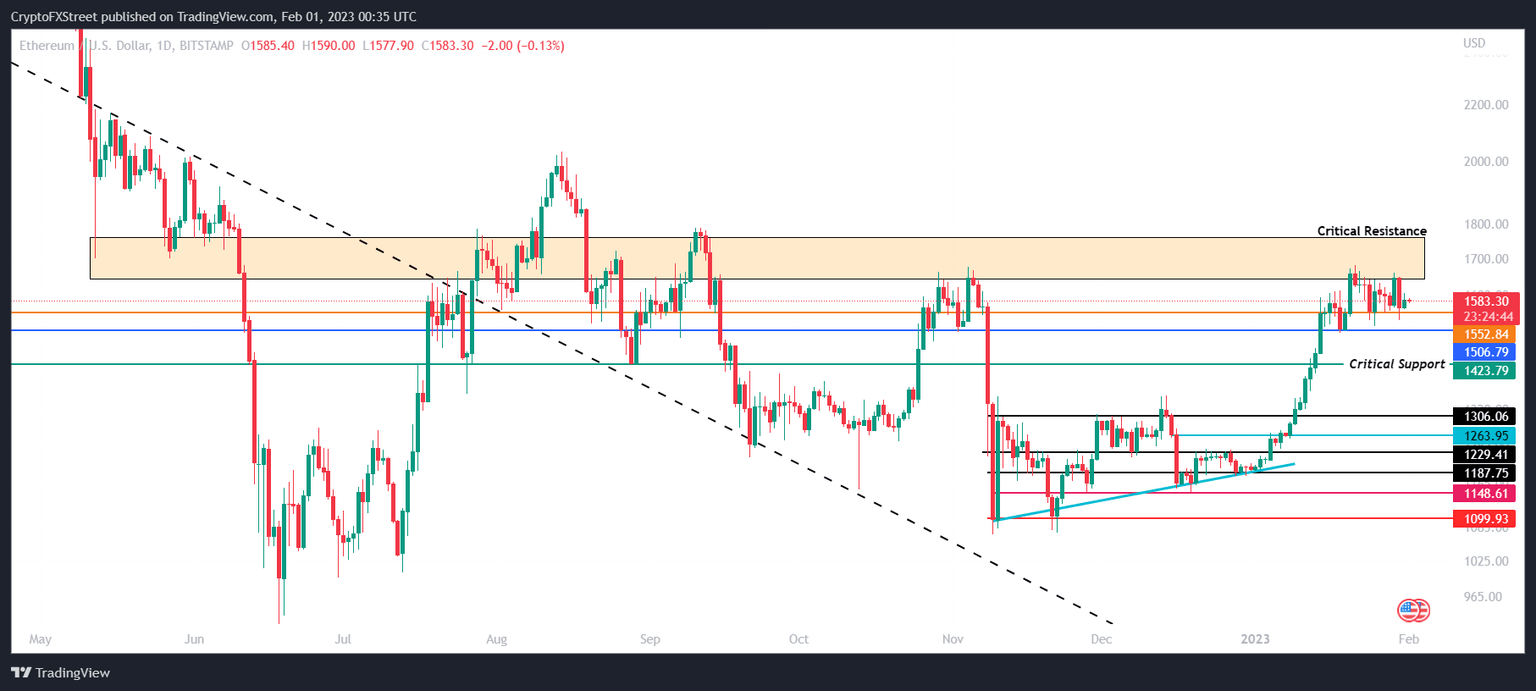

Ethereum price is close to breaching the four-month-old resistance level at $1,641, failing its attempts for the last two weeks. Trading at $1,585 at the time of writing, ETH needs the bulls to stick it out for a little bit longer in order to flip the critical resistance into support.

Once $1,641 is turned into a support floor, ETH will have the opportunity to rally toward the critical resistance at the upper limit of the resistance block at $1,761. If buyers can sustain this rise, Ethereum price will be propped for a further rally towards the $2,000 mark.

ETH/USD 12-hour chart

Nevertheless, the altcoin is equally close to losing its immediate support level at $1,552. If invalidated, the cryptocurrency will slip to tag $1,506, and a further decline will bring the price to $1,423. A daily close below this critical support level would invalidate the bullish thesis, leaving ETH vulnerable to a fall to December highs of $1,306.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.