Ethereum struggles to keep up with Bitcoin ahead of Shanghai upgrade

- Ethereum network’s large wallet investors have been scooping up ETH tokens consistently for the past week.

- With the Shanghai upgrade less than a month away, the total value locked in the Ethereum deposit contract hit a new all-time high.

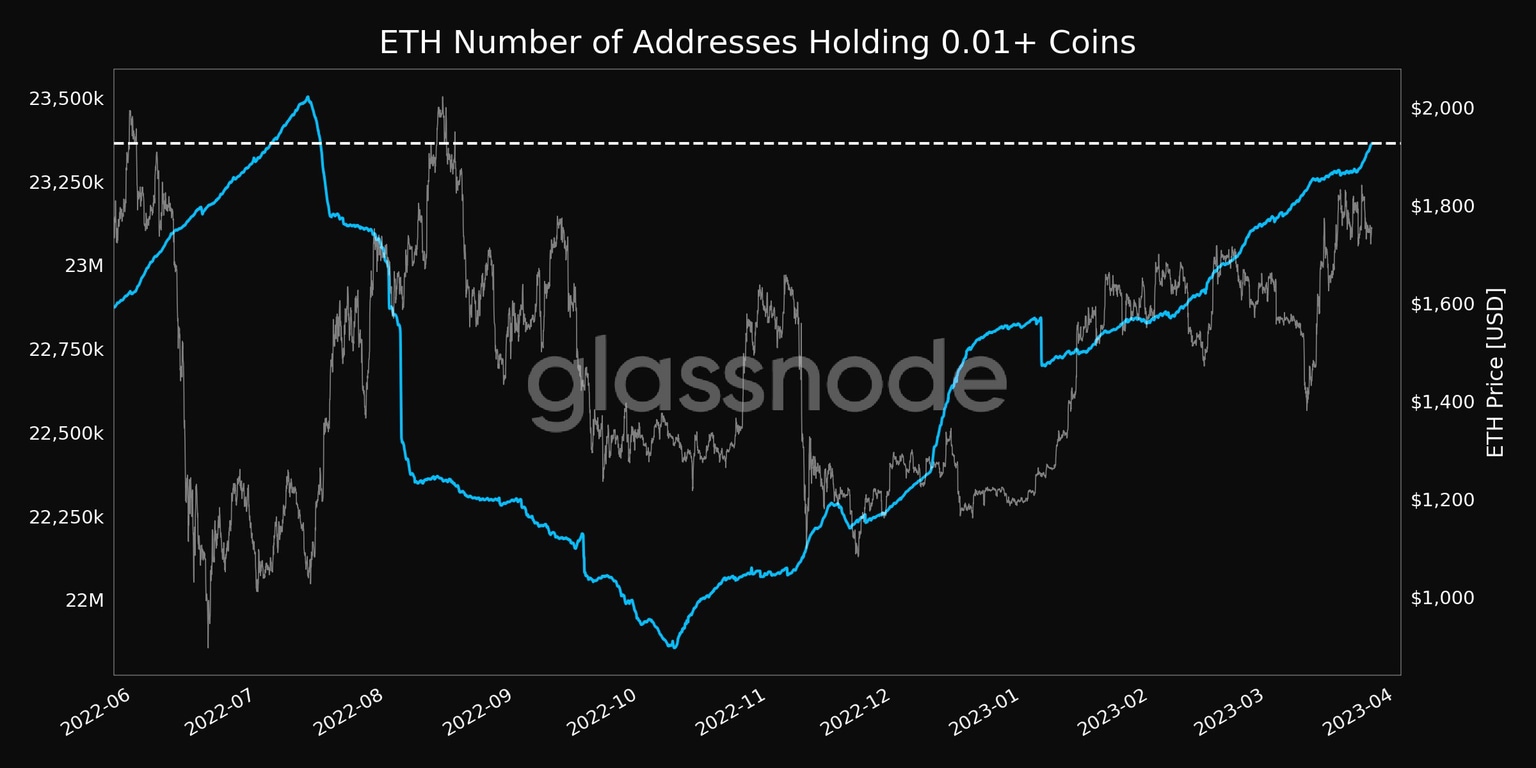

- Ethereum has seen a resurgence in demand from retail investors with 23.3 million addresses that have at least 0.01 ETH.

Ethereum (ETH) Shanghai upgrade is drawing close and it is key for ETH holders and bulls to defend critical support at $1,680 to fight further decline in the altcoin's price. Ethereum whales holding between 1,000 and 10,000 ETH have been scooping up the altcoin consistently for a week. The altcoin's demand among retail investors has climbed as ETH holders fight consolidation.

Also read: Ethereum Layer 2 rat race intensifies, here's how to benefit

Ethereum bulls need to defend against a drop below $1,680, here’s why

On the Ethereum price chart, the $1,680 level represents the top of a symmetrical triangle that dates back to September 2021.

ETHUSDT Perpetual Contract

$1,680 is therefore key support for the altcoin and bulls need to defend against a drop below this level. While crypto market participants remain indecisive it is key for Ethereum to sustain above its critical support level to defend against further decline in the days leading up to the ETH token unlock event.

Ethereum whales accumulate ETH ahead of Shanghai upgrade

Ethereum network’s large wallet investors have continued accumulation of the altcoin as the Shanghai upgrade draws close. The upgrade aims at making Ethereum accessible and scalable. Importantly, ETH token unlock will occur post the Shanghai upgrade; this is an event that the Ethereum holder community has anticipated since the launch of the ETH2 deposit contract.

Based on data from Santiment, ETH wallet addresses holding between 1,000 and more than 10,000 ETH, and 1 million to 10 million ETH tokens have added the altcoin to their balance consistently in the last seven days. Large wallet addresses are accumulating the largest altcoin by market capitalization.

%2520%5B11.14.57%2C%252027%2520Mar%2C%25202023%5D-638154937098960677.png&w=1536&q=95)

ETH accumulation by large wallet investors

Retail investors match whale’s enthusiasm. There are currently over 23.3 million addresses that have at least 0.01 ETH and the address count has hit an eight month high according to Glassnode.

ETH number of addresses holding 0.01+ Ethereum tokens

Interestingly, Total Value Locked (TVL) in the ETH2 deposit contract hit an all-time high above 17 million ETH. These metrics fuel a bullish thesis for the second-largest cryptocurrency by market capitalization.

With the rising uncertainty in the crypto ecosystem, despite the bullish thesis, influencers and crypto analysts question why the narrative has turned bearish.

Ethereum struggles to keep up with Bitcoin performance

Ethereum, the largest altcoin in the crypto ecosysten is still struggles to keep the pace with Bitcoin performance in 2023. Analysts on crypto Twitter noted that ETH held more steady during the FTX collapse, than it is ahead of the Shanghai upgrade.

ETH v. BTC

@cryptoalle, an analyst on Twitter argues that altcoins are outperforming, while Ethereum struggles to keep up with Bitcoin.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.