- Hong Kong has approved applications for a spot Bitcoin and Ethereum ETF.

- Whales have been accumulating ETH as they view recent crypto market dump as buying opportunity.

- Ethereum may not post significant gains in coming days despite price recovery.

Ethereum's (ETH) price slightly improved on Monday after Hong Kong approved applications for a spot Bitcoin and Ethereum ETF. Whales have also been accumulating ETH after the market dip over the weekend.

Read more: Ethereum price stagnates as EIP-3074 brings smart contract functionalities to wallets

Daily digest market movers: Hong Kong ETH ETF approval, whale accumulation

Ethereum has seen a slight gain coming out of a bearish weekend. Here are your latest market movers for the number one altcoin:

- Hong Kong Securities & Futures Commission (SFC) approved applications for spot Bitcoin and Ethereum ETFs on Monday. The approval was confirmed by several applicants, including HashKey Capital, Harvest Global Investments, Bosera Capital and China Asset Management.

Unlike spot Bitcoin ETFs in the US, which are based on cash redemption, Hong Kong's spot Bitcoin and Ethereum ETFs will allow an in-kind redemption and subscription model. This means that investors can subscribe to and redeem their investments using the underlying asset.

In contrast, several analysts and crypto community members expect the US Securities & Exchange Commission (SEC) to deny applications for a spot Ethereum ETF in May.

- Hong Kong's ETH ETF approval coincides with increased whale activity surrounding Ethereum. Following the crypto market dip over the weekend, whales have been on a buying spree for the second-largest digital asset.

In the past few hours, eight whales who have previously profited from ETH returned to spend a combined 31.88 million in USDT and USDC to purchase 9,787 ETH on-chain on Monday, according to data from Spot On Chain. The purchase comes at an average price of $3,257.

Another whale wallet related to digital asset firm Matrixport withdrew 16,300 ETH from Binance, according to data from Lookonchain. The same wallet had withdrawn ETH in bulk from exchanges on several occasions since March 29, withdrawing a total of 67,286 ETH.

Other large whale withdrawals include:

This whale spent 70M $USDC to buy 23,790 $ETH at $2,942 from the bottom again after $ETH dropped.

— Lookonchain (@lookonchain) April 14, 2024

He has bought 85,931 $ETH($278.5M) from #Binance and #DEX in the past week, with an average buying price of $3,241.

He still holds $136M stablecoins and may buy more $ETH.… pic.twitter.com/d7yYdqEnDB

- Lookonchain also posted on X:

It seems that whales bought $ETH at the bottom!

— Lookonchain (@lookonchain) April 13, 2024

Whale"0x4359" withdrew 37,018 $ETH($120.7M) from #Binance 4 hrs ago and this whale has withdrawn 62,141 $ETH($202.6M) from #Binance in the past 5 days.https://t.co/41366OnM5Y

Fresh whale wallet"0xE347" withdrew 7,300 $ETH($23.8M)… pic.twitter.com/qEtTSYU3Us

- The market dip before Hong Kong's spot ETH ETF approval may have seemed like a good buying opportunity for these whales. Some of these withdrawals may have also gone into Ethereum liquid staking and restaking protocols as several of them have recorded impressive increases in the past 24 hours, according to data from DeFiLlama.

Also read: Ethereum price recovers slightly as whales begin accumulation spree

Technical analysis - ETH may not see a huge price increase

Ethereum began the new week with a strong start, showing recovery signs from the general crypto market dump over the weekend.

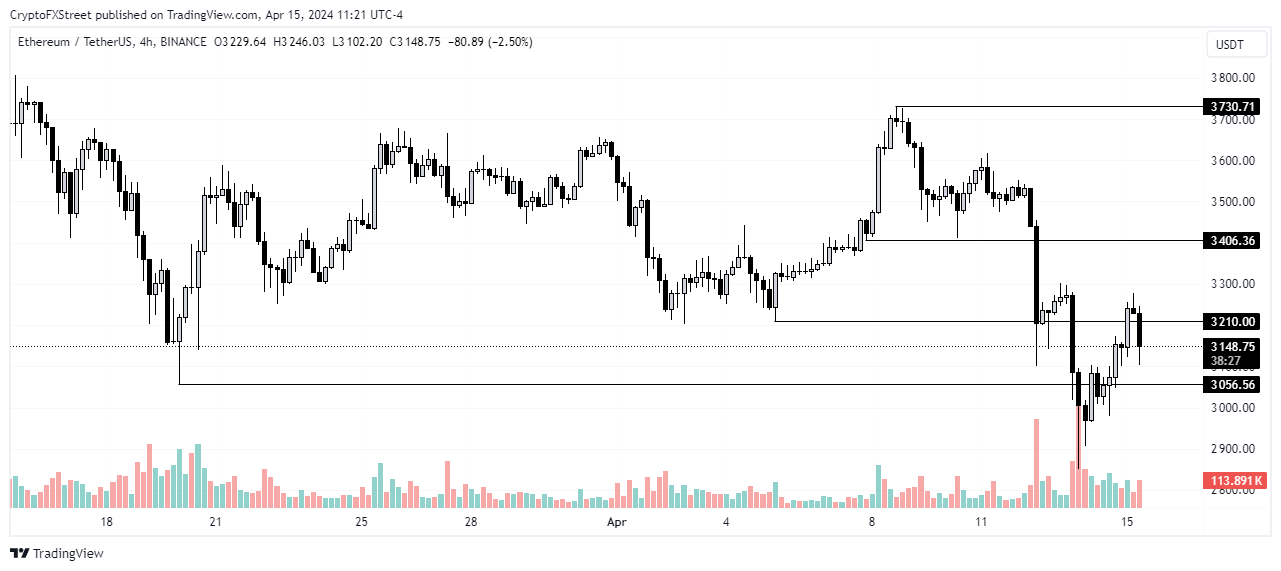

While recent whale activity has enabled its price to recover from the bottom of $2,850 recorded on Saturday, ETH may not see huge increases in the next few days. If whales maintain their buying activity, ETH could settle inside the range of $3,210 and $3,406 within the next few days in an attempt to fill the liquidity void formed on April 12.

ETH/USDT 4-hour chart

However, things could change quickly if the upcoming Bitcoin halving - less than four days away - causes a significant shift in the crypto market. A move below the $3,056 support of March 20 will indicate another bearish trend in ETH. If it breaks past the $3,406 resistance of April 7, ETH could target the $3,730 key level and eventually rally to $4,000.

Also read: Ethereum extends correction as Van Eck CEO dampens chances of spot ETH ETF approval

ETH is currently trading at $3,134, up 3.1% at the time of writing on Monday.

Ethereum FAQs

Ethereum is a decentralized open-source blockchain with smart contracts functionality. Serving as the basal network for the Ether (ETH) cryptocurrency, it is the second largest crypto and largest altcoin by market capitalization. The Ethereum network is tailored for scalability, programmability, security, and decentralization, attributes that make it popular among developers.

Ethereum uses decentralized blockchain technology, where developers can build and deploy applications that are independent of the central authority. To make this easier, the network has a programming language in place, which helps users create self-executing smart contracts. A smart contract is basically a code that can be verified and allows inter-user transactions.

Staking is a process where investors grow their portfolios by locking their assets for a specified duration instead of selling them. It is used by most blockchains, especially the ones that employ Proof-of-Stake (PoS) mechanism, with users earning rewards as an incentive for committing their tokens. For most long-term cryptocurrency holders, staking is a strategy to make passive income from your assets, putting them to work in exchange for reward generation.

Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) mechanism in an event christened “The Merge.” The transformation came as the network wanted to achieve more security, cut down on energy consumption by 99.95%, and execute new scaling solutions with a possible threshold of 100,000 transactions per second. With PoS, there are less entry barriers for miners considering the reduced energy demands.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin Weekly Forecast: BTC nosedives below $95,000 as spot ETFs record highest daily outflow since launch

Bitcoin price continues to edge down, trading below $95,000 on Friday after declining more than 9% this week. Bitcoin US spot ETFs recorded the highest single-day outflow on Thursday since their launch in January.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Solana Price Forecast: SOL’s technical outlook and on-chain metrics hint at a double-digit correction

Solana (SOL) price trades in red below $194 on Friday after declining more than 13% this week. The recent downturn has led to $38 million in total liquidations, with over $33 million coming from long positions.

SEC approves Hashdex and Franklin Templeton's combined Bitcoin and Ethereum crypto index ETFs

The SEC approved Hashdex's proposal for a crypto index ETF. The ETF currently features Bitcoin and Ethereum, with possible additions in the future. The agency also approved Franklin Templeton's amendment to its Cboe BZX for a crypto index ETF.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.