Ethereum Weekly Forecast: ETH/USD volatility ousted as DeFi skyrockets to $2 billion

- Ethereum volatility resembles Bitcoin’s followed by little to no price action.

- DeFi ecosystem hits the $2 billion mark for the first time riding on Kyber Network boom.

- Ethereum 2.0 and the DeFi news fail to trigger a rally for Ethereum as correlation with Bitcoin mounts.

Ethereum alongside the largest cryptocurrency, Bitcoin are dealing with a peculiar situation characterized by low trading volume, poor investor interest as well as the lack of catalysts. The slumber period is happening amid positive reactions from selected altcoins such as Ripple (XRP), Tezos (XTZ), Stellar (XLM) and Chainlink (LINK) among others.

ETH/USD made a considerable recovery from the lows in June around $215. The renewed bullish momentum hit highs above $240 and even tested the hurdle at $245. However, attempts to head for $250 were thwarted culminating in declines below $240. At the time of writing, ETH/USD is trading at $238 following a 1.30% loss on the day. If recovery stalls and bulls delay in reclaiming the support at $240, Ethereum could usher in the weekend session in losses.

Related content: Ethereum Price Update: ETH/USD bullish scenario, why $250 and $280 are within reach?

The wait for ETH 2.0 is getting tiresome

The crypto community including enthusiasts and newbies are all aware of the Ethereum 2.0. The protocol that hopes to revolutionize the crypto industry by supporting a larger transaction capacity, efficient smart contracts execution, higher transactions per second, coins staking and the transition to a Proof-of-Stake PoS) protocol among other key features.

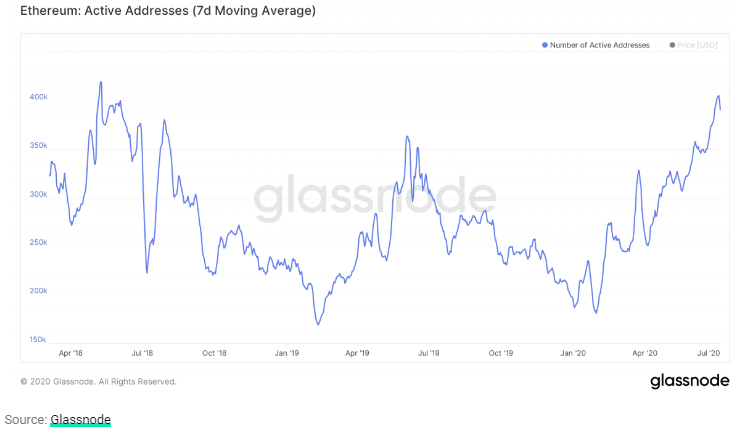

The attention gained from user and community anticipation has seen the Ethereum ecosystem grow tremendously in spite of the slumber in price action. Glassnode, an on-chain data analysis platform said on Friday that Ethereum’s number of active addresses has hit 405,014. The last time Ethereum active addresses hit this level was back in May 2018 when the crypto was trading around $800. It is clear that the growth has not been brought about by price action but the developments that are ongoing within the network. According to the research team at Coinmetrics:

The current active address surge, however, is not driven by an ETH price peak, as ETH’s price has remained under $250 since February. Instead, it appears to be driven by rapid growth of Ethereum-based stablecoins and decentralized finance (DeFi).

The Ethereum 2.0 is seen as the saving grace that will see the network finally solve the scaling issues. Congestion of ETH network has been a common occurrence that sometimes leads to a spike in transaction fees.

Unfortunately, the launch date for Ethereum 2.0 is still unknown despite developers working around the clock. Investors’ interest has remained on top perhaps due to the promises ETH 2.0 would bring to the table. For now, attention is shifting to other altcoins such as Cardano that are coming up as direct competitors of ETH.

Ethereum’s DeFi hits $2 billion

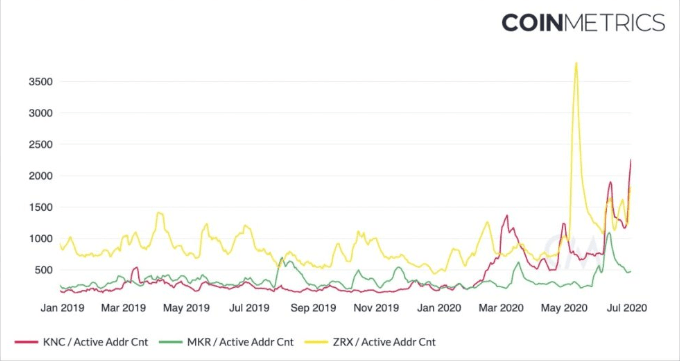

The decentralized finance (DeFi) ecosystem within the Ethereum network has been on a progressive and impressive growth pattern in 2020. Data by DeFi Pulse has recently indicated that the funds locked in DeFi have hit a new milestone of $2 billion. This is a tremendous achievement owing to the fact that in March during the “Black Thursday,” crash, the sector suffered dire losses. The recent surge has been attributed to the growth of platforms such as Compound and the Kyber Network (KNC). Coinmetrics team also dived into the factors behind the surge witnessed in KNC and explained:

KNC is hitting new all-time highs entering July in anticipation of its Katalyst and KyberDAO updates which will introduce new staking rewards – once the update goes live KNC holders will be able to participate in protocol governance by staking their tokens, while earning ETH rewards in return.

Ethereum Technical Analysis: Low volatility or calm before a storm

Despite the surge in ETH transaction volume as well as the number of active addresses, ETH/USD has been lethargic in its trading for over a month. The stability witnessed with Ethereum and Bitcoin since May has left questions in regard to the volatile nature of digital assets. Bitcoin’s scenario is taken lightly due to the fact that there have been few to no events in the period after halving. Ethereum, on the other hand, continues to raise eyebrows as to why it is not matching up to the strong fundamentals seen within its network such as the boom in DeFi, ETH options and the anticipation for ETH 2.0. According to Pierce Crossby, the general manager at Tradingview:

The recent boom in DeFi is mostly tapping into the interests of ’existing’ Ether investors or ’hodlers.’ As a result, there is very little new ’demand’ in terms of cash inflows. Comparably, when a currency is listed on a new broker/exchange or similar commercial channels, there is net new cash to a given security; DeFi is just an additional application for existing investors. Not a mass-market product.

As data by Skew, a crypto analysis platform shows, Ethereum correlation to Bitcoin had recently hit a two-year and high. Perhaps this is the reason why Ethereum is giving a blind eye to all positive news. Skew also notes that the volatilities of the two largest cryptocurrencies have been similar for some time now. Moreover, the spread between Bitcoin and Ethereum is almost zero.

At the time of writing, Ethereum is trading at $238 after adjusting from $245 following a false triangle breakout. Support is anticipated at the 50 SMA, $230 as well as at $220. Consolidation is likely to take precedence in the coming sessions based on both the RSI and the MACD. Gains above $240 are bound to cause a shift in the focus back to $250.

ETH/USD daily chart

%20(56)-637299703988063291.png&w=1536&q=95)

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren