- Ethereum rises to a two-year high at $433 after extending the bullish leg above $400.

- High Ethereum transaction fees could eventually harm DeFi growth.

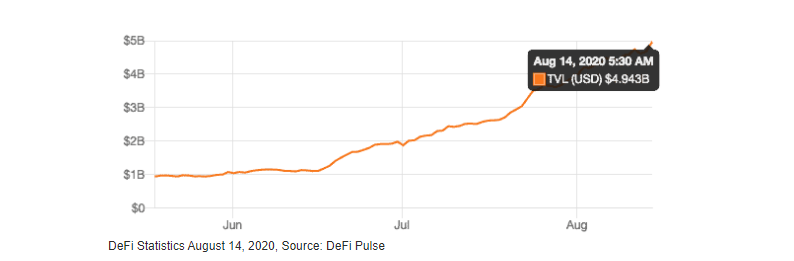

- Funds locked in DeFi hit the $5 billion mark in spite of the high Ethereum transaction costs.

Ethereum rallied to a two year high this week after stepping above $430. However, the rising value of Ether has not shifted the attention from the skyrocketing gas fees that are now said to be hurting the decentralized finance ecosystem. Due to the heightened activities within DeFi, the Ethereum hash rate hit all-time highs as discussed on Thursday. At the time of writing, Ethereum is trading at $423 amid a push by the bulls to have the price above $430 in addition to establishing strong support at $420.

Can Ethereum hit $1,000 by the end of the year?

Some options traders, mainly on Panama-based derivatives exchange, Deribit are already betting that Ether will trade above $1,000 by the end of the year. The contracts now stand at 3,470 as discussed with a value of more than $1.3 million. 1,120 of the call options expire on in December 2020 with some having an expiry date as far as March 2021. The CCO of Deribit, Luuk Strijers confirmed the bullish nature of traders on the exchange saying:

Volumes have been decent and open interest [open positions] is over 2,500 contracts already, indicating some traders believe ETH can potentially show a price move of over 180% in five to seven months.

Ethereum miners’ daily profitability at two-year high

As mentioned, transaction fees within the Ethereum network are currently exorbitantly high. This has resulted in a massive increase in the miners’ revenue which has seen the daily profit hit a 27-months high. As per the data provided by BitInfoCharts, mining is now profitable at $5.8 per 100 megahashes per second (MH/s), a level that has not been witnessed since May 2018.

The surge in profits has been attributed to the increase in ETH prices coupled with high gas fees within the network. The DeFi ecosystem is directly linked to the increased network activity that leads to a clog and ultimately high transaction fees. Mining operations are now wrecking in over 90% in profit even with electricity power costing $0.05 per kilowatt-hour. The situation is likely to remain the same in the coming weeks as no amendment has been agreed upon within the community on how to handle the surge in transaction costs.

Ethereum gas fees crippling DeFi

Decentralize finance growth is ballistic at the moment but high Ethereum gas fees are not favoring this growth. On Thursday, the Ethereum network gobbled an all-time high of $6.87 million in total fees. The CEO of Synthetix, Kain Warwick said that DeFi is now “prohibitively expensive” for most people at the moment compared to the situation three months ago. A user on reddit, Will 3380 lamented on the issue of high transaction fees saying that it is becoming a major “roadblock.”

To require a transaction fee of 99 dollars is beyond ridiculous. This will be a major roadblock to growth if someone on the team does not address this.

According Qiao Wang, the head of product at Messari, a cryptoanalysis platform, the delay in the release of Ethereum 2.0 is presenting an opportunity for a highly scalable blockchain network that could dethrone Ethereum. High transaction fees and the longer processing time is just bad user experience.

I've changed my mind after using a dozen of Defi platforms. So long as ETH 2.0 is not fully rolled out, there's an obvious opportunity for a highly scalable blockchain to dethrone Ethereum. Paying $10 transaction fee and waiting 15 seconds for settlement is just bad UX.

In spite of the high gas fees, the amount of funds locked in DeFi has hit a new milestone by crossing the $5 billion mark. Data by DeFi Pulse puts the exact funds in USD at $4.94 billion. Approximately, 4.5 million in ETH is locked in the ecosystem compared to 27,000 BTC.

Ethereum technical analysis

Ethereum has bounced off an accelerated trendline (broken line). This has given bulls energy and a reason to maintain their positions and even increase them in anticipation of a rally above $450 in the approaching weekend session. The two-year high traded at $433 (on Coinbase) is currently the most significant resistance, however, before that Ether will have to topple the resistance at $430.

ETH/USD is ushering in the weekend session while technically and fundamentally healthy. Short term indicators such as the RSI and the MACD ooze bullish signals. The Elliot Wave Oscillator has started to print the second bullish session of the month. In other words, the path of least resistance is north but first support above $420 is key for the run-up to $450.

ETH/USD daily chart

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Ripple update: XRP shows resilience in recent crypto market sell-off

Ripple's XRP is up 6% on Tuesday following a series of on-chain metrics, which reveals investors in the remittance-based token held onto their assets despite the wider crypto market sell-off last week.

Floki DAO floats liquidity provisioning for a Floki ETP in Europe

Floki DAO — the organization that manages the memecoin Floki — has proposed allocating a portion of its treasury to an asset manager in a bid to launch an exchange-traded product (ETP) in Europe, allowing institutional investors to gain exposure to the memecoin.

Six Bitcoin mutual funds to debut in Israel next week: Report

Six mutual funds tracking the price of bitcoin (BTC) will debut in Israel next week after the Israel Securities Authority (ISA) granted permission for the products, Calcalist reported on Wednesday.

Crypto Today: BTC hits new Trump-era low as Chainlink, HBAR and AAVE lead market recovery

The global cryptocurrency market cap shrank by $500 billion after the Federal Reserve's hawkish statements on December 17. Amid the market crash, Bitcoin price declined 7.2% last week, recording its first weekly timeframe loss since Donald Trump’s re-election.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.

(82)-637329936909131005.png)