Ethereum validator exit hits all-time high of 15,000 as Celsius announces mass ETH unstaking

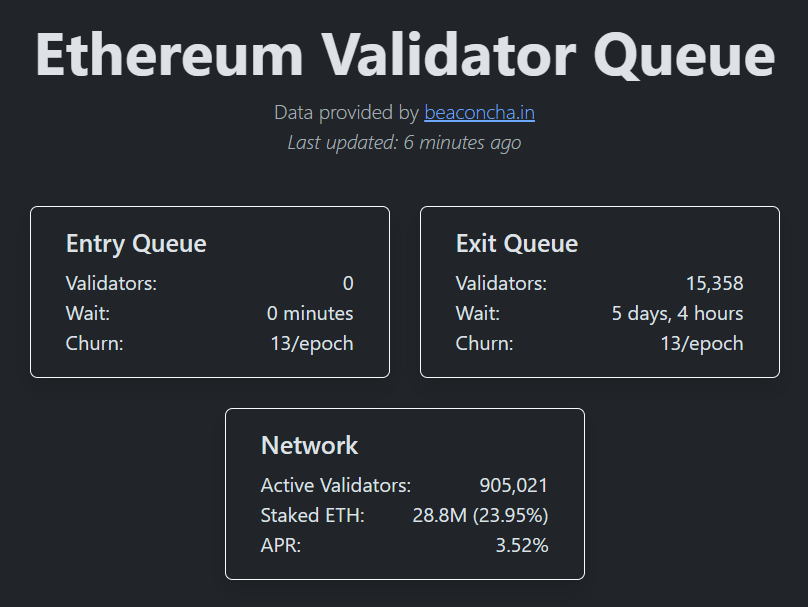

- Ethereum on-chain data shows that the current exit queue has a wait time of 5 days and 4 hours.

- Celsius announced that it would be unstaking its existing ETH holdings in order to offset restructuring costs.

- The collective value of ETH set to be removed from the Ethereum validator chain is over $1.09 billion.

Ethereum Shanghai update introduced the option to withdraw the ETH staked by investors, essentially giving validators the option to exit the market. Since then, Friday marked the biggest day for the network as it noted the highest count of validator exits in the queue, all thanks to Celsius

Ethereum validator backlog

Ethereum is witnessing a historical moment. For the first time since it activated the withdrawal of staked ETH, a mass exit event can be witnessed. At the time of writing, the chain had an exit queue of 15,358 validators, and the expected wait time is presently five days and 4 hours.

This means that any validator that attempts to exit now will have to wait for five days before they can get their 32 ETH back. Furthermore, based on the value of one validator staking being 32 ETH, the chain is set to note an outflow of $1.09 billion worth of staking over the next few days.

Ethereum validator exit queue

However, despite being such a humungous figure, it will barely make a dent in the network or sway the price action. This is because, at the moment, Ethereum has over 905,000 validators, and the total amount staked on the network is 28.8 million ETH. This represents nearly 24% of the entire circulating supply of the digital asset.

The reason behind the backlog

Celsius, a prominent name in the crypto space until its bankruptcy in July 2022, is in the process of restructuring the entire company. This includes asset distribution, for which Celsius has begun recalling and rebalancing assets to ensure ample liquidity.

Consequentially, the company announced that it would be unstaking all its existing ETH holdings in order to offset the costs it has been facing throughout the restructuring process. It also addressed the backlog caused by this decision, stating that the process would take a few days given the enormous amount of ETH set to be unstacked.

As a reminder, eligible creditors will receive in-kind distributions of BTC and ETH as outlined in the approved Plan

— Celsius (@CelsiusNetwork) January 5, 2024

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.