Ethereum underperforms Nvidia, Bitcoin, Meta, others on risk-adjusted returns amid declining investor interest

- Ethereum ETFs' high outflows signify low institutional interest amid declining ETH CME trading volume.

- Ethereum underperforms in terms of risk-adjusted returns compared to Nvidia, Bitcoin, Meta, Gold, NASDAQ-100 and others.

- ETH could follow a key trendline to decline toward $2,100 before staging a rally.

Ethereum (ETH) is up 0.1% on Wednesday following increased outflows and declining trading volume across ETH products. This follows key data showing ETH's recent underperformance compared to other top assets.

Daily digest market movers: Ethereum ETF outflows, declining ETH CME volume

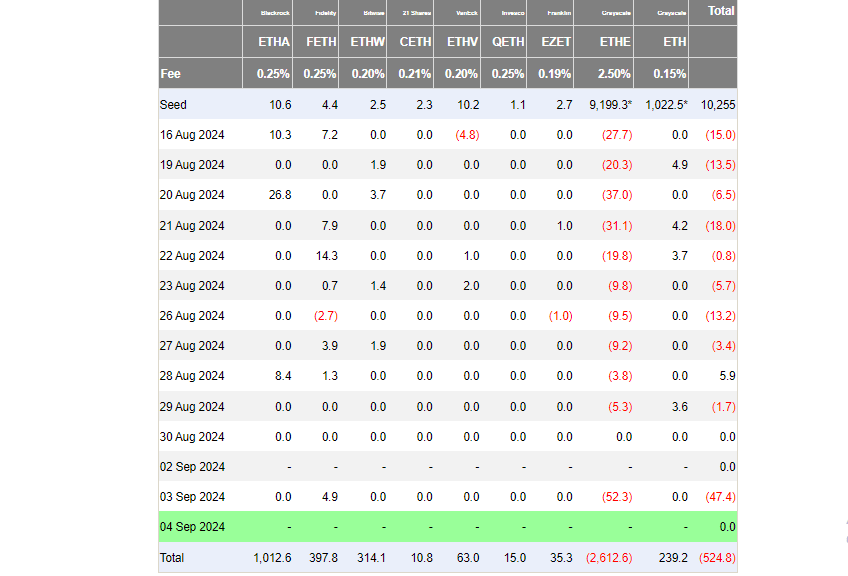

US spot Ethereum exchange-traded funds (ETFs) recorded outflows on their first trading session after the Labour Day holiday. The products witnessed net outflows of $47.4 million, its highest in the past month, per Farside Investors data.

The negative flows were spearheaded by $52.3 million in outflows from Grayscale's ETHE. Other issuers saw zero flows except for Fidelity's FETH, which recorded $4.9 million in inflows. The high ETH ETF outflows align with the general decline across the financial market on Tuesday, where stocks shaved $1 trillion off their market capitalization.

ETH ETF Flows

The consistent switch between zero to negative flows across ETH ETFs also indicates weak demand from institutional investors in Ethereum.

While many attribute the poor performance to a lack of staking within the ETFs, another cohort of investors who don't consider staking yields are also showing disinterest in ETH. According to CCData, Ethereum's futures and options Chicago Mercantile Exchange (CME) trading volume in August fell by 28.7% and 37.0% to $14.8 billion and $567 million, respectively — its lowest futures volume since December 2023.

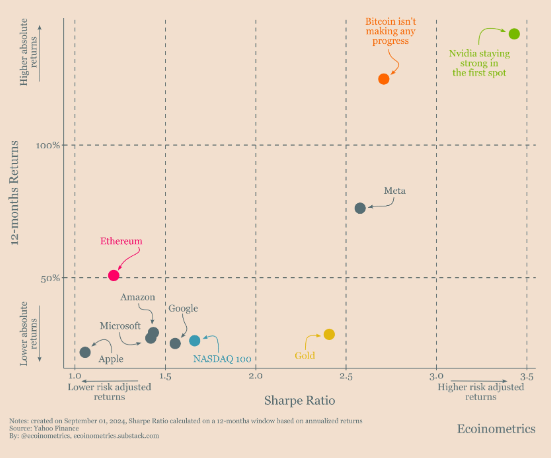

This reflects increasing caution from US investors toward ETH. A possible reason may be ETH's low risk-adjusted returns compared to other top assets. Assets and stocks like Nvidia (NVDA), Gold, Meta, Bitcoin and the NASDAQ-100 have proven to provide higher risk-adjusted returns than ETH in 2024, per Ecoinometrics data.

Ethereum Risk-Adjusted Returns vs Others

Risk-adjusted return is the metric that measures the return of an investment relative to the risk involved.

Another potential reason could be the historically poor performance of Ethereum and the crypto market in Q3, per Coinglass data. Additionally, crypto community members have been debating about the decreasing Ethereum blockchain revenue since the introduction of blobs space in the Dencun upgrade to help scale Layer 2 networks.

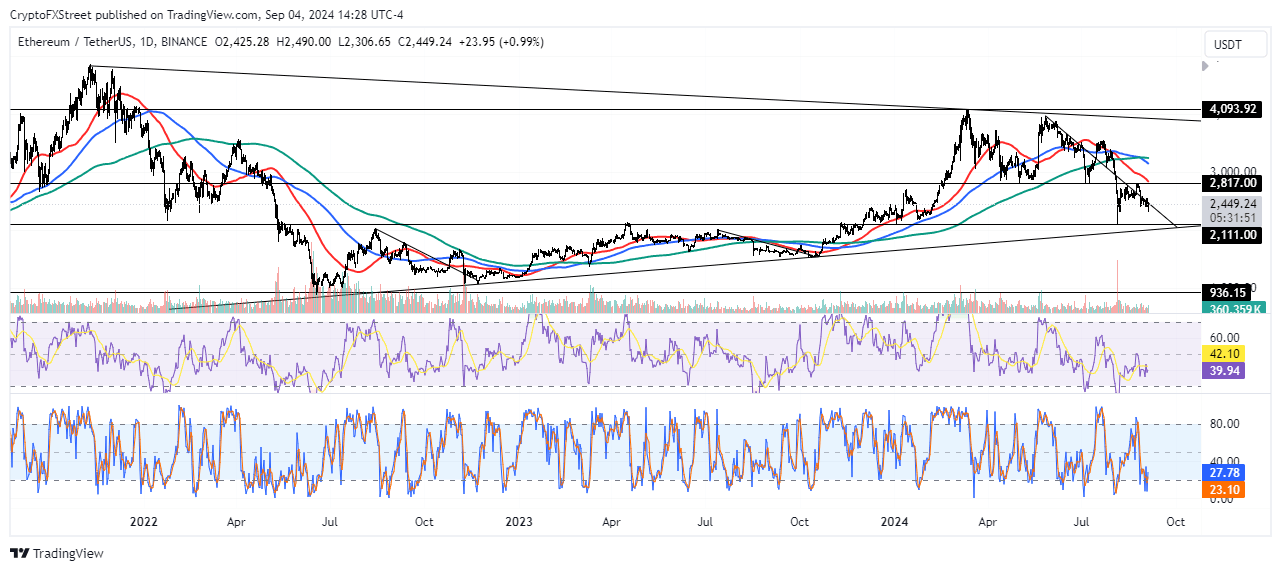

ETH technical analysis: Ethereum could decline to $2,100

Ethereum is trading around $2,450 on Wednesday, up 0.1% on the day. In the past 24 hours, ETH has seen nearly $40 million in liquidations with long and short liquidations accounting for $26 million and over $13 million, respectively.

ETH broke below the support level around $2,400, briefly falling to $2,310 before seeing a quick recovery. This indicates strong buying pressure around the $2,300 price level, as evidenced in IntoTheBlock's data, which shows investors purchased over 51 million ETH around the price.

ETH/USDT Daily chart

On the daily chart, ETH continues to trade around a key trendline that suggests its price could decline toward $2,100 to $2,200 in the coming weeks. ETH posted similar declines from August to November 2022 and July to October 2023 before staging a rally. If history repeats itself, ETH could decline toward the $2,100 support in September before seeing a rally.

A daily candlestick close above $2,817 will invalidate the thesis.

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) are indicating a slight bearish momentum.

In the short term, ETH could rally to $2,410 to liquidate positions worth $28.8 million.

Ethereum FAQs

Ethereum is a decentralized open-source blockchain with smart contracts functionality. Serving as the basal network for the Ether (ETH) cryptocurrency, it is the second largest crypto and largest altcoin by market capitalization. The Ethereum network is tailored for scalability, programmability, security, and decentralization, attributes that make it popular among developers.

Ethereum uses decentralized blockchain technology, where developers can build and deploy applications that are independent of the central authority. To make this easier, the network has a programming language in place, which helps users create self-executing smart contracts. A smart contract is basically a code that can be verified and allows inter-user transactions.

Staking is a process where investors grow their portfolios by locking their assets for a specified duration instead of selling them. It is used by most blockchains, especially the ones that employ Proof-of-Stake (PoS) mechanism, with users earning rewards as an incentive for committing their tokens. For most long-term cryptocurrency holders, staking is a strategy to make passive income from your assets, putting them to work in exchange for reward generation.

Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) mechanism in an event christened “The Merge.” The transformation came as the network wanted to achieve more security, cut down on energy consumption by 99.95%, and execute new scaling solutions with a possible threshold of 100,000 transactions per second. With PoS, there are less entry barriers for miners considering the reduced energy demands.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi