Ethereum stakers are underwater with Shanghai hard fork drawing close

- Ethereum tokens staked in the ETH2 deposit contract are sitting on unrealized losses.

- Shanghai hard fork is slated for the second week of April, and nearly 17 million ETH tokens will be available for withdrawal.

- Experts note that market participants are front-running the Shanghai token unlock and expect it to be a non-event for ETH.

Ethereum price hit a new 2023 high, above $1,900 as market participants engage in front-running the Shanghai hard fork. The event is slated to occur on April 12. Experts believe ETH token unlock could turn out to be a non-event.

Also read: GMX proposes allocation of 1.2% protocol fees to Chainlink for its services, analysts turn bullish

Ethereum staked in ETH2 deposit contract is underwater

Ethereum tokens staked in the ETH2 deposit contract were locked since the Beacon chain contract’s launch in 2020. The altcoin’s price nosedived, declining nearly 63% from it's all-time high. Therefore large volumes of ETH staked in the deposit contract is currently “underwater” or sitting on unrealized losses.

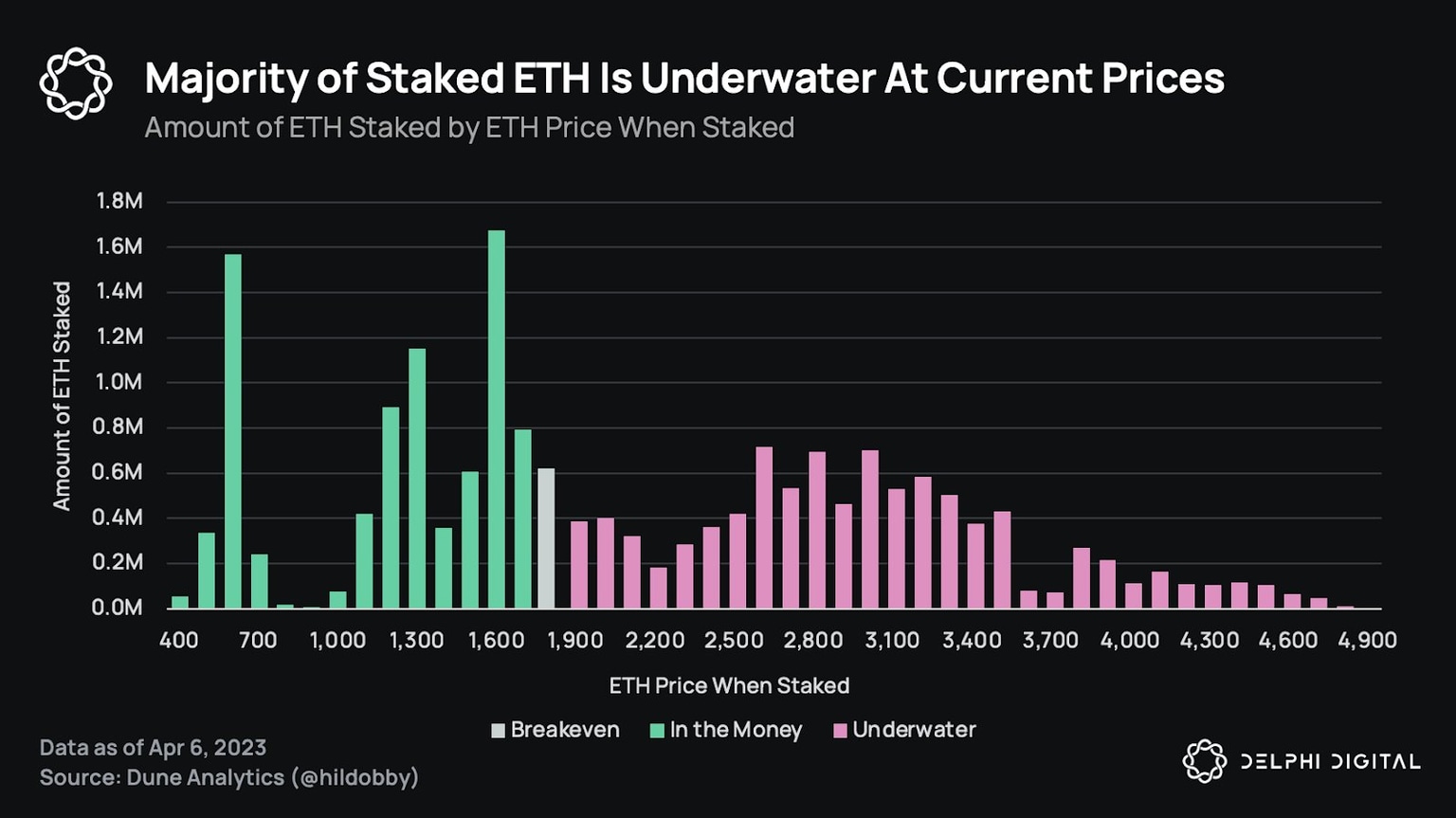

The following chart from Delphi Digital shows the state of staked ETH.

Majority of staked ETH is underwater

Ethereum tokens staked when ETH price was between $1,900 and $4,900 are currently underwater and this segment represents a large volume of the staked assets.

The Shanghai hard fork will result in a token unlock, however it is unlikely that validators unlock their staked assets and realize losses. This fuels a narrative for the token unlock to turn out to be a “non-event.”

Ethereum market participants front-run the Shanghai hard fork

Ethereum price climbed to its 2023 high above $1,900 in the days leading up to the Shanghai hard fork. Experts like Adriano Feria, an analyst on Twitter argue that front-running by Ethereum traders is likely to turn the token unlock into a non-event.

The amount of selling from people trying to frontrun $ETH's staking unlock was probably much higher than the actual event itself will produce... that's a lot of $$$ waiting on the sidelines for a non-event.$ETH stakers consist of the highest conviction level of ETH investors.…

— AdrianoFeria.eth (@AdrianoFeria) April 5, 2023

The analyst’s thesis is that ETH stakers consist of the highest conviction level of Ethereum investors and this supports the theory that token unlock may not be a bearish event for the altcoin. Validators who are profitable at the current price level are likely to sell their unlocked ETH tokens, this limits the selling pressure on the asset.

Ethereum price is therefore likely to experience a temporary pullback with the Shanghai hard fork.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.