Ethereum to $900 or $9000?

Like many others, the second-largest cryptocurrency, Ethereum (ETHUSD), bottomed on August 5 at $2121, rallied overlappingly until the end of the month, and sits today at around $2480. It's not the most awe-inspiring rally, to be honest. Since our preferred analysis method is the Elliott Wave Principle (EWP), this “sloppy” price action remains open to interpretation. But we are starting to see light at the end of the tunnel. Namely, in our previous update, see here, we found that “The decline from the March high into last Monday’s low still counts best as three waves: W-X-Y. See Figure 1 below.”

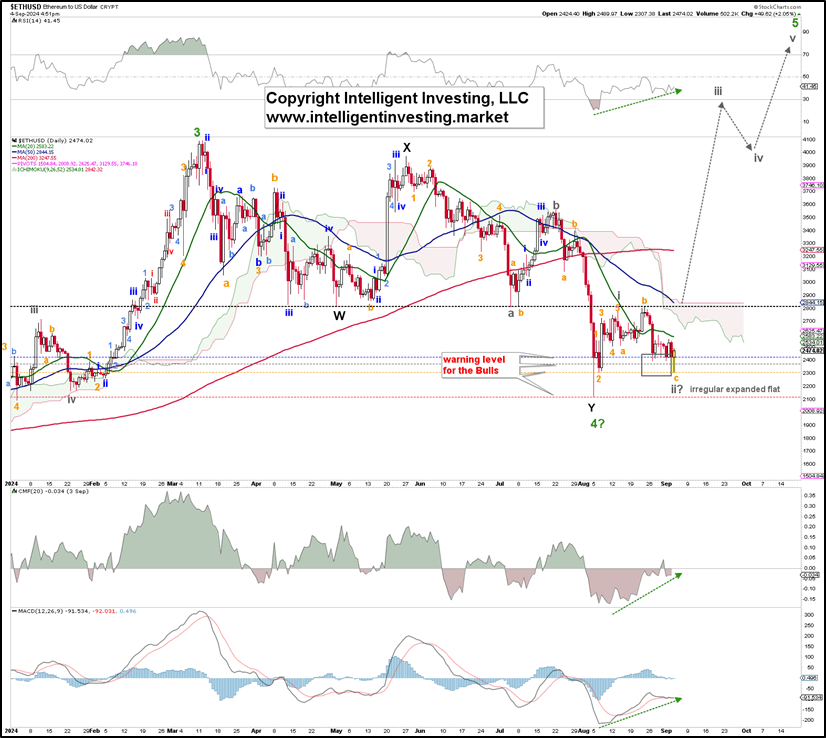

Figure 1. The daily resolution candlestick chart of ETH with several technical indicators

Thus far, the August 5 low has held, and as long as it does, we can allow for the (grey) wave-i, ii setup, as shown, to develop further. In this case, grey W-i was a leading diagonal, and grey W-ii was an irregular expanded flat. Note that at today’s low, almost 76.40% of the potential W-i rally was retraced, a typical level for a 2nd wave. Moreover, the technical indicators (TIs, such as the RSI14, MF14, and MACD) are starting to creep up, which is a positive development. However, ETHUSD is still well below its declining Ichimoku Cloud, 20-day simple moving average (d SMA), and below the declining 50d and 200d SMA. Thus, the chart trend is still 100% Bearish, and the Bulls have a lot of work left to do. First, a break back above the late-August high, labeled as orange W-b, at $2813, is required to help tell us the grey W-iii is underway. That level is critical support/resistance.

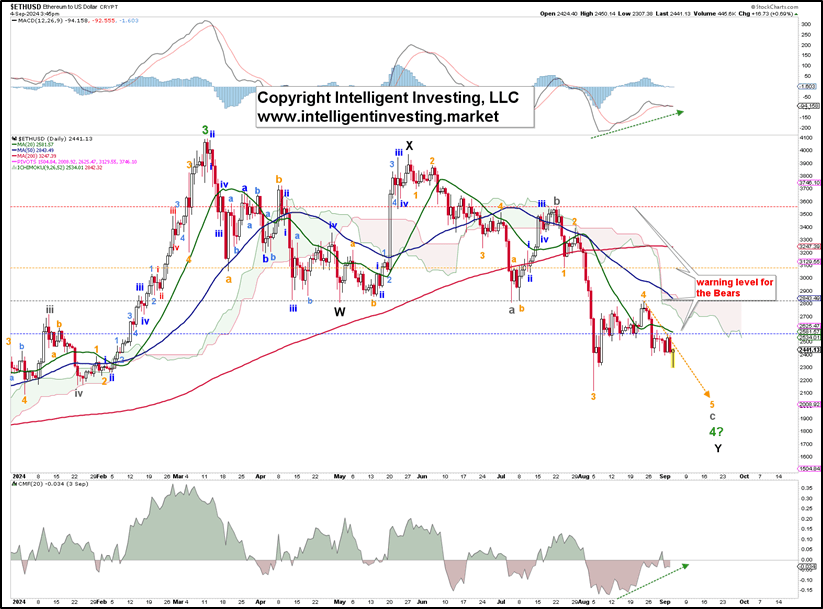

Meanwhile, in our previous update, we also found that “Unfortunately, we still cannot delineate between the "low in," as shown in Figure 1, and the "one more 5th wave lower" option.” This is, regrettably, still the case. Namely, the Bulls' third (orange) warning level is holding, but if it fails, we will have to look for the low 2000s again. See Figure 2 below.

Figure 2. The daily resolution candlestick chart of ETH with several technical indicators

In that case, the August rally was a 4th wave bounce, and a final 5th wave to ideally $2050+/-50 should be expected for an even more protracted W-X-Y correction than we already have at the August low. Conversely, we have placed the warning levels for the Bears on the chart that will tell us above which prices such a lower low become less and less likely. The 1st (blue) warning will be at $2555, the 2nd at $2812, etc.

Thus, although the price action is still less than ideal, we now have simple price-based parameters to help us tell if we see lower prices first, or if the August 5th low, and even today’s low, will stand.

Author

Dr. Arnout Ter Schure

Intelligent Investing, LLC

After having worked for over ten years within the field of energy and the environment, Dr.