Ethereum Technical Analysis: ETH/USD tries to recover following bearish Thursday

- ETH/USD dropped from $174.70 to $161.25 this Thursday.

- The daily chart shows that the RSI indicator is trending around 32.35, next to the oversold zone.

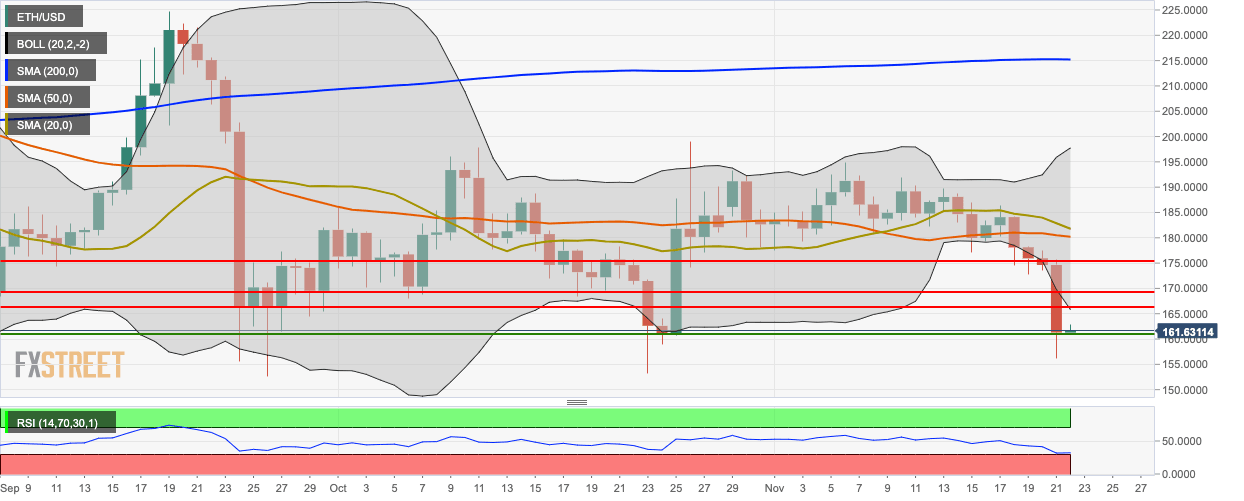

ETH/USD daily chart

The daily ETH/USD price has dropped below the 20-day Bollinger curve, indicating that it is undervalued. The Bollinger jaw has widened, showing increasing price volatility. The pair is also floating below the 200-day Simple Moving Average (SMA 200), SMA 50 and SMA 20 curves.

ETH/USD 4-hour chart

The 4-hour chart shows that the price dropped from $175.25 to $160.45 in 16 hours. Having found support at the $160.45 level and gone up to $161.75. The Elliott Oscillator has had five straight red sessions. The Bollinger width has gone up from 0.067 to 0.14, indicating increasing volatility.

ETH/USD hourly chart

The hourly ETH/USD is trending in an upwards channel formation and is floating below the SMA 20, SMA 50 and SMA 200 curves. Currently, the hourly price has found resistance at the $162.75 line and dropped to $161.75.

Key Levels

Author

Rajarshi Mitra

Independent Analyst

Rajarshi entered the blockchain space in 2016. He is a blockchain researcher who has worked for Blockgeeks and has done research work for several ICOs. He gets regularly invited to give talks on the blockchain technology and cryptocurrencies.

-637099898433346866.png&w=1536&q=95)

-637099898077087762.png&w=1536&q=95)