Ethereum takes center stage as ETF hype hits fever pitch

Markets appear to be pricing-in the approval of Ether Spot ETFs after Bloomberg analyst Eric Balchunas hinted that the US Securities and Exchange Commission (SEC), could be “doing a 180” on its Ether Spot ETF decision. This saw Ethereum soar on Monday breaching the $3,500 mark, before a Tuesday rally that saw it cross the $3,800 mark - for the first time since the heights of March.

Ethereum was also helped by an unexpected positive ruling last week that appeared to clarify its nature as a decentralized entity, and thus not a security - as had been argued in the case between the SEC and Robinhood. The ruling was interpreted by some investors, as regulators inadvertently making the case for Ethereum - driving its price up.

With the SEC now approving rule changes that will pave the way for Ethereum ETFs, some analysts foresee an Ether price rally reminiscent of Bitcoin’s rally after its ETF was approved back in January. That rally saw Bitcoin breach its previous record of $68,990.90 thanks to capital inflows into spot bitcoin ETFs from fund managers such as BlackRock (BLK) and Franklin Templeton (BEN).

The Ethereum ETF approval could have a more profound impact on markets according to analysts, because of its smaller market capitalization at $450 billion compared to Bitcoin’s $1.4 Trillion - making it more sensitive to demand shifts. Ethereum’s scarcity could also be a factor - with only 9.9% of the total supply reportedly accessible for trading.

The case for a potential upside is strengthened even further considering the Ethereum network’s makeup, after the network transitioned to a proof-of-stake mechanism in 2022 - making it more deflationary as overall supply decreases. Given these conditions, even modest inflows from traditional financial institutions into the newly approved Ethereum ETFs, could have a significant impact on price trajectory.

Ethereum’s price action

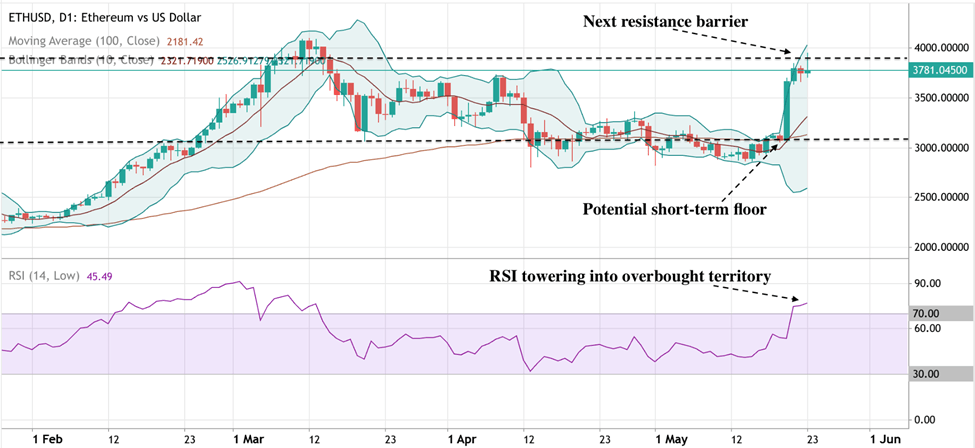

At the time of writing, Ether is showing signs of a pause with prices holding just below the $3,800 mark - after breaching that mark on May 21. Analysts note that bullish pressure still exists which is seen by prices remaining elevated above the 100-day EMA. Prices are also close to the upper bollinger band, a hint at overbought conditions and a sign that a pull back could be on the way. This is supported by the RSI towering past the 70 mark into overbought territory.

Source: Deriv MT5

Traders will also note the bollinger bands widening- a tell-tale sign of incoming volatility. If buy pressure resumes, buyers could face some pushback at the $3880 resistance barrier, a price point they have had difficulty staying above before.

On the downside, a further pull-back could trigger more short-term sellers and profit takers that could see a slide to last week’s levels of $3078. If markets don’t react to the SEC’s ruling immediately, prices could remain in a holding pattern between the $3,300 mark and the $3800 mark.

Author

Prakash Bhudia

Deriv

Prakash Bhudia, HOD – Product & Growth at Deriv, provides strategic leadership across crucial trading functions, including operations, risk management, and main marketing channels.