Ethereum price targets rally to $2,000 ahead of ETH token unlock

- Ethereum token unlock may not be a negative event for ETH with the existence and relevance of liquid staking derivatives.

- Experts argue that unlocking ETH tokens when the altcoin is 50% below its all-time high will be a non-event.

- Ethereum’s shrinking supply and bullish momentum pushed Ethereum above previous range highs; experts predict a rally to $2,000.

Ethereum transition from Proof-of-Work to Proof-of-Stake (PoS) was the last major upgrade to the altcoin’s blockchain. The Shanghai hard fork and token unlock is next key event in Ethereum. The shift to PoS purged 70,000 ETH tokens from the altcoin’s circulating supply.

Experts are bullish on Ethereum’s price rally to $2,000, and believe that the token unlock will turn out to be a non-event with the option of stakers pouring ETH into liquid staking derivatives.

Also read: Ethereum price steadies above $1,700 as ETH holders grow confident ahead of token unlock

Ethereum token unlock could be non-event with LSD tokens narrative

Adriano Feria, an AI advocate and crypto analyst argues that the bear case for the ETH token unlock ignores the existence of liquid staking derivatives and assumes that stakers are 100% illiquid going into Shanghai.

Stakers are considered to be high conviction holders that are certainly not planning to sell during a bear market. Unlocking staked ETH tokens at a time when the altcoin is 50% below its all-time high makes it a non-event. The tailwind from re-staking ETH could help the altcoin sustain its deflationary trend.

As the ETH token unlock draws close, Liquid Staking Tokens are making a comeback. Lido leads in new ETH staking deposits with 45,600 ETH staked since March 22, representing 36.4% of 7 day ETH deposits.

ETH deposited on Lido

Liquid Staking tokens begin recovery, offering alternative to selling ETH at a loss

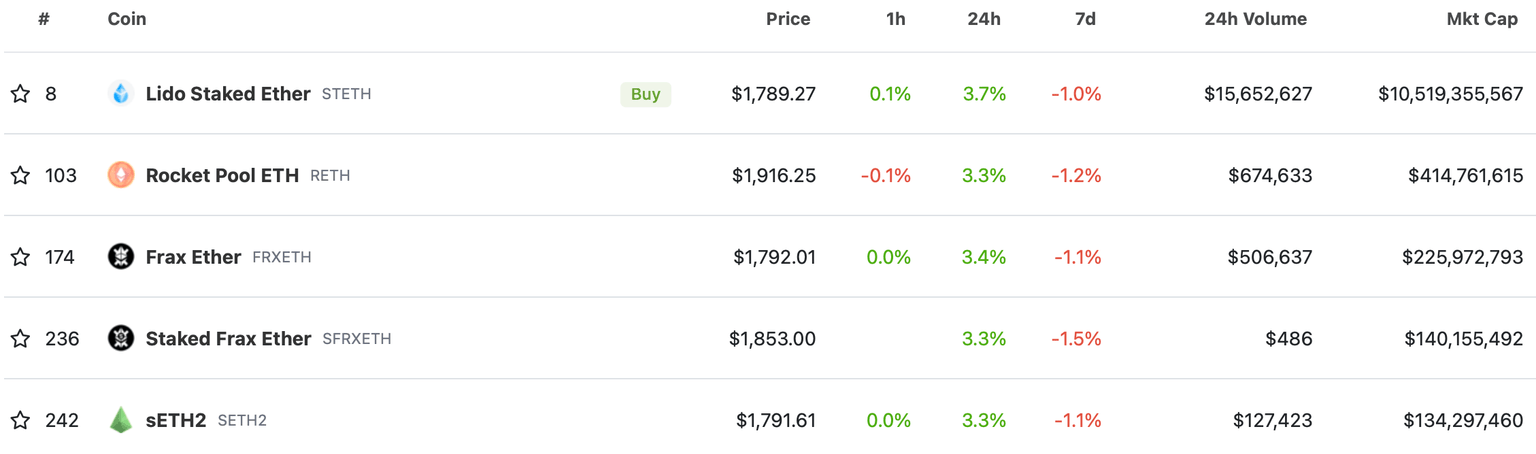

With Ethereum price nearly 50% away from its all-time high, it is likely that validators unlocking their staked ETH are likely sitting on unrealized losses. Instead of realizing losses and selling ETH below the price at which the tokens were acquired, Liquid Staking projects are offering lucrative yields and there has been noticeable recovery in their tokens since Tuesday. The following chart shows between 3 and 4% gain in Liquid Staking tokens overnight.

Liquid Staking tokens

Frax Ether recently revealed increasing protocol revenues despite losses, with the upcoming ETH token unlock acting as a bullish driver for the loosely-pegged Ethereum stablecoin. The capital waiting on the sidelines to be unlocked will help lower the execution risk of Ethereum and debunk Fear, Uncertainty and Doubt around new Liquid Staking projects and their tokens.

Ethereum supply nosedives by nearly 70,000 ETH

Ethereum supply plunged with the altcoin’s Merge, or the transition event to PoS. Nearly 70,000 ETH tokens have been pulled out of circulation, effectively reducing the selling pressure on the second-largest cryptocurrency by market capitalization.

Ethereum Supply Decreasing Post Merge

A decrease in the volume of tokens under circulation is typically considered bullish for an asset.

Can Ethereum’s shrinking supply fuel ETH rally to $2,000?

Ethereum’s shrinking supply is one of the bullish drivers for the altcoin. Pentoshi, a crypto analyst on Twitter has predicted an Ethereum price rally to $2,000. The largest altcoin made a recovery above previous range highs after a retest on Tuesday. According to the expert a rally above the $1,778 level is a bullish sign.

ETH/USD 1D price chart

A drop below the previous range high could invalidate the bullish thesis for the smart contract network’s token. Pentoshi is bullish on the altcoin since it made a swift recovery from the FUD surrounding regulatory crackdown on the largest cryptocurrency exchange in the ecosystem, Binance.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.