Ethereum erases weekend gains as yearlong SEC investigation comes to light

- Consensys' latest court filings revealed the SEC began investigating Ethereum's security status in March 2023.

- Hong Kong's spot Ethereum and Bitcoin ETFs will debut on Tuesday.

- Whales and institutional investors are dumping Ethereum, considering increased outflows following the recent dip.

Ethereum (ETH) began the week by posting losses of 4.2% on Monday after recent filings from Consensys revealed that the Securities & Exchange Commission (SEC) began formal investigations into ETH's security status since March 2023.

Read more: Ethereum cancels rally expectations as Consensys sues SEC over ETH security status

Daily digest market movers: ETH outflows, SEC's Ethereum security classification, Hong Kong ETFs

Ethereum has slipped back to key range on Monday following recent happenings in the crypto market. Here are your key ETH market movers:

- After receiving a fourth subpoena in March, Consensys sued the SEC last week for unlawfully trying to classify Ethereum as a security. The move sparked a heated debate in the crypto community on ETH's security status.

A recent filing on Monday revealed the SEC began a formal investigation into "Ethereum's status as a security" on March 28, 2023, according to Fox Business. The SEC believed "possible offers and sales of certain securities, including, but not limited to ETH," had transpired since 2018. This includes launching investigations and serving subpoenas to people and organizations that have facilitated the trading of Ethereum.

"Sources with direct knowledge of the matter tell FOX Business that subpoena recipients were instructed by the SEC to sign confidentiality agreements in order to receive information about the progress of the probes," said Fox Business. The recent filings also revealed, "the SEC may believe sales of Ethereum pre-merger, as early as 2018, are securities."

- Bloomberg analyst Eric Balchunas has pointed out that this would reduce the chances of a spot Ethereum ETF in May.

I said this on a recent town hall Spaces (as one of the main reasons eth etf ain’t happening) and some guy sharply refuted it. Forget who. I think he was a lawyer. Anyway this is for you Holmes: https://t.co/vtxRCbytpq

— Eric Balchunas (@EricBalchunas) April 29, 2024

Also read: Ethereum fees drops to lowest level since October, ETH sustains above $3,200

- While the SEC seems to be increasing efforts to classify Ethereum as a security, Hong Kong's spot ETH ETFs will go live tomorrow as regulators in the region have long stated that Ethereum isn't a security.

An issuer told WuBlockchain that the combined issuance scale of Hong Kong's spot ETH and BTC ETFs could reach $200 million to $300 million, far higher than the $125 million first-day issuance scale of spot Bitcoin ETFs in the US. The issuer expects the final market size to reach $2-3 billion. However, many US analysts predicted its maximum market size will be at most $500 million.

- On the institutional front, investors continued reducing their exposure to Ethereum, which experienced outflows worth $38.4 million in the past seven days, according to data from CoinShares. This marks the third consecutive week that Ethereum has experienced outflows. Since the beginning of April, total ETH outflows have reached $123.8 million.

- Following a recent drop in ETH's price, six whales, including FTX/Alameda, dumped 44,000 ETH worth roughly $140 million, according to Lookonchain.

6 whales dumped more than 44K $ETH($140M) after the market dropped!

— Lookonchain (@lookonchain) April 29, 2024

0x4353 deposited 10,431 $ETH($32.66M) to #Binance.https://t.co/3hqVXQvHlu

0x4446 deposited 11,892 $ETH($38M) to #Binance.https://t.co/HvLu7N4DnM

0x488b sold 3,543 stETH($11.23M) at $3,170 and 3,000… pic.twitter.com/93ISSkJWfW

ETH technical analysis: Ethereum may trade sideways without key price trigger

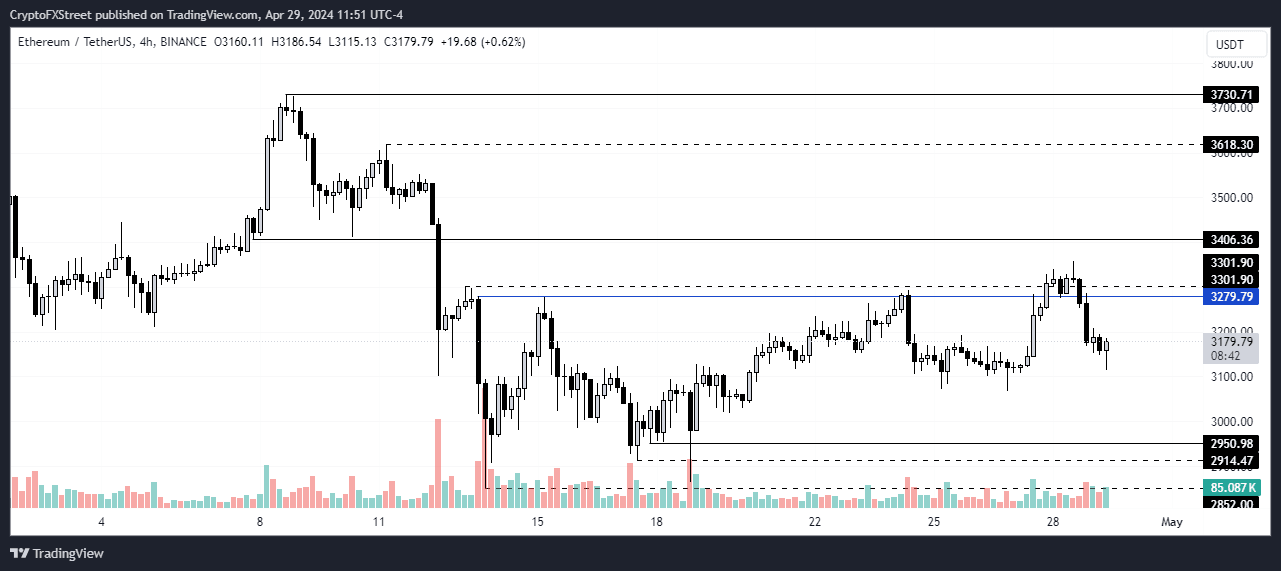

After trading inside the $2,852 and $3,300 range for 15 days, ETH briefly broke the upper level on Sunday. However, it quickly erased its weekend gains a few hours later, beginning the new week at around $3,170. This shows that the range is becoming important for ETH.

Read more: Ethereum dips slightly amid Renzo depeg, BlackRock spot ETH ETF amendment

Like the general crypto market, Ethereum appears to need a trigger that can push its price heavily. ETH may sustain a sideways movement in the coming days and then rise slightly to fill the liquidity void of Sunday.

ETH/USDT 4-hour chart

ETH may also experience brief volatility as the SEC's spot ETH ETF decision on May 23 approaches. Long actions may slow down, except if ETH dips to around $2,900 to $3,000.

In the long run, if Bitcoin fails to see a major move, ETH will likely continue consolidating. Ethereum is trading at $3,181 at the time of writing.

Cryptocurrency metrics FAQs

The developer or creator of each cryptocurrency decides on the total number of tokens that can be minted or issued. Only a certain number of these assets can be minted by mining, staking or other mechanisms. This is defined by the algorithm of the underlying blockchain technology. Since its inception, a total of 19,445,656 BTCs have been mined, which is the circulating supply of Bitcoin. On the other hand, circulating supply can also be decreased via actions such as burning tokens, or mistakenly sending assets to addresses of other incompatible blockchains.

Market capitalization is the result of multiplying the circulating supply of a certain asset by the asset’s current market value. For Bitcoin, the market capitalization at the beginning of August 2023 is above $570 billion, which is the result of the more than 19 million BTC in circulation multiplied by the Bitcoin price around $29,600.

Trading volume refers to the total number of tokens for a specific asset that has been transacted or exchanged between buyers and sellers within set trading hours, for example, 24 hours. It is used to gauge market sentiment, this metric combines all volumes on centralized exchanges and decentralized exchanges. Increasing trading volume often denotes the demand for a certain asset as more people are buying and selling the cryptocurrency.

Funding rates are a concept designed to encourage traders to take positions and ensure perpetual contract prices match spot markets. It defines a mechanism by exchanges to ensure that future prices and index prices periodic payments regularly converge. When the funding rate is positive, the price of the perpetual contract is higher than the mark price. This means traders who are bullish and have opened long positions pay traders who are in short positions. On the other hand, a negative funding rate means perpetual prices are below the mark price, and hence traders with short positions pay traders who have opened long positions.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi