- Ethereum DeFi tokens have observed a decline in the user base due to the Shanghai upgrade hype dying down.

- Staking and lending protocols emerged as the ones to benefit the most from the Shapella upgrade.

- The DeFi market is on the path of developing a shield against the impact of the spot and TradFi market events.

The Ethereum Shapella hardfork fever is coming down, and the price is once going back to depending on supply and demand. The vanishing effects from the hype is also impacting users’ behaviors who are seen dispersing out of DeFi protocols. Is this a bad sign, or does the situation differ from reality?

Ethereum DeFi networks since the upgrade

Owing to the Shanghai hardfork, the Decentralized Finance (DeFi) protocols were expected to draw in users and investors in high volume. But these users were expected to stick around even after the hype died down, which is not the case at the moment.

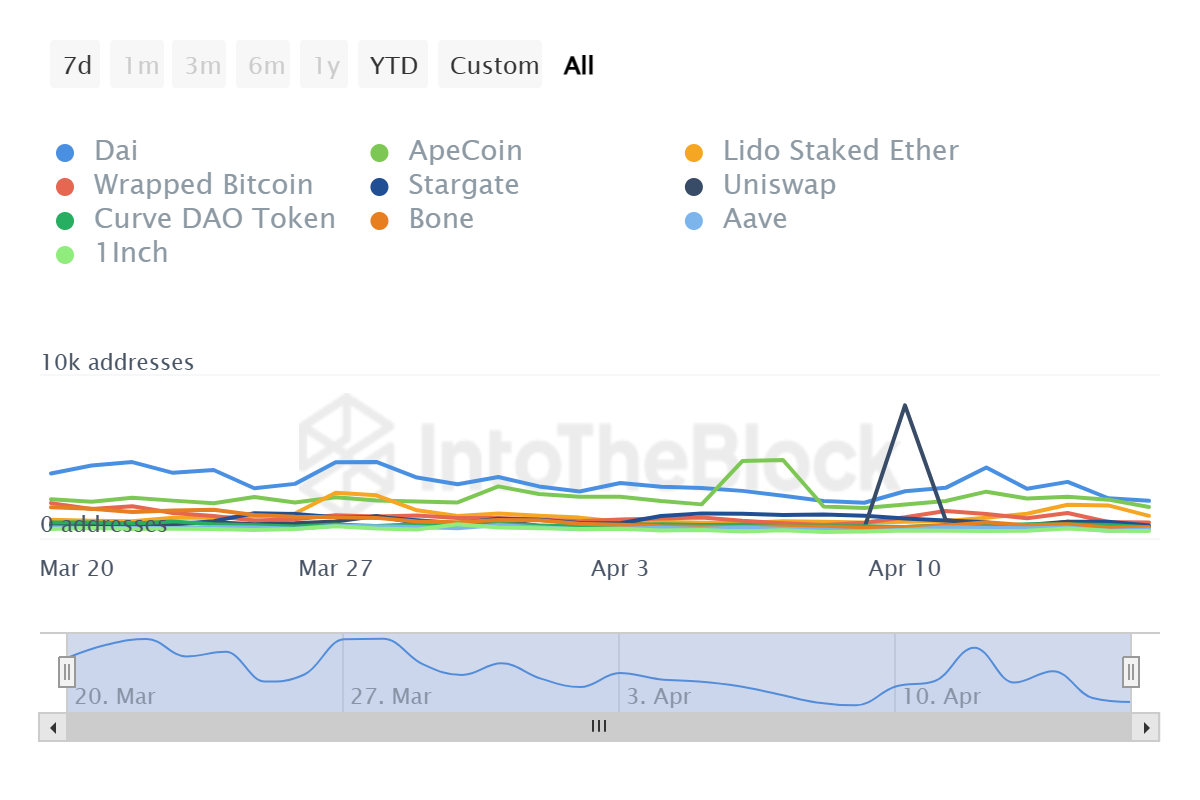

Most of the top DeFi tokens peaked in terms of active addresses around the time of the upgrade going live on the mainnet. However, right after, these daily active users went back to being dormant, resulting in active addresses falling. These tokens included the likes of Lido, Uniswap, Aave, etc.

DeFi daily active addresses

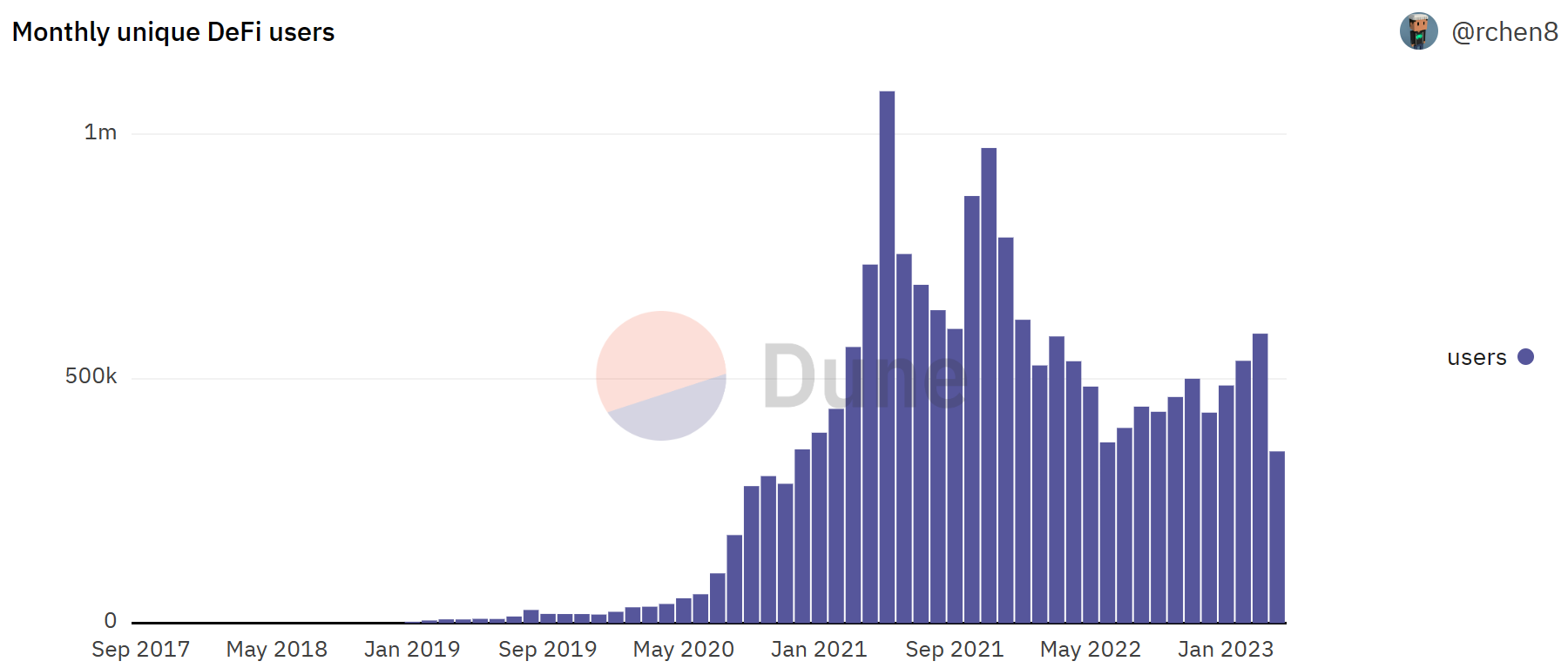

This declining interest in DeFi protocols and tokens could also result in the network observing the presence of fewer users than last month. The monthly total of unique users for the month of March was nearly 600,000, but at the moment, April has registered only 350,000 users.

DeFi monthly unique users

The only front Ethereum is safe at is the spot market price action, where the altcoin is trading above $2,076, the level it was last at in May 2022. Although, at the time of writing, the cryptocurrency is observing a 2% decline, it would likely maintain its nearly year-long high.

Where is the demand going?

While the DeFi markets are suffering from user retention, protocols continue to observe an inflow of funds, and many users still believe that Decentralized Finance still is the best to come out of Ethereum - past, present and future. In line with the same, Mr. Edul Patel, CEO and Co-founder of Mudrex, a global crypto-investing platform, stated,

"The successful implementation of the Shanghai upgrade in Ethereum will substantially drive the DeFi and smart contracts in the foreseeable future. Integrating PoS and other enhancements would make the network more expandable, streamlined, and fortified. This will pave the way for the growth and progression of DeFi and smart contracts. Therefore, Ethereum is expected to persist as one of the top blockchain platforms for many years.

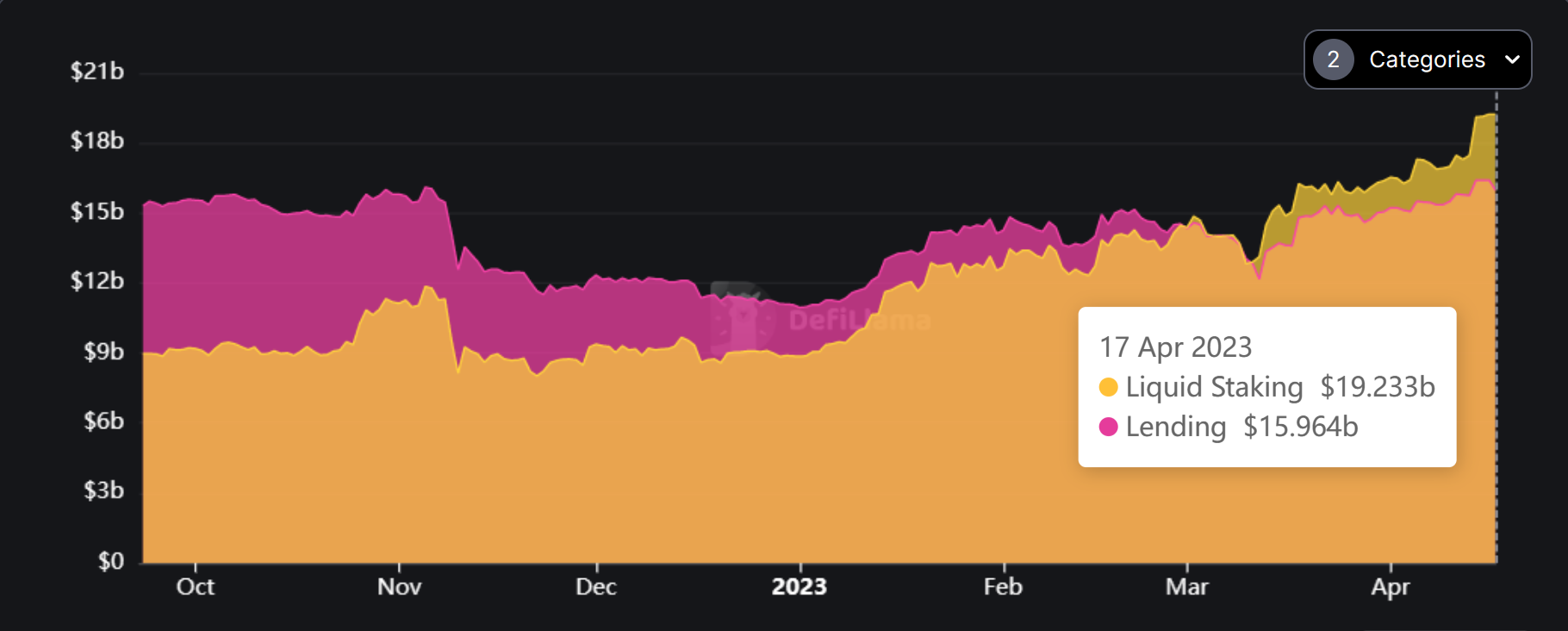

Furthermore, the DeFi market is still prospering, it's just that the money is being moved from the top categories of protocols, such as DEXes, to liquid staking and lending protocols. Since the beginning of the year, the total value locked (TVL) among the lending protocols' has risen from $10.95 billion to $15.96 billion.

DeFi TVL across lending and liquid staking protocols

On the other hand, the liquid staking protocols have observed a 116% increase in their combined TVL. While a positive sign, it was expected since Ethereum's Shanghai hardfork had staking withdrawal at the core of the upgrade.

Even though the Shanghai hype has dissipated, and the users might be backing off, for now, the DeFi market will keep evolving to stay relevant. The rising demand for web3 will eventually turn the DeFi space resilient to the events of the spot and macroeconomic conditions.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin Weekly Forecast: BTC nosedives below $95,000 as spot ETFs record highest daily outflow since launch

Bitcoin price continues to edge down, trading below $95,000 on Friday after declining more than 9% this week. Bitcoin US spot ETFs recorded the highest single-day outflow on Thursday since their launch in January.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Solana Price Forecast: SOL’s technical outlook and on-chain metrics hint at a double-digit correction

Solana (SOL) price trades in red below $194 on Friday after declining more than 13% this week. The recent downturn has led to $38 million in total liquidations, with over $33 million coming from long positions.

SEC approves Hashdex and Franklin Templeton's combined Bitcoin and Ethereum crypto index ETFs

The SEC approved Hashdex's proposal for a crypto index ETF. The ETF currently features Bitcoin and Ethereum, with possible additions in the future. The agency also approved Franklin Templeton's amendment to its Cboe BZX for a crypto index ETF.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin (BTC) price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot Exchange Traded Funds (ETFs) in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.