Ethereum Sentiment Overview: Are stablecoin’s killing the Ethereum vibe?

- Ethereum is losing its bridging utility to stablecoins as investors seek stability.

- DeFi is mooning even as Ethereum price continues to struggle while USDT market dominance is growing.

Going back three years, the birth and boom of initial coin offerings (ICOs) were mainly attributed to Ethereum surging prices. Token creators even scammers easily jumped onto the Ethereum token platform with a short term goal of reaping good profits.

Ethereum and Bitcoin became the easiest way for the token holders to cash out. They would first convert to Ether of BTC before ending up with the various fiat currencies such as the US dollar. During this time, either stablecoins were not popularized or simply did not exist at all.

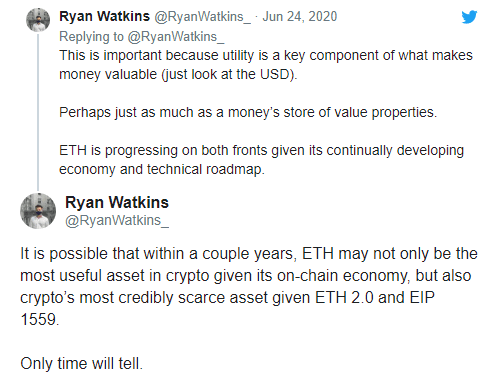

Over the last few weeks, Decentralized Finance (DeFI) tokens have recorded impressive gains. However, Ethereum has continued to struggle like many other cryptocurrencies despite the platform supporting most of the DeFi ecosystem. According to Messari analyst, Ryan Watkins, there is absolutely no correlation between Ethereum and DeFi’s surge. In this case, Ethereum has no reason to rally even as the “DeFi is mooning.”

According to Watkins, the issue of stablecoins ‘killing’ Ethereum’s chance of rallying due to ecosystems such as DeFi was reduced by the emergence of stablecoins. A thesis paper by Qiao Wang also argued that stablecoins “crypto dollars), allow investors to bypass native cryptoassets like ETH for their speculative fervor.” These stablecoins literally “killed the chance for any smart contract platforms to accrue significant monetary nature.”

Some DeFi tokens are currently purchased directly from exchanges such as Coinbase, completely removing Ethereum as the bridge. Some of these tokens are Compound and Balancer. Messari data highlights that some activities such as volumes connected to Ethereum-based products have been falling.

On the other hand, the dominance of assets such as Tether (USDT) continues to surge despite their controversies. However, this is not to say that Ethereum is becoming a lesser useful platform. Watkins says that the platform is transitioning to a utility platform able to support multiple digital economies.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren