Ethereum revenue could double to $5 billion and fee may fall to $0.01 in 2024: Bitwise prediction

- Bitwise, the world's largest crypto index fund manager, noted in its prediction for 2024 that Ethereum is poised to witness a doubling in its revenue.

- Furthermore, the EIP-4844 upgrade is expected to reduce the average transaction cost on Ethereum by 90%.

- Ethereum price is maintaining a bullish macro outlook, marking a 53% rise in the past two months.

While 2024 is expected to be Bitcoin's year in more ways than one, it will also bear a significant impact on Ethereum price and network. But in its own way, the home of Decentralized Finance (DeFi) is predicted to make an impact on the market by likely improving the overall operations and financials of the network.

Ethereum revenue to double in 2024

Bitwise Asset Management, the world's largest crypto index fund manager, published its predictions for 2024. Two of these ten predictions are focused on Ethereum, making it the most in-demand network despite the rise of layer-2 chains and competitive layer-1 chains.

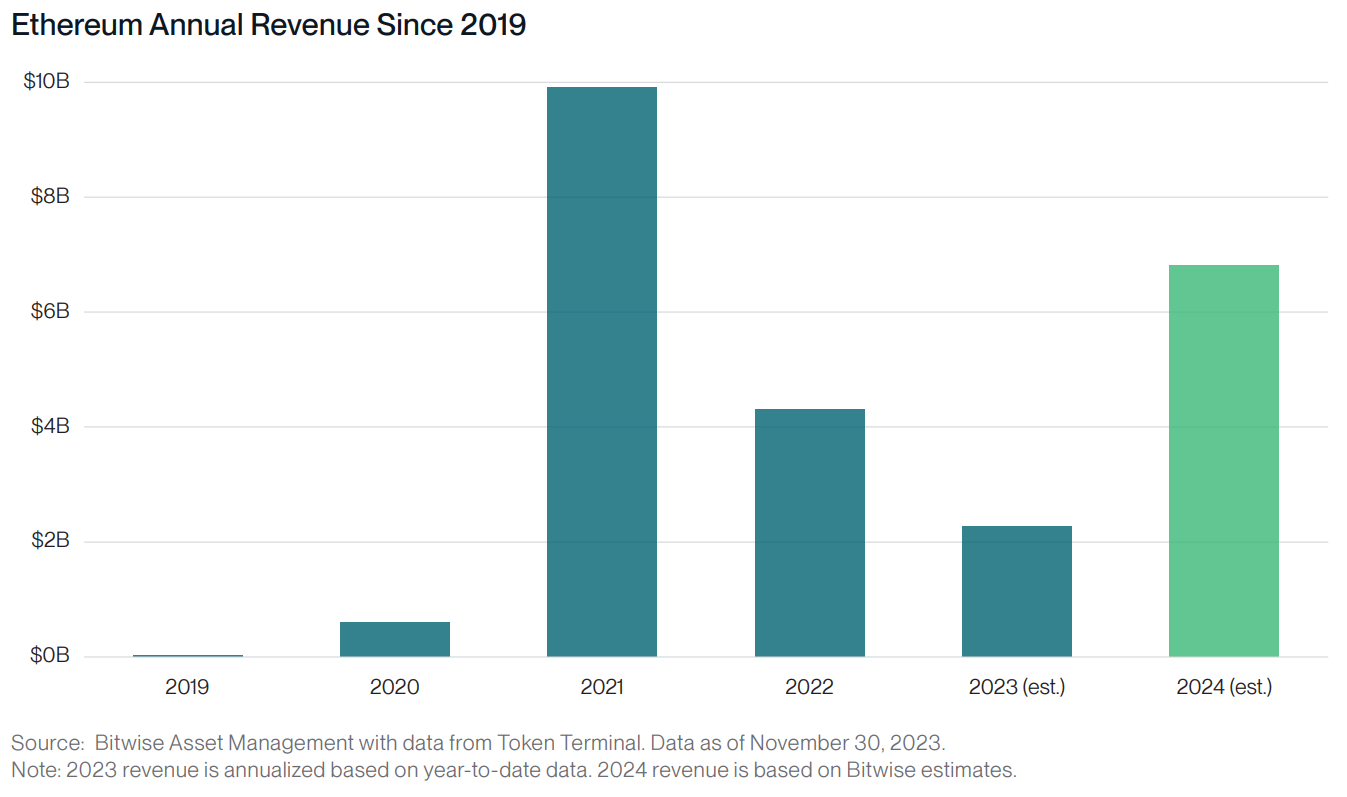

Bitwise noted that Ethereum revenue will probably double to $5 billion over the next year. Per the report, the network reported $2.3 billion in fees, i.e., revenue, which is almost half the revenue of 2022's $4.1 billion. Bitwise, in regard to this prediction noted,

"Ethereum functions like a global supercomputer, hosting thousands of crypto applications that people use every day. And in order to use those applications, you have to pay a fee using the Ethereum crypto asset. That's cash flow."

Ethereum network revenue

Another crucial prediction for 2024, the asset manager made, was that the average transaction costs on Ethereum will fall to $0.01. This prediction falls in line with the expected network upgrade going by the name of EIP-4844.

The primary goal of the proposal is to reduce the average transaction cost by 90% in order to make the network more accessible to mainstream users. According to Bitwise's report, with fees going down, Ethereum will radically increase the types of activities individuals can feasibly participate in on the network. Major product ideas like micropayments, social media, and large-scale gaming would become possible.

Whether these pan out in 2024 is up to the conditions of the market at that time and the impact they would have on Ethereum price.

Ethereum price remains bullish

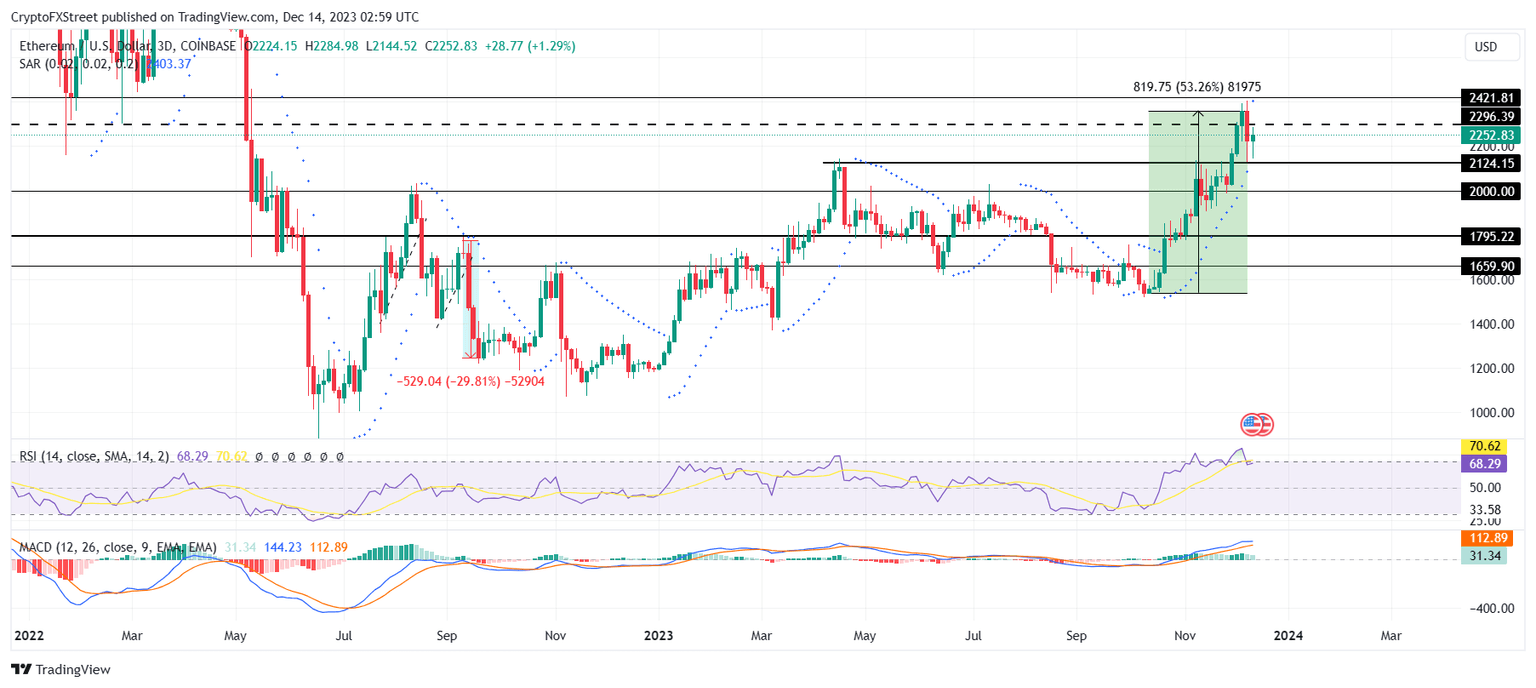

Ethereum price in the short-term timeframe might have noted some correction, but when it comes to the macro outlook, ETH is still bullish. The 53% increase observed in the past two months is expected to continue into 2024, potentially bringing the price to $2,500.

The Moving Average Convergence Divergence (MACD) is exhibiting bullish signal on the 3-day chart. This bullishness might exhaust or demand some correction following the spot Bitcoin ETF approval rally.

However, at the moment, ETH is expected to recover and flip the $2,296 resistance into support to push the price to $2,421.

ETH/USD 1-day chart

If this breach fails, the altcoin could retrace to $2,142 and losing this support line would invalidate the bullish thesis, likely pushing ETH down to $2,000.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.