Ethereum resumes consolidation after brief dip, buyback yield exceeds that of major S&P 500 companies

- Ethereum whale jumps on ‘buy the dip’ opportunity after Israel's attack on Iran.

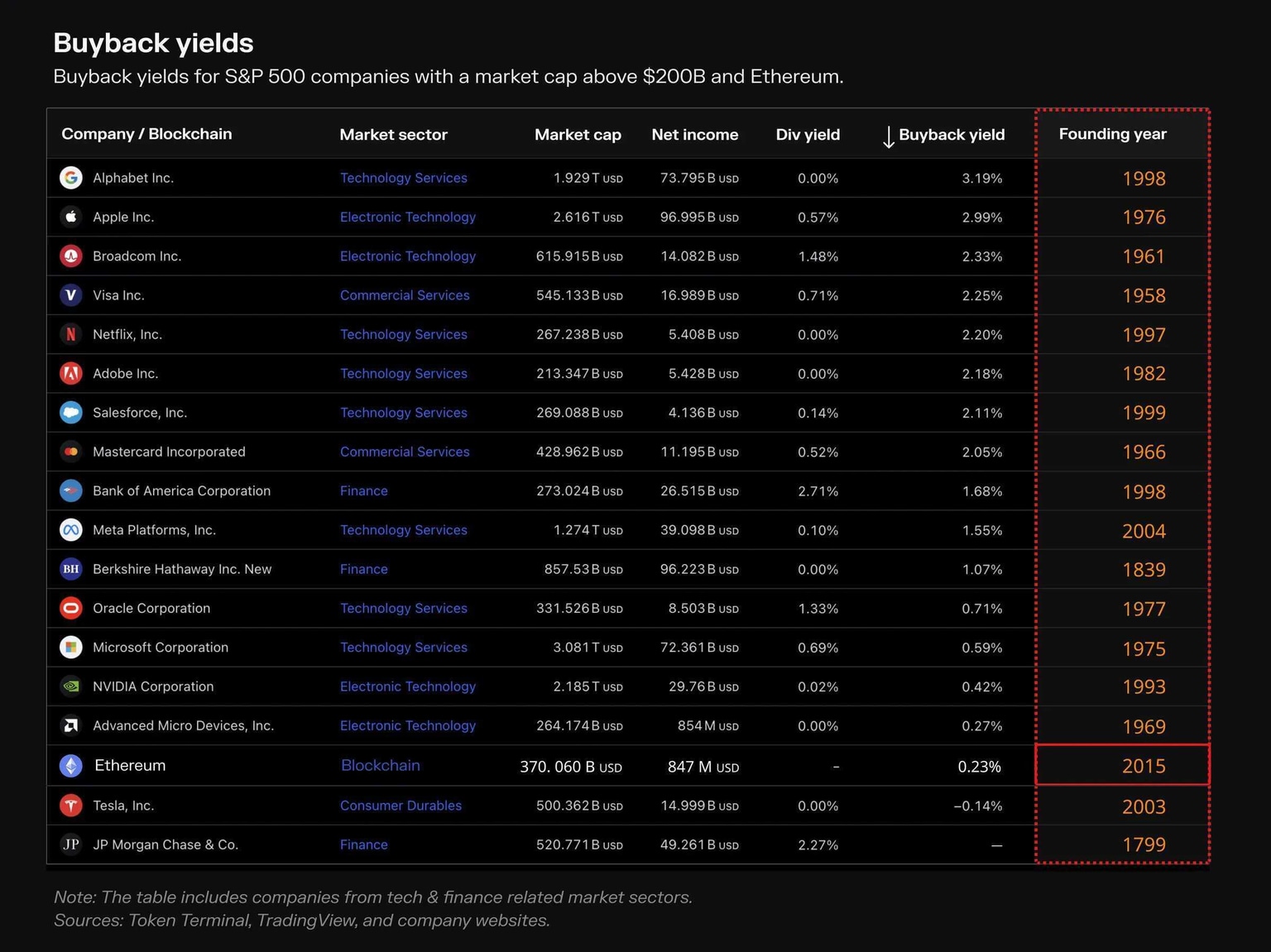

- The buyback yield of Ethereum exceeds that of major S&P 500 firms.

- Ethereum may continue trading inside key range as investors await the market's response to Bitcoin halving.

Ethereum resumed its sideways movement on Friday after briefly crashing due to Israel's attack on Iran. The move presented a buying opportunity for a whale, who quickly profited from it. This also comes when Ethereum's buyback yield exceeds that of several S&P 500 firms.

Read more: Ethereum shows firm support at key level as its correlation with US indices increase

Daily digest market movers: Israel's retaliation, whale activity, buyback yields, Hong Kong's ETH ETF

Ethereum wasn't left out, as the entire crypto market took a hit on Friday following Israel's strike in retaliation to Iran's attack on April 13. Here are your key market movers:

- As ETH dipped briefly on Friday, a whale jumped on the opportunity, spending 9.5 million USDT to buy 3,253 ETH at ~$ $2,925, according to crypto analytics platform Spot On Chain. However, ETH's price has quickly recovered, especially as Iranian officials have downplayed responding to the attack. As a result, the whale made nearly $625,000 in unrealized profit.

- Ethereum is outshining major tech and financial giants in terms of buyback yields, according to Token Terminal. In a list of $200 billion+ finance and tech S&P 500 companies, including Apple, Alphabet and Berkshire Hathaway, Ethereum ranks number 16, above Tesla and JPMorgan with a buyback yield of 0.23%.

Buyback for Ethereum, in this case, is implemented through token burns that began after The Merge in 2022. The number one smart contract blockchain achieved this feat in only nine years compared to the median age of 44 years of other companies in the list.

ETH buyback yield

Also read: Ethereum moves sideways as Q1 report indicates token burns are making it deflationary

- Meanwhile, Bloomberg ETF analyst Eric Balchunas expressed doubts that Mainland China investors may not get access to Hong Kong's spot ETH ETFs when they start trading. This pessimism is based on China's ban on all crypto-related activities in 2021. However, other analysts have pointed to Hong Kong's positive reception to crypto investment as a good sign that spot ETH ETFs would see impressive inflows when they launch in the region.

- Despite ETH's brief price decline, ETH's long liquidations weren't heavy, sitting around $34.4 million in the past 24 hours. This may be due to heavy liquidations already seen earlier in the week.

Technical analysis: ETH may continue trading inside key range

ETH attempted to break the $2,852 support on Friday after Israel attacked Iran. However, prices have quickly bounced back, and ETH appears to be continuing its consolidation. The calm may be due to investors exercising caution as they await how the market responds to Bitcoin's fourth halving, which is a few hours away.

Read more: Ethereum declines as crypto market crash increases bearish sentiment

Considering that many analysts have predicted that Bitcoin halving is already priced in, ETH may experience light volatility in the next few hours.

ETH/USDT 4-hour chart

But in the coming weeks, it won't go outside the range of $2,852 and $3,406 formed in recent price movements, except if major external factors prevail on its price. In the long term, ETH could test the resistance of $3,730. An unlikely approval of spot ETH ETFs by the Securities & Exchange Commission (SEC) would send it past the $4,000 key level to a new all-time high.

Ethereum FAQs

Ethereum is a decentralized open-source blockchain with smart contracts functionality. Serving as the basal network for the Ether (ETH) cryptocurrency, it is the second largest crypto and largest altcoin by market capitalization. The Ethereum network is tailored for scalability, programmability, security, and decentralization, attributes that make it popular among developers.

Ethereum uses decentralized blockchain technology, where developers can build and deploy applications that are independent of the central authority. To make this easier, the network has a programming language in place, which helps users create self-executing smart contracts. A smart contract is basically a code that can be verified and allows inter-user transactions.

Staking is a process where investors grow their portfolios by locking their assets for a specified duration instead of selling them. It is used by most blockchains, especially the ones that employ Proof-of-Stake (PoS) mechanism, with users earning rewards as an incentive for committing their tokens. For most long-term cryptocurrency holders, staking is a strategy to make passive income from your assets, putting them to work in exchange for reward generation.

Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) mechanism in an event christened “The Merge.” The transformation came as the network wanted to achieve more security, cut down on energy consumption by 99.95%, and execute new scaling solutions with a possible threshold of 100,000 transactions per second. With PoS, there are less entry barriers for miners considering the reduced energy demands.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi