Ethereum reclaims number one spot as leading DEX chain for first since September, overtakes Solana

Last month, Ethereum reclaimed its title as the leading smart contract blockchain for decentralized exchange (DEX) trading, as the market swoon dampened activity on Solana, the go-to platform for memecoin traders.

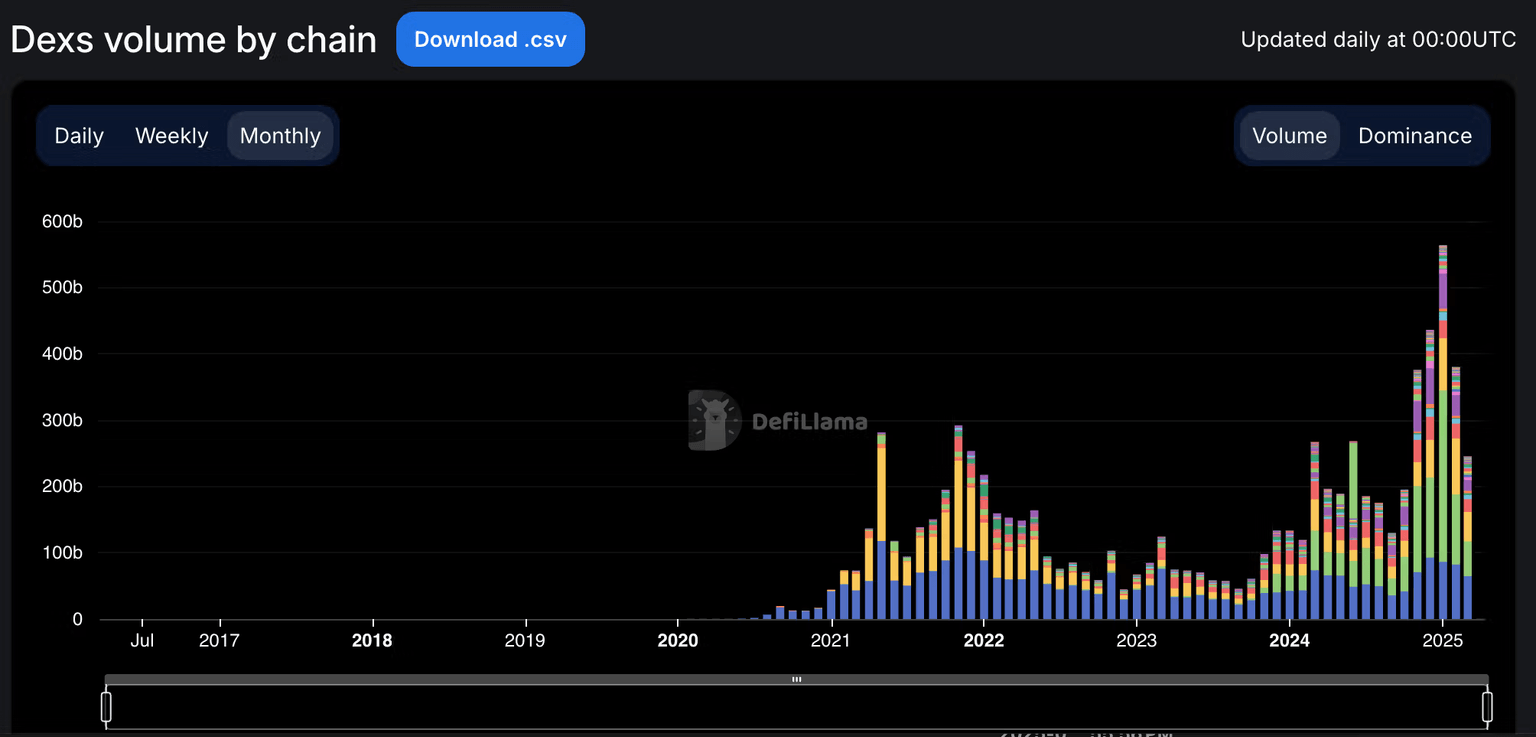

Ethereum-based DEXes registered an industry-leading cumulative trading volume of $64.616 billion in March, beating Solana's tally of $52.62 billion by 22%, according to data source DefiLama. That's the first time since September that Ethereum topped the charts, pushing Solana to the number two spot.

The change in leadership happened as the total crypto market capitalization fell 4.2% to $2.63 trillion, extending February's 20% loss, as macroeconomic uncertainty and disappointment over the lack of fresh BTC purchases in the U.S. strategic reserve saw bitcoin slip below $80,000.

The bearish market sentiment dampened speculation across the broader landscape, especially within the memecoin sector, as reflected in the significant decline in activity on Raydium, the leading Solana-based DEX and a hotspot for meme trading in late 2024.

Throughout March, Raydium did not log a single day with trading volume exceeding $1 billion, highlighting a considerable decrease from its record-high of $13 billion on Jan. 18, DefiLlama data show.

Additionally, daily volume on the Solana-based memecoin launch pad averaged less than $100 million in March, down significantly from the peak of $390 million in mid-January. Activity on Solana-based DEXes peaked with the debut of President Donald Trump's TRUMP token in January.

Meanwhile, Ethereum's outperformance was driven by Uniswap, which achieved over $30 billion in trading volume, with Fluid taking the distant second spot with $9 billion in activity.

Still, Ethereum's ether token fell over 18% to $1,822 in March, registering bigger losses than Solana's SOL token, which fell by 15.8%, per data source TradingView and CoinDesk.

Per observers, ether's inflationary tokenomics and the growing popularity of Layer 2 solutions, which supposedly siphon activity from the main chain, are responsible for ether's poor performance.

Author

CoinDesk Analysis Team

CoinDesk

CoinDesk is the media platform for the next generation of investors exploring how cryptocurrencies and digital assets are contributing to the evolution of the global financial system.