- Coinbase analysts expressed confidence that spot ETH ETFs would be approved.

- Vitalik Buterin has responded to criticisms labeled at Ethereum developers, stating how they have been addressing some of the concerns of community members.

- Ethereum could see a further rise as it outperforms Bitcoin for the first time in May.

Ethereum (ETH) saw a quick rally on Friday, posting a 5% gain as its co-founder, Vitalik Buterin, responded to recent criticisms from the crypto community. Coinbase analysts have also expressed confidence that spot ETH ETFs would debut in the market soon.

Read more: Ethereum drops below $3,000 again, spot ETH ETF sparks debate in crypto community

Daily digest market movers: Processing speed, Buterin's response

Coinbase analysts have said that spot Ethereum ETFs would debut in the market despite the silence from the Securities & Exchange Commission (SEC) towards issuers. "As crypto begins to take form as an election issue, it’s also less certain in our view that the SEC would be willing to front the political capital necessary to support a denial," said Coinbase analyst David Han.

He added that if the first deadline on May 23 sees a rejection from the SEC, "there’s a high likelihood that litigation could reverse that decision."

Meanwhile, following Ethereum's slow price growth compared to Bitcoin and Solana, many crypto community members on X have targeted core Ethereum developers through a series of criticisms.

Many criticized Ethereum's "acceptance of MEV" after the Department of Justice arrested two brothers for an MEV-related exploit on the number one smart contract blockchain. Others complained that Ethereum folks need to post more about the protocol and its updates.

Read more: US Department of Justice charges brothers for alleged 12-second MEV fraud

One X user, @chainyoda, shared his plight:

Ethereum has a very bad case of cosmos infection. Last cycle the ethereum discourse was human usable apps like uniswap and aave. This cycle all the ethereum devs and investors speak only PhD eg based sequencer, shared sequencer, intercontinental rollup... and one else gives a fk

— chainyoda (@chainyoda) May 17, 2024

More importantly, Geth core developer Peter Szilagyi expressed dissatisfaction with the several upgrades the Ethereum network has undergone in a short while. "My criticism is that you (Ethereum developers have) [...] have abandoned due process and rushed to hotfix things."

Private transactions. Check.

— Péter Szilágyi (karalabe.eth) (@peter_szilagyi) May 16, 2024

Proprietary settlements (MEV). Check.

Staked Ether issued by central auth. Check.

0 local miner tips will nuke local stakers.

Gigagas hardware reqs will nuke local nodes.

Voila, the banking system recreated. All privately held and operated.

The increased concerns sparked a series of posts from several Ethereum core contributors, including Josh Stark, Tim Beiko, Dankrad Feist and Ethereum co-founder Vitalik Buterin.

Buterin gave a detailed response to these criticisms in a blog post, stating that the concerns raised by community members are valid and "are already being addressed by protocol features that are already in-progress."

He also stated that several other concerns from the community can be "addressed by very realistic tweaks to the current roadmap." Buterin addressed three major areas that he believes form the majority of the concerns raised:

- MEV and builder dependence

- Liquid staking

- Hardware requirement of nodes

He discussed how Verkle trees, EIP-4444, robust solo staking, and a peer-pressuring development process for MEV reduction can solve these issues.

"There is a near-unlimited number of blockchain projects aiming for the niche of ‘we can be super-fast, we'll think about decentralization later.’ I don't think Ethereum should be one of those projects," said Buterin.

"We should have deep respect for the properties that make Ethereum unique, and continue to work to maintain and improve on those properties as Ethereum scales," he added.

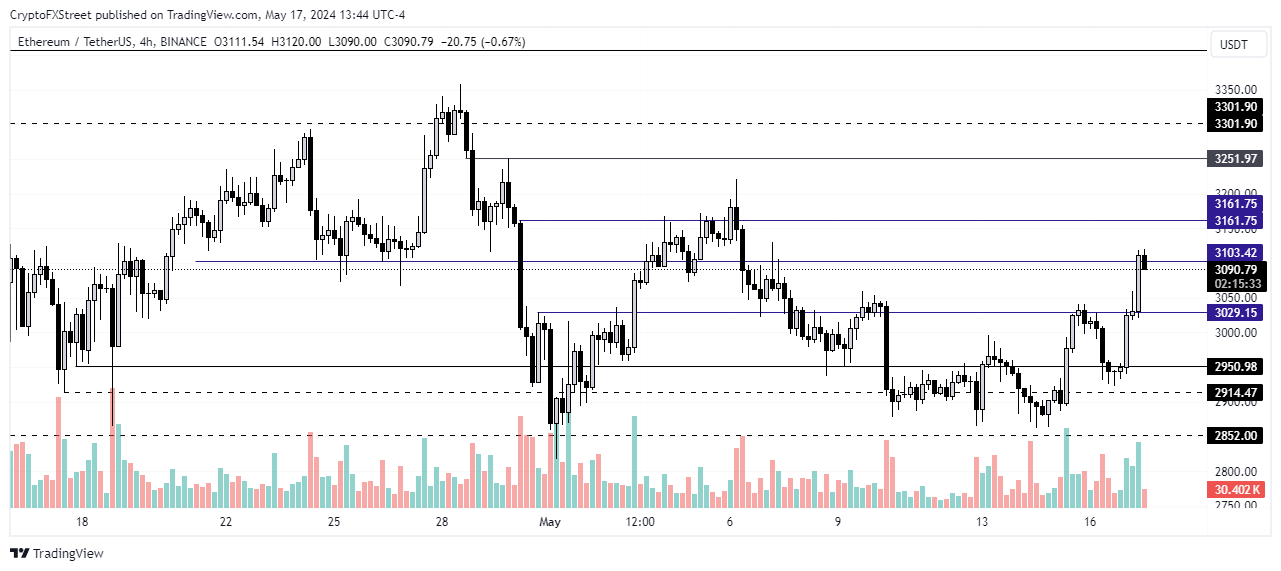

ETH technical analysis: Ethereum could attempt to break $3,251 resistance

Ethereum posted a 5% gain on Friday after it broke the $3,103 resistance. The rise follows a general appreciation of assets in the crypto market. However, Ethereum notably outperformed Bitcoin in the past 24 hours after several community members highlighted the ETH/BTC ratio was nearing a bottom.

As a result, ETH short liquidations are outpacing longs for the first time. With a total liquidation of $24.5 million in the past 24 hours, short liquidations sit at $17.54 million compared to $6.76 million long liquidations, according to data from Coinglass.

The recent ETH rise has also caused a spike in ETH open interest, which increased by 6.6% in the past 24 hours. This signifies renewed investor interest in ETH, meaning it may see less sideways movement in the coming days.

ETH/USDT 4-hour chart

If renewed confidence prevails, ETH could attempt to break the $3,161 resistance and, if successful, move past the $3,251 mark. However, it's important to watch out for volatility in the days leading up to the SEC's decision on spot ETH ETFs on May 23.

Ethereum FAQs

Ethereum is a decentralized open-source blockchain with smart contracts functionality. Serving as the basal network for the Ether (ETH) cryptocurrency, it is the second largest crypto and largest altcoin by market capitalization. The Ethereum network is tailored for scalability, programmability, security, and decentralization, attributes that make it popular among developers.

Ethereum uses decentralized blockchain technology, where developers can build and deploy applications that are independent of the central authority. To make this easier, the network has a programming language in place, which helps users create self-executing smart contracts. A smart contract is basically a code that can be verified and allows inter-user transactions.

Staking is a process where investors grow their portfolios by locking their assets for a specified duration instead of selling them. It is used by most blockchains, especially the ones that employ Proof-of-Stake (PoS) mechanism, with users earning rewards as an incentive for committing their tokens. For most long-term cryptocurrency holders, staking is a strategy to make passive income from your assets, putting them to work in exchange for reward generation.

Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) mechanism in an event christened “The Merge.” The transformation came as the network wanted to achieve more security, cut down on energy consumption by 99.95%, and execute new scaling solutions with a possible threshold of 100,000 transactions per second. With PoS, there are less entry barriers for miners considering the reduced energy demands.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin slightly recovers after sharp sell-off following Fed rate cut decision

Bitcoin (BTC) recovers slightly, trading around $102,000 on Thursday after dropping 5.5% the previous day. Whales, corporations, and institutional investors saw an opportunity to take advantage of the recent dips and added more BTC to their holdings.

Aave Price Forecast: Poised for double-digit correction as holders book profit

Aave (AAVE) price hovers around $343 on Thursday after correcting more than 6% this week. The recent downturn has led to $5.13 million in total liquidations, 84% of which were from long positions.

Memecoins DOGE and PEPE approaches key levels: Eyes for a recovery

Dogecoin and Pepe prices retest their crucial support level on Thursday after declining more than 10% this week. Sideline investors seeking to accumulate dog-themed and frog-themed memecoins may consider doing so at their support levels for a potential recovery rally ahead.

Crypto market bleeds following hawkish rate cut decision by Fed

Bitcoin and the crypto market are down on Wednesday following the Federal Open Market Committee (FOMC) announcement to slow down rate cuts in 2025, with the benchmark federal funds rate declining to a lower range of 4.25% to 4.50%.

Bitcoin: BTC reclaims $100K mark

Bitcoin briefly dipped below $94,000 earlier this week but recovered strongly, stabilizing around the $100,000 mark by Friday. Despite these mixed sentiments this week, institutional demand remained strong, adding $1.72 billion until Thursday.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.