Ethereum price to slide lower as Binance congestion gridlock trips up top 3 coins

- Ethereum price attempts recovery from whipsaw price action on Monday.

- ETH sees its recovery stall as a key support level turns into resistance and limits further upside.

- Expect another 10% drop for ETH when short-term support proves too feeble to withstand selling pressure.

Ethereum (ETH) price had a rough session on Monday as Binance reported issues liftingf its ban on Bitcoin withdrawals that had to be reinstated only hours after it got lifted. With massive congestion as a result, major cryptocurrencies slid lower intraday and only saw some losses being pared back in the last US session on Monday. Ethereum price sees its bulls unable to break above the key 55-day Simple Moving Average (SMA) as the price undergoes a firm rejection and is bound to head substantially lower.

Ethereum price action witnesses handover from bulls to bears

Ethereum price had a very nervous session as its price action fell into the crosshairs from the fallout of Binance, which lifted its ban on Bitcoin withdrawals. The process did not go as smoothly as hoped for with at one point Binance even reinstating the ban as a massive gridlock occurred due to congestion on the network. This then tripped Bitcoin and other major cryptocurrencies with Ethereum's price down over 5% at one point.

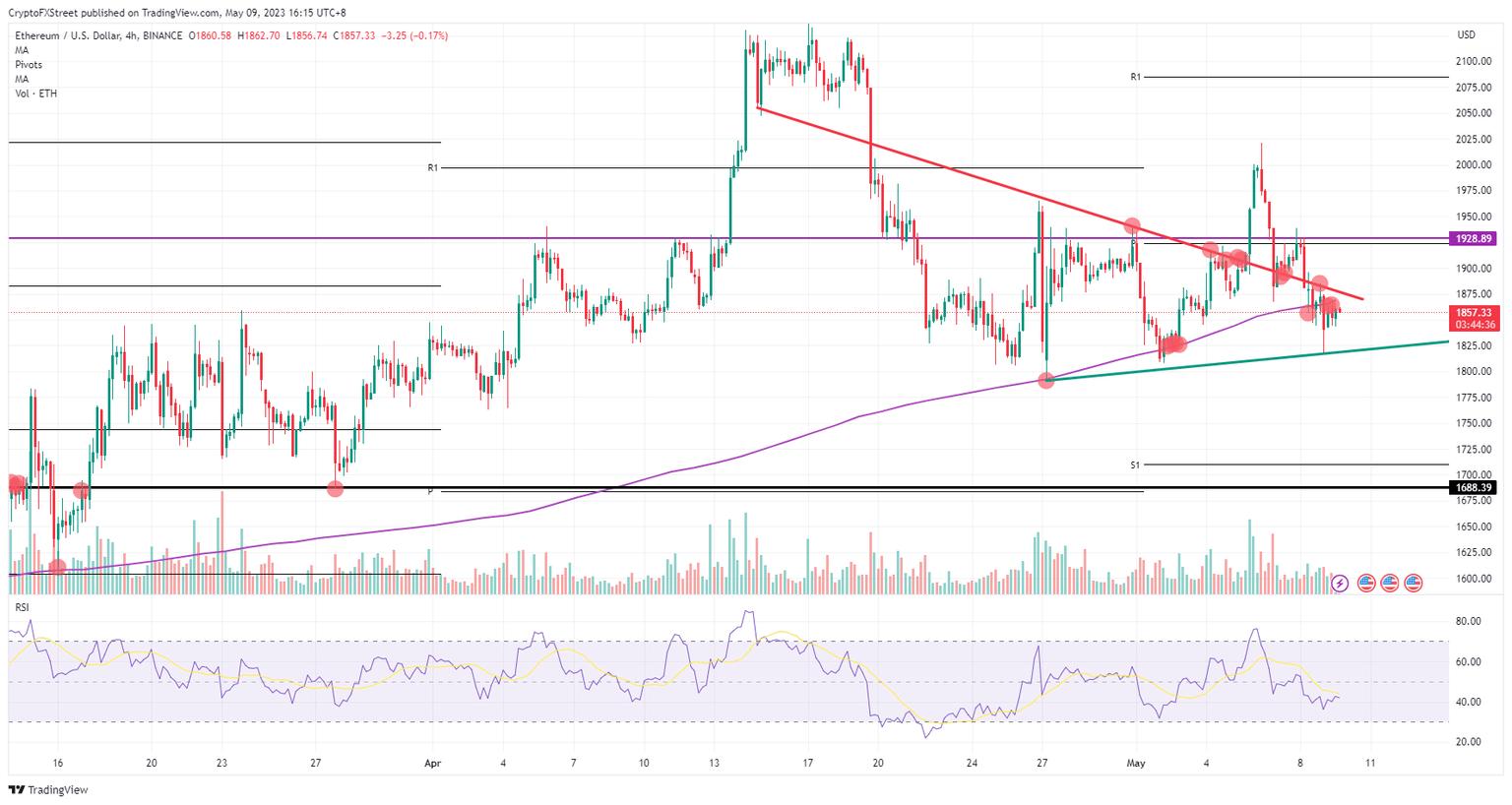

ETH saw some paring back of losses, while bulls are unfit and unable to push price action back above the important 55-day SMA, which has been acting as support for the most part of April and May. What follows now is a firm rejection on the topside with bears entering and taking control of Ethereum's price action. Look out for $1,825, which is near the green ascending trendline and might hold briefly. Once that gives way, expect a nosedive move to $1,688 with a 10% loss in the offing.

ETH/USD 4H-chart

A turnaround is still possible should a bigger risk on tailwind emerge and lift the support for cryptocurrencies as an asset class. Expect to see a nice grind higher with a break above $1,875 that erases bearish pressure from both the 55-day SMA and that red descending trendline. A stretch to $1,928 could be possible, although do not expect that to come quickly as it will be a level closely watched by bears wishing to strike again.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.