Ethereum price to revisit $3,200 as ETH bulls clear a critical hurdle

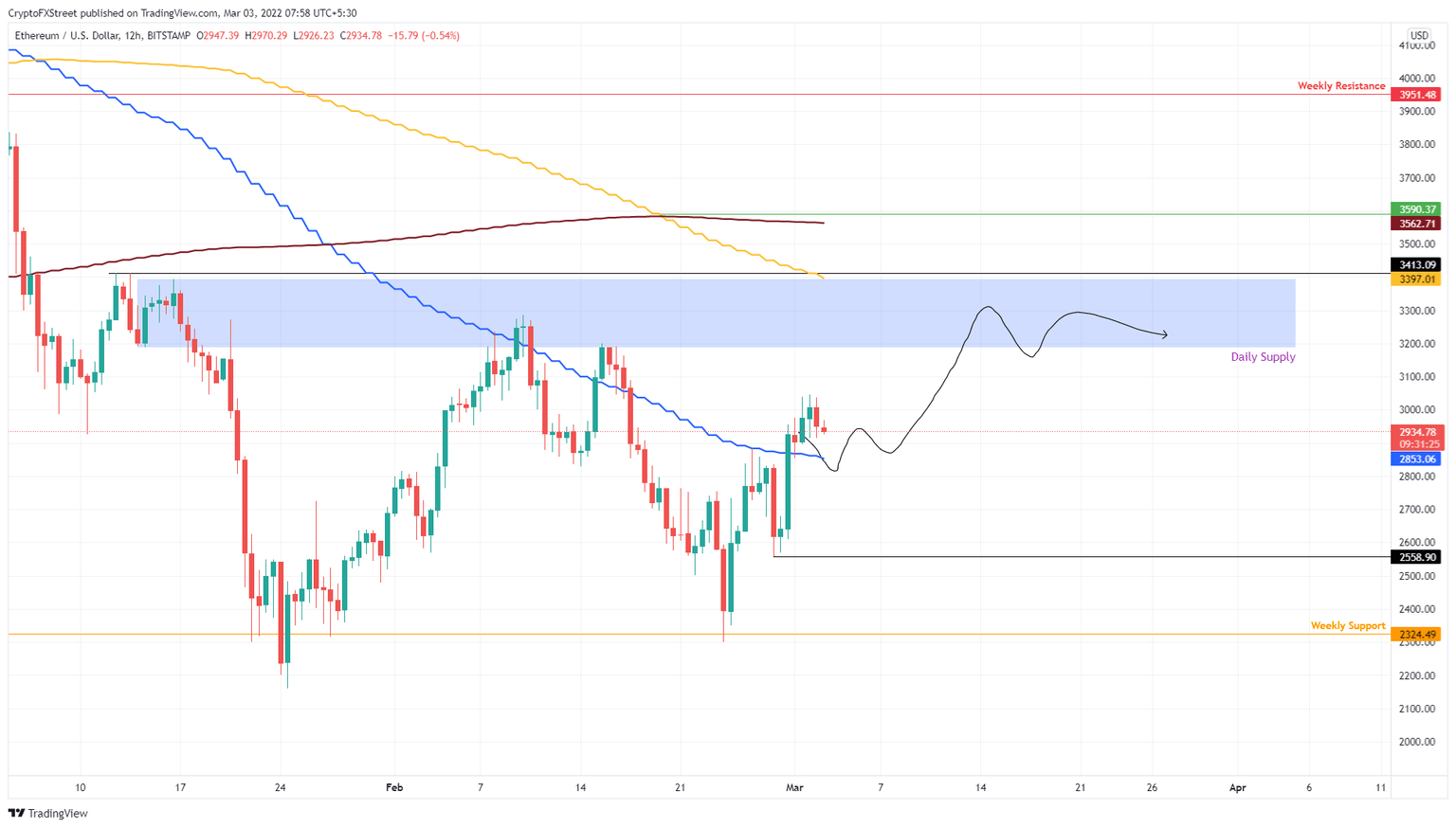

- Ethereum price moved past the 50-day SMA at $2,853, indicating the uptick in buying pressure.

- A successful retest of the 50-day SMA will seal the breakout and forecast a move to $3,200.

- A twelve-hour candlestick close below $2,558 will create a lower low and invalidate the bullish thesis for ETH.

Ethereum price action has been stuck between two major barriers since January 24. The recent uptrend allowed ETH to push through a vital resistance barrier, signaling the bulls’ intentions to move higher.

Ethereum price to revisit stiff barriers

Ethereum price set a supply zone, extending from $3,188 to $3,393 on January 15, before retracing 36% to the weekly support level at $2,324. A bounce off the weekly foothold led to a full recovery that retested the supply zone, but the momentum was lacking, leading to a rejection.

After retesting the weekly support barrier at $2,324 for the second time, ETH is making another attempt to revisit the $3,200 hurdle. So far, Ethereum price has sliced through the 50-day Simple Moving Average (SMA) at $2,853 and is currently retesting it to signify a successful breakout.

A bounce off this barrier is likely, and investors can expect the resulting rally to retest the supply zone’s lower limit at $3,188. In a highly bullish case, ETH could make a run for the upper limit at $3,393, which roughly coincides with the 100-day SMA.

ETH/USDT 12-hour chart

While things are looking up for Ethereum price, a breakdown of the 50-day SMA will indicate an increased sell-side pressure. This move needs to recover and set a higher low to sustain the optimistic outlook.

If the buyers fail to do so, resulting in a twelve-hour candlestick close below $2,567, it will create a lower low and invalidate the bullish thesis for Ethereum price.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.