Ethereum price to break resistance cluster and target $3,200

- Ethereum price shows bulls attempting to assault a resistance cluster that will likely dictate the future direction of ETH for the remainder of the month.

- Bulls struggle to break higher as sellers consistently reject moves above the resistance cluster.

- Rejection higher could push ETH below the $2,000 value area.

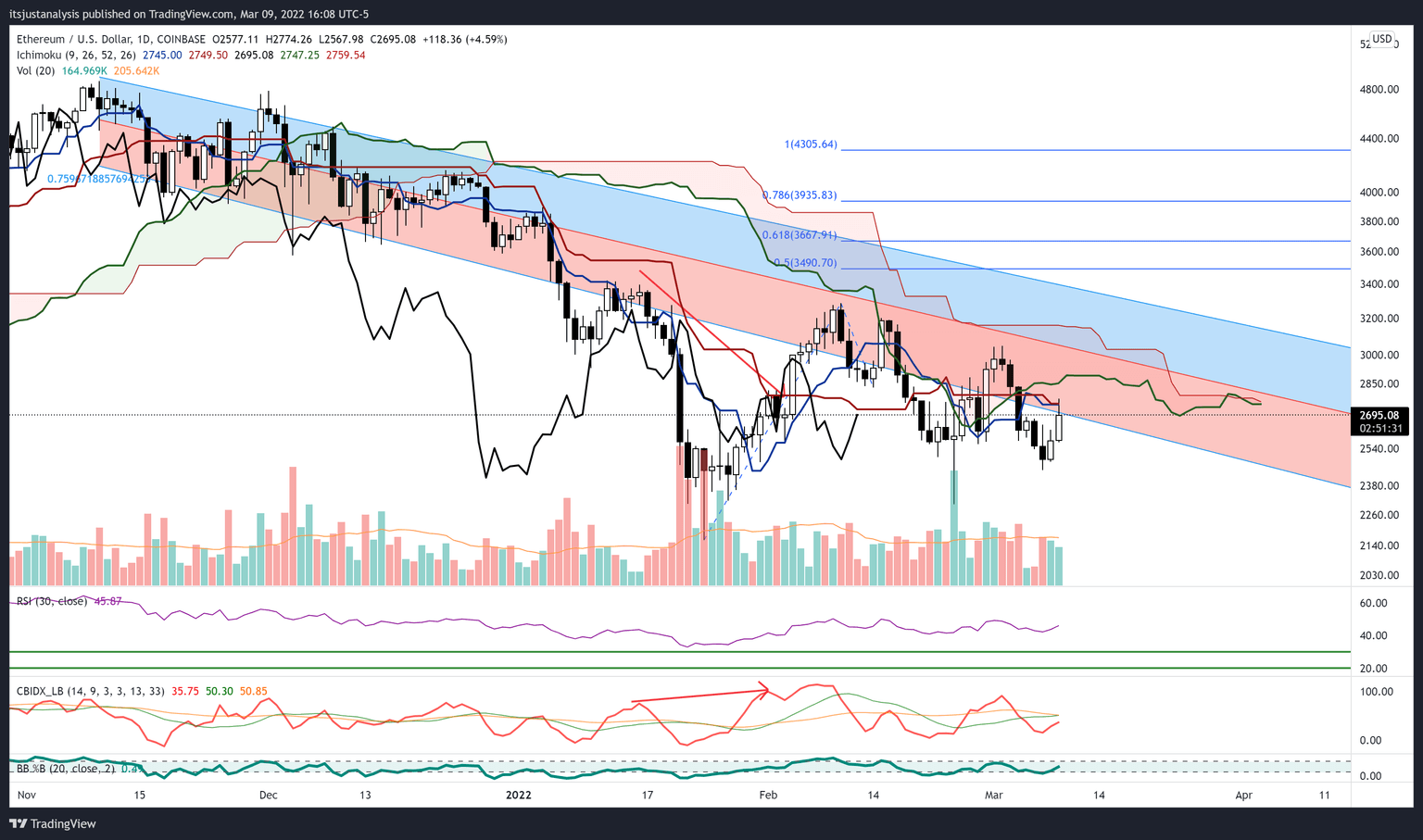

Ethereum price is trading against several resistance levels near the $2.700 level. Buyers kept ETH above those levels for most of the New York session, but selling pressure resumed as the normal trade day ended, and a ‘sell the rally’ environment took over.

Ethereum price must close at $2,800 before testing its final resistance at $3,200

Ethereum price is up against a major decision point. The lower trendline of a prior bull flag (represented as a linear regression channel), the Tenkan-Sen, and Kijun-Sen share the $2,700 value area. $2,700 is the current roadblock preventing buyers from instituting a new rally for Ethereum.

For bears to remain in control of Ethereum price, they need to keep ETH from a daily close below the resistance cluster at $2,700. Doing so would give bears the confirmation signal required to begin a new round of selling and push ETH down to the $1,800 price level.

ETH/USD Daily Ichimoku Kinko Hyo Chart

For bulls to take over, a close above $2,900 would likely confirm the beginning of a new bullish momentum swing, pushing Ethereum price back inside the Ichimoku Cloud and terminating much of the strength that sellers currently have.

Ultimately, for bulls, they’ll need to challenge the top of the bull flag and a high volume node in the volume profile at the $3,200 value area.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.