Ethereum price tests crucial support at $1,570 as ETH becomes a polarizing topic

- Ethereum price dipped to the $1,550 range before a quick pullback to $1,570 but prospects for more losses remain.

- ETH fees are recording the lowest levels seen in 2023, with traders growing impatient over price.

- With bearish sentiment climaxing, a possible turnaround seems likely according to experts from market intelligence platform, Santiment.

Ethereum (ETH) price correlation to Bitcoin (BTC) has continued to widen since the mid-September reading, with the second-largest cryptocurrency by market capitalization now wandering on its own. With its bearish outlook, ETH has often rubbed longs the wrong way, compelling them to close their positions to avoid more severe losses.

Also Read: Ethereum price dip extends, liquidates $10 million in long positions as exchange outflows skyrocket

Ethereum price slumps below $1,570

Ethereum (ETH) price dipped almost 5% on October 9 to the current price of $1,580 after an intra-day low of $1,546. The position of the Relative Strength Index (RSI) and its lagging Awesome Oscillator (AO) shows the slump may not be over yet, meaning ETH holders should brace up. Data on CoinMarketCap shows a 110% increase in trading volume for the token in the last 24 hours.

A decisive daily candlestick close below the $1,570 level would not only see Ethereum price grab the buy side liquidity, but could also commence a new downtrend by filling orders due to the last lower high.

ETH/USDT 1-day chart

To some extent, the Ethereum Foundation has played a huge role in driving ETH price down by acting as the basis for Fear, Uncertainty, and Doubt (FUD). This happens when it makes any form of selloff. Critics have even pegged these selloffs as a lack of faith in the protocol, with large-scale dumps usually following these targeted selloffs.

Ethereum Foundation Sells 1700 ETH to USDC

— SecuX (@SecuXwallet) October 9, 2023

The #Ethereum Foundation (EF) sold 1700 ETH to #USDC on October 9, 2023. This move has sparked speculation in the crypto market, with some blaming Vitalik Buterin, the co-founder of Ethereum, while others blame the EF itself.

Besides the direct sell-offs from the Ethereum Foundation, leaders within the community, including co-founder Vitalik Buterin, are also known to liquidate enormous amounts of Ethereum for undisclosed reasons.

Meanwhile, the behavior analytics platform for cryptocurrencies, Santiment, which sources on-chain, social and development information, shows that Ethereum fees are at their lowest levels of 2023 after a steady multi-month slump. Meanwhile, social dominance, showing the number of mentions on crypto-related social media, has hit a seven-month high.

With Ethereum price heading south, investors are growing impatient, evidenced by the growing chatter around the Proof-of-Stake (PoS) token.

ETH Santiment data

According to Santiment, traders are now split about the future of Ethereum price, making ETH a polarizing topic especially on Crypto X. With bearish sentiment growing, experts from Santiment anticipate a turnaround.

️ #Ethereum has dropped to $1,570, & #crypto's #2 market cap asset has become an increasingly polarizing topic. Currently at its lowest fee levels of 2023, traders are growing impatient. Rising #bearish sentiment is a good sign of an impending turnaround. https://t.co/WwmO7hXga7 pic.twitter.com/7JJaiiSZSo

— Santiment (@santimentfeed) October 9, 2023

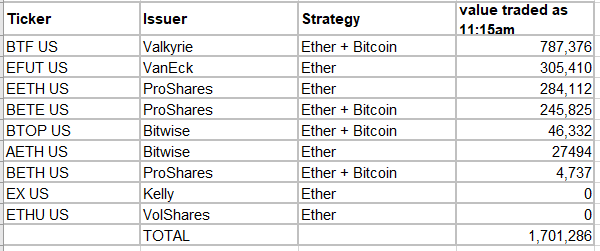

In the meantime, Ethereum Futures Exchange-traded funds (ETF) have failed to live up to the hype, contrary to expectation, with all ETH ETFs combined generating only up to $1.7 million in trading volume trading volume as of October 2.

ETH futures ETF trading volume

In the same way, the institutional interest in ETH has been bleak since the onset of the year, resulting in $114 million in outflows. Read the full story here.

Ethereum FAQs

What is Ethereum?

Ethereum is a decentralized open-source blockchain with smart contracts functionality. Serving as the basal network for the Ether (ETH) cryptocurrency, it is the second largest crypto and largest altcoin by market capitalization. The Ethereum network is tailored for scalability, programmability, security, and decentralization, attributes that make it popular among developers.

What blockchain technology does Ethereum use?

Ethereum uses decentralized blockchain technology, where developers can build and deploy applications that are independent of the central authority. To make this easier, the network has a programming language in place, which helps users create self-executing smart contracts. A smart contract is basically a code that can be verified and allows inter-user transactions.

What is staking?

Staking is a process where investors grow their portfolios by locking their assets for a specified duration instead of selling them. It is used by most blockchains, especially the ones that employ Proof-of-Stake (PoS) mechanism, with users earning rewards as an incentive for committing their tokens. For most long-term cryptocurrency holders, staking is a strategy to make passive income from your assets, putting them to work in exchange for reward generation.

Why did Ethereum shift from Proof-of-Work to Proof-of-Stake?

Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) mechanism in an event christened “The Merge.” The transformation came as the network wanted to achieve more security, cut down on energy consumption by 99.95%, and execute new scaling solutions with a possible threshold of 100,000 transactions per second. With PoS, there are less entry barriers for miners considering the reduced energy demands.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.

%2520%5B21.02.05%2C%252009%2520Oct%2C%25202023%5D-638324821092071656.png&w=1536&q=95)