- Ethereum recorded yet another record high, reaching $2,340.

- An analyst suggested that Ether price could surge by another 500%, given Ethereum’s fundamentals.

- Berlin upgrade and Coinbase direct listing could also positively impact Ethereum price.

Ahead of Ethereum’s Berlin upgrade and the Coinbase direct listing, Ether is up by over 8% in the past week and has made a new all-time high at $2,340.

Ethereum price to surge by another 500%

With the rise of non-fungible tokens (NFTs) and decentralized finance (DeFi) over the past year, Ethereum has benefitted from being one of the most used blockchain networks in the crypto industry.

Although the Ethereum network does have some drawbacks, including high transaction fees, Ether’s price has more than doubled since the start of the year.

Former hedge fund manager and crypto analyst Teeka Tiwari recently claimed that Ethereum is currently extremely undervalued. ETH price could surge by another 500%, taking its price to the five-digit territory.

Tiwari further believes that Ethereum could surpass the value of Microsoft, Apple, Google and Facebook combined over the next decade. According to Tiwari, DeFi and decentralized apps (Dapps) will make Ethereum the most valuable software platform in history.

The analyst added that he is not the only believer in the future in Ethereum, as SkyBridge Capital CEO Anthony Scaramucci highlighted Ethereum’s fundamentals, saying that it is going to make it a “sticky cryptocurrency and a store of value, and something people will transact with.”

Tiwari suggested that Ethereum is currently “wildly undervalued” and that the cryptocurrency will go “much, much higher.”

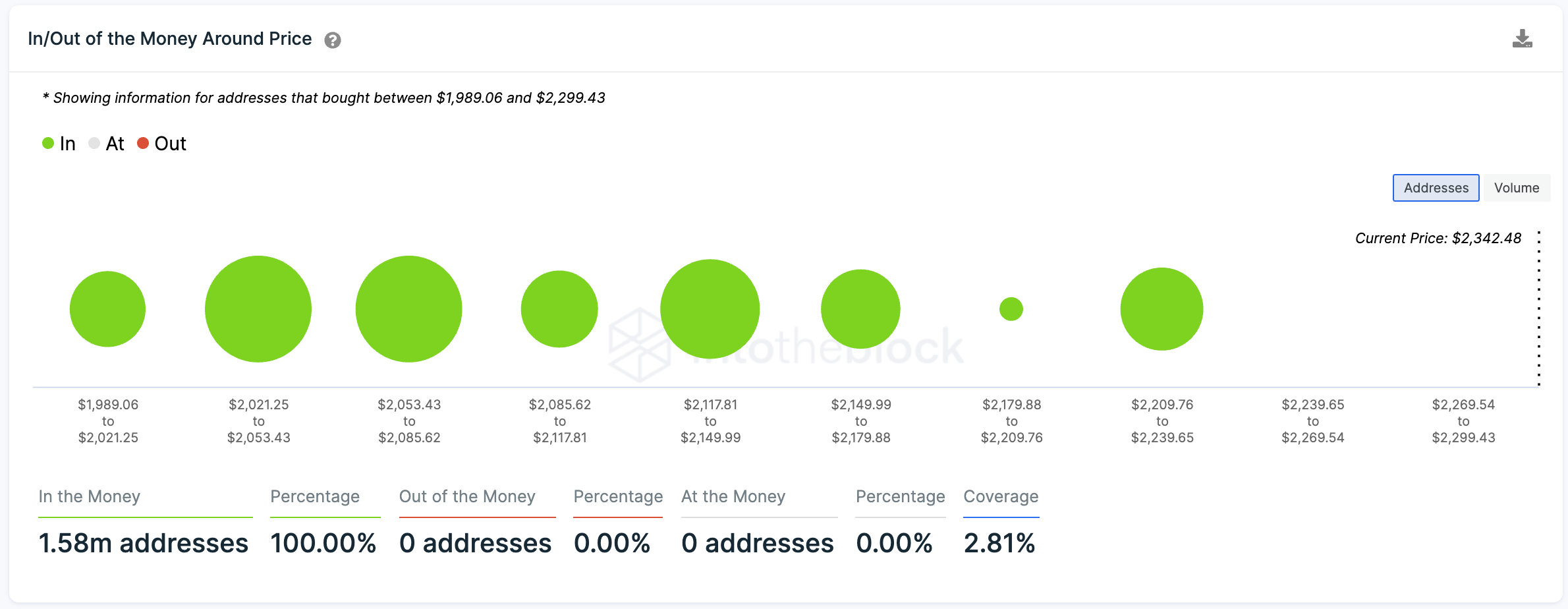

The IntoTheBlock In/Out of the Money Around Price (IOMAP) data shows that Ethereum has virtually no resistance ahead, having made a record high. An interesting level to watch is between $2,209 to $2,239, which could hold massive support for the cryptocurrency. If a correction occurs and this level is lost, the next support could be found at $2,149 to $2,179.

Ethereum IOMAP data

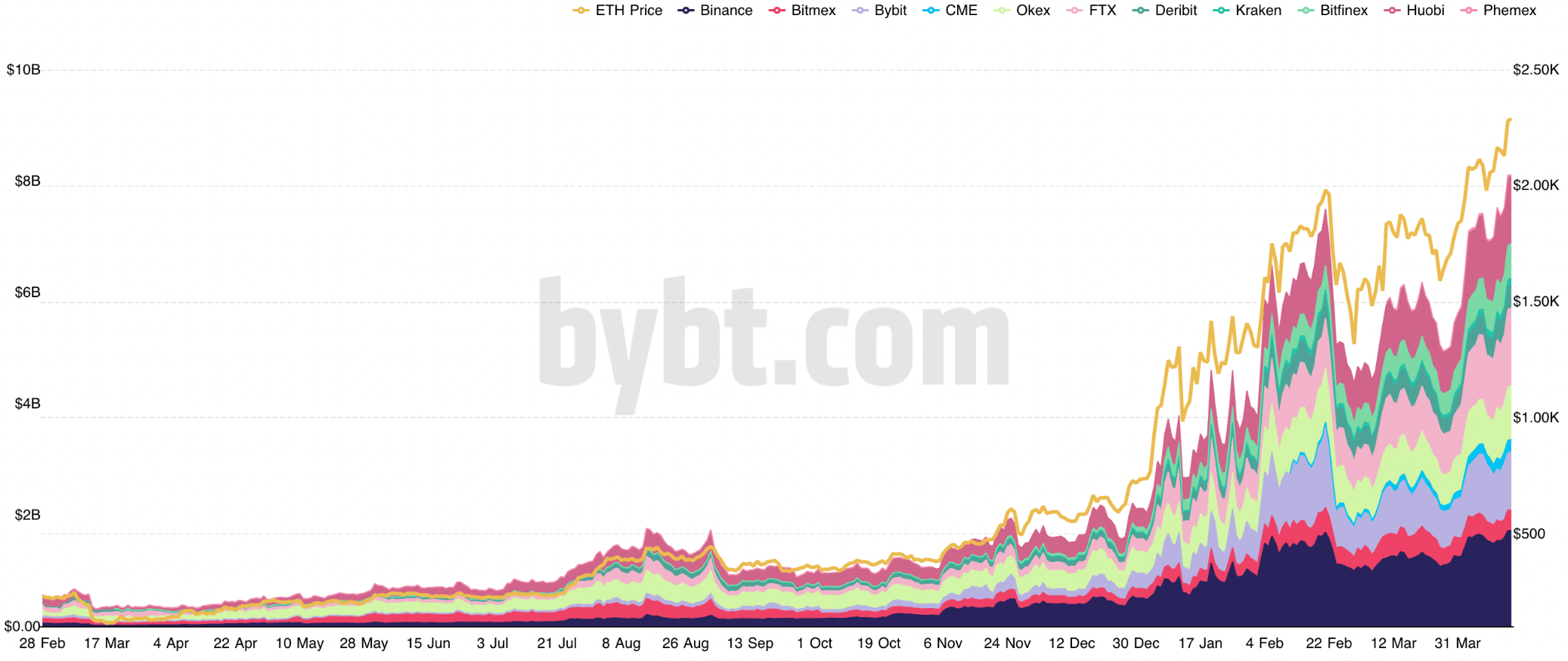

Ethereum’s price surge has caused Ether’s open interest to reach a new record high of $8 billion, which is roughly 50% of Bitcoin’s figure in February this year.

Ether futures open interest

The current futures open interest surge reflects that markets allow even more prominent players to participate in derivatives trading. This also reflects CME Ethereum futures contracts, which was a significant milestone for Ether.

With an increase of institutions entering the crypto market, Ethereum price could still have massive room for growth.

Ether to be more scarce than Bitcoin

While the DeFi and NFT industries continue to grow, Ethereum faces high transaction fees and lagging transaction times. The Berlin hard fork, expected on April 14, is expected to pave the way for other upgrades in the future, including London. The upgrade is a step closer to Ethereum 2.0, where the network will be using the proof-of-stake consensus mechanism.

Gas prices were at all-time highs as the network faced increased demand, while ETH price also steadily increased.

The Berlin upgrade will provide some solutions to Ethereum’s high transaction costs, although congestion on the network would still likely remain until scalability is improved.

The crypto market is expected to benefit from another huge bullish driver in the market – Coinbase’s direct listing – which will occur on April 14 as well.

Coinbase’s direct listing is expected to be a “watershed” moment for the cryptocurrency industry, as other entities in the sector could follow the footsteps of the major exchange in the future. CEO of Token Metrics, Ian Balina, commented:

Ether is surging because it is relatively undervalued compared to Bitcoin. Factoring in Coinbase’s $100 billion [valuation] that will bring users to the crypto space, and Ethereum being the only other crypto asset with CME futures contracts for institutions, one can see why Ethereum is surging.

Following the Berlin upgrade, the London upgrade expected in July could make Ether deflationary and more scarce than Bitcoin, especially after introducing the crypto’s ability to be burned after transactions, said Balina.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Litecoin Price Prediction: LTC tries to retake $100 resistance as miners halt sell-off

Litecoin price grazed 105 mark on Monday, rebounding 22% from the one-month low of $87 recorded during last week’s market crash. On-chain data shows sell pressure among LTC miners has subsided. Is the bottom in?

Bitcoin fails to recover as Metaplanet buys the dip

Bitcoin price struggles around $95,000 after erasing gains from Friday’s relief rally over the weekend. Bitcoin’s weekly price chart posts the first major decline since President-elect Donald Trump’s win in November.

SEC Commissioner Hester Pierce sheds light on Ethereum ETF staking under new administration

In a Friday interview with Coinage, SEC Commissioner Hester Peirce discussed her optimism about upcoming regulatory changes as the agency transitions to new leadership under President Trump’s pick for new Chair, Paul Atkins.

Bitcoin dives 3% from its recent all-time high, is this the cycle top?

Bitcoin investors panicked after the Fed's hawkish rate cut decision, hitting the market with high selling pressure. Bitcoin's four-year market cycle pattern indicates that the recent correction could be temporary.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.