Ethereum price submerged at $2,800 spells trouble for early bulls

- ETH price is coiling into a diagonal pattern.

- Ethereum price printed a large bearish engulfing candlestick.

- Invalidation of the downtrend is a breach at $3,039.

Ethereum price shows a bearish stronghold within the price action. Countertrend trading the ETH price trading is deemed high risk and inadvisable.

Ethereum price could continue its decline

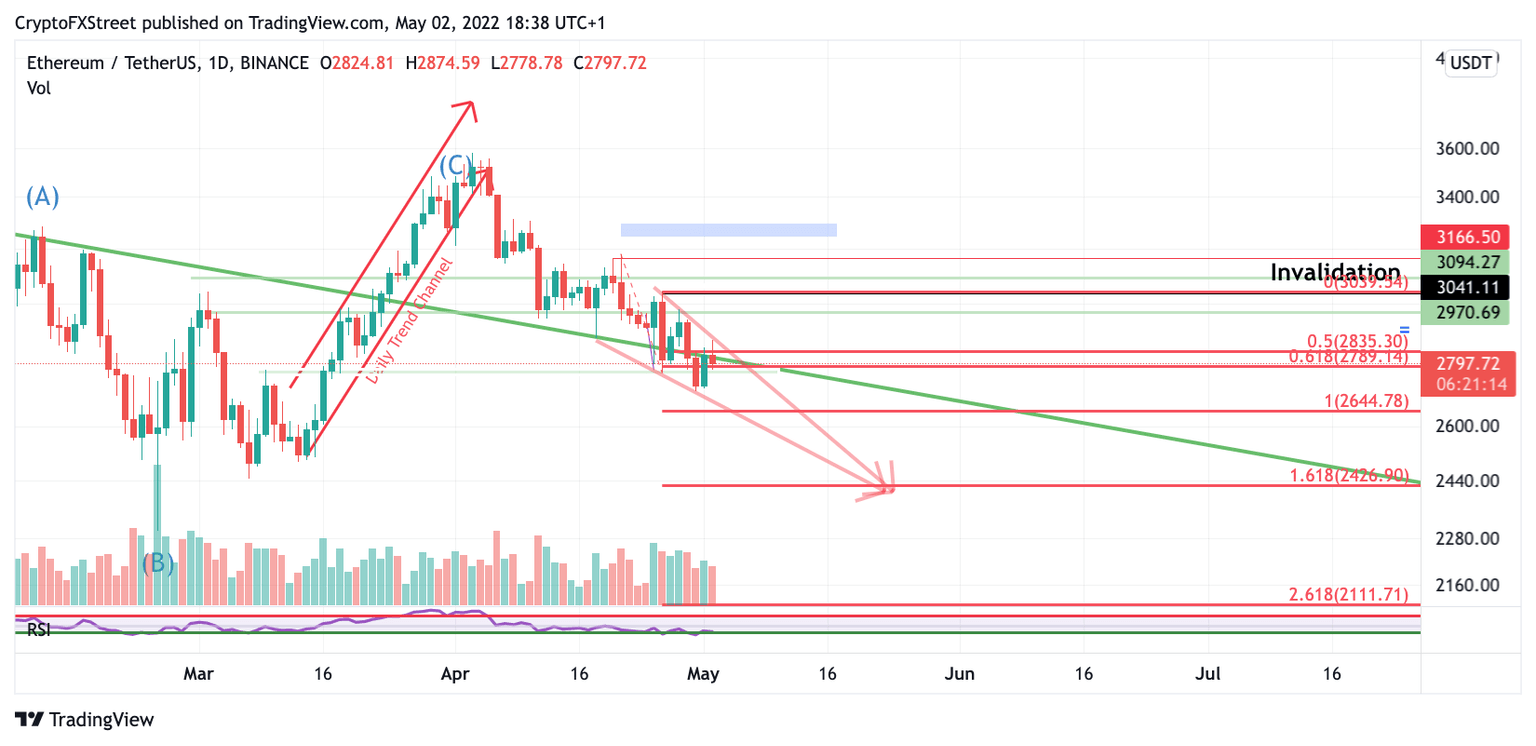

Ethereum price appears to be coiling within an ending diagonal formation, a hopeful indication for the bulls. However, the price action within the pattern still has not finished displaying full evidence of completion. Ending diagonals are commonly known to overshoot. There has been no breach of either side of the trend line at the current time. The strong bearish engulfing candlestick printed on April 26th with a close of $2,809 could be just one decline within the pattern. Thus one more dip for the ETH price is still on the card while respecting the overall diagonal dimensions.

Ethereum price volume also hints at another drop in price as an equal amount of bearish volume has been entering the market. A Fibonacci projection tool surrounding the most significant decline within the triangle forecasts a drop of $2,426. Traders should expect choppy price action with potential fakeouts to entice bulls to enter on the wrong side of the trade.

ETH/USDT 1-Day Chart

The invalidation of the bearish thesis is a breach of $3,039. The downtrend scenario would be void if the bulls could pull a swing into this level. A potential bullish target would be $3,280, resulting in an 18% increase from the current Ethereum price.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.