Ethereum price stalls at $2,000, leaves ETH holders in a tough spot

- Ethereum price rebounds, but it lacks the decisiveness and commitment that generally accompanies important lows.

- ETH 200-day SMA remains instructive for price support.

- Short-term ETH holders are watching their unrealized gains evaporate as the NUPL metric enters capitulation zone.

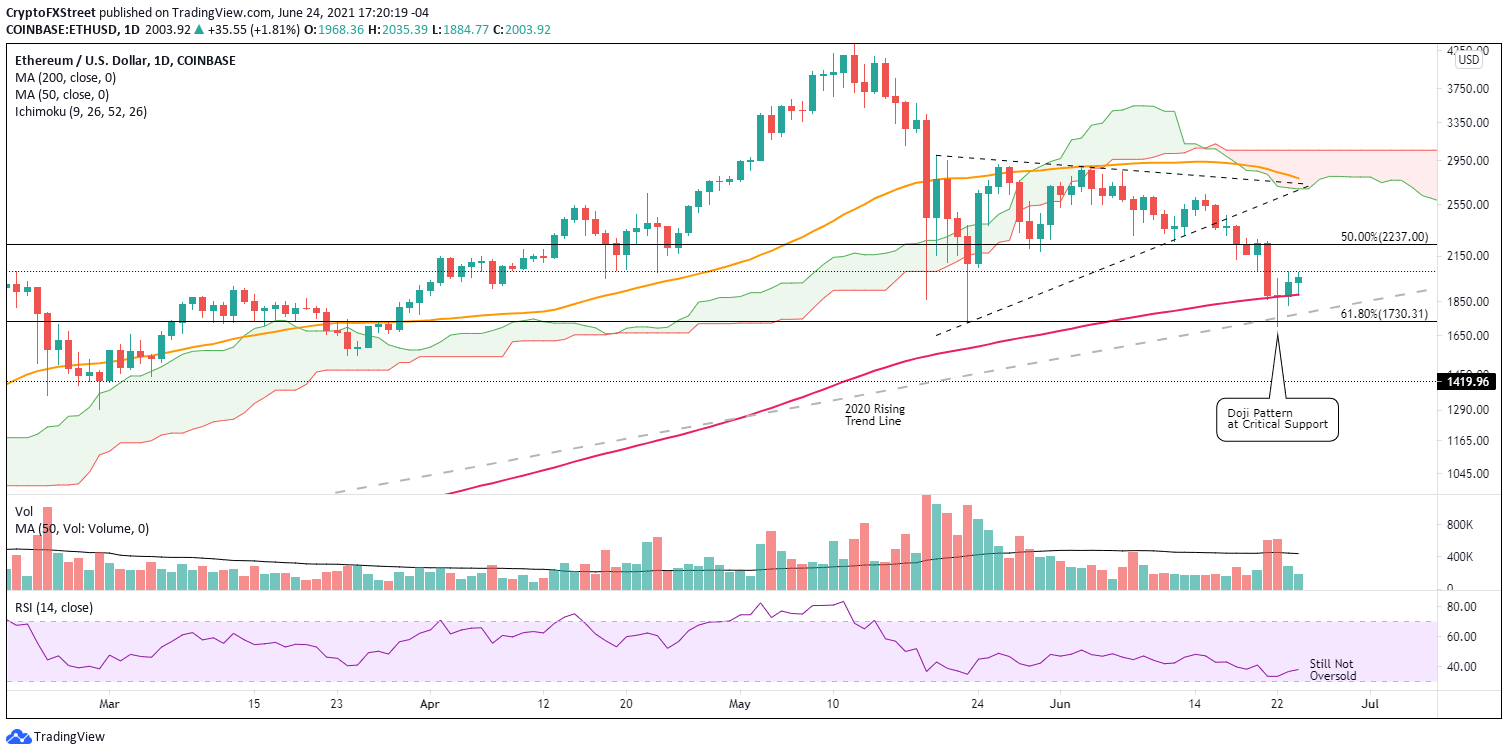

Ethereum price is logging another up day after recovering the 200-day simple moving average (SMA). Still, the gains have been timid, and the underlying volume does not reflect accumulation as ETH struggles with the February high.

The smart contracts giant successfully tested the May 23 low and the 2020 rising trend line, but it has done very little to reveal bigger directional intentions.

Ethereum price still not standing on both feet

The positive response of Ethereum price to the outstanding support framed by the 200-day SMA at $1,878, the 2020 rising trend line at $1,793, the 61.8% retracement of the March 2020-May 2021 advance at $1,730 and the May 23 low of $1,728 created a hint of optimism for enthusiastic ETH investors and short term speculators.

Ethereum price action since June 22 has not been compelling or comparable to some of the rebounds in other altcoins, suggesting something specific to ETH may be interfering with its attempts to dismantle the February high of $2,041 confidently. An essential part of the problem has been the low volume, uncharacteristic of final correction lows and may reveal more downside ahead for the digital asset.

A daily close above $2,041 is the first step to getting ETH standing on both feet but still leaves the resistance at the 50% retracement of the advance from March 2020 to the May 2021 high at $2,237 as another serious technical hurdle. However, if Ethereum price can get above $2,041 and close this week flat or nearly flat, it would a convincing conclusion to the week and raise the odds that ETH has finally realized a long-term low.

Additional upside targets include the apex of the symmetrical triangle at $2,730, but further gains will be rebuffed by the convergence of the 50-day SMA at $2,784 and the Ichimoku cloud, yielding a 35% from the February high.

ETH/USD daily chart

Ethereum price could resolve lower very quickly, putting it in danger of printing a new correction low. In front of that outcome is the support defined by the 2020 rising trend line at $1,777 and then the 61.8% Fibonacci retracement at $1,730. Beyond those levels, ETH will not encounter much support until the 2018 high of $1,419.

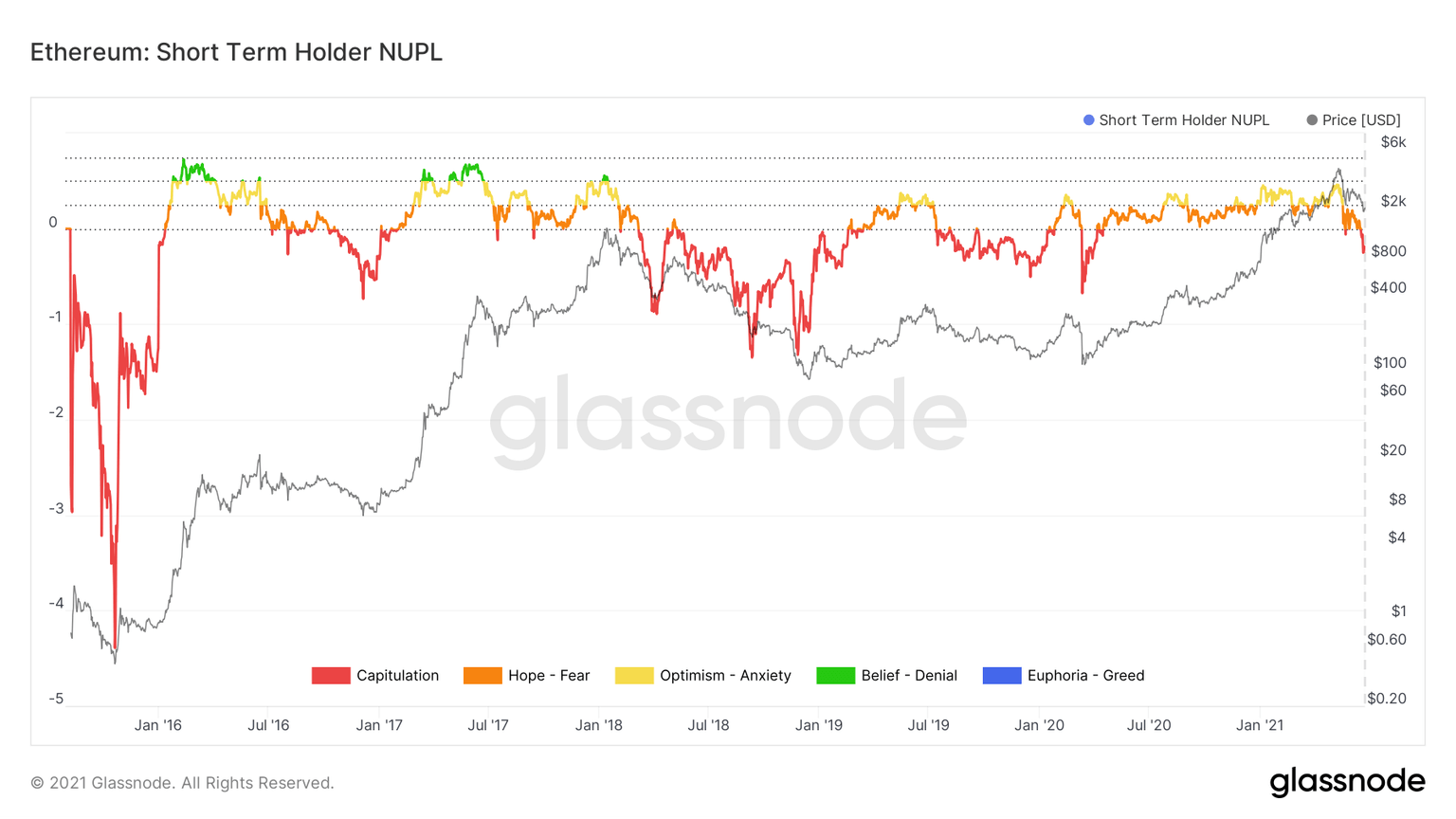

The weak comeback by Ethereum price keeps the heat on the short-term holders of ETH. Based on the Glassnode STH-NUPL (short-term holder net unrealized profit/loss), short-term ETH holders (coins unmoved for <155 days) are staring at their unrealized gains disappear as the net unrealized profit and loss metric enters the capitulation zone. More specifically, the indicator illustrates how owners of recently purchased ETH tokens are witnessing paper gains turn into paper losses. According to Glassnode, “short-term holders are now holding an aggregate paper loss of 25% of the market cap.”

In light of the STH-NUPL sizeable decline, it is safe to assume that significant quantities of ETH were purchased from near the February high to the all-time high of $4,384. The risk moving forward is that these short-term holders will close positions as prices rebound into the original cost basis (STH-NUPL=0).

ETH STH-NUPL - Glassnode

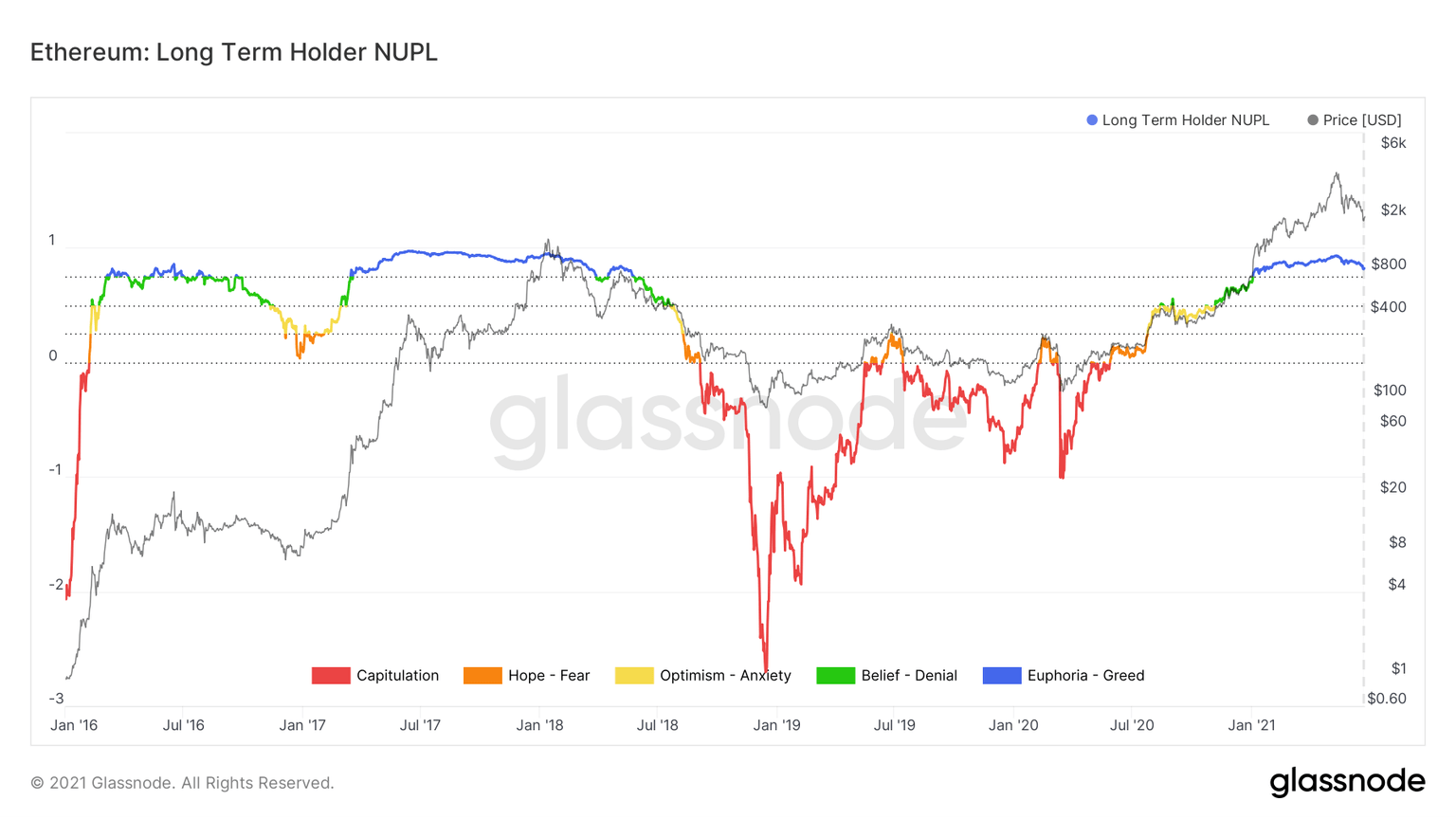

Conversely, long-term holders (>155 days) of ETH remain securely in profit, holding paper gains equal to around 80% of the market capitalization, thereby classifying the current status as euphoria on the chart.

The LTH-NUPL continues to be flat, with most long-term holders carrying profits. However, if ETH stays at these levels or breaks firmly below the May lows, they will suffer a fall in their unrealized gains, testing their conviction for the first time in 2021.

ETH LTH-NUPL - Glassnode

ETH was the most compelling story heading into the May high, surpassing the performance of Bitcoin and most altcoins. Still, it has been a tricky period since the May high, testing the patience of die-hard speculators.

Unless Ethereum price resolves the February high of $2,041, short-term ETH holders may be compelled to further exit positions. Moreover, a new shift to lower prices will finally test the holding power of long-term ETH holders, adding a new potential source of selling pressure for the smart contracts token.

Author

Sheldon McIntyre, CMT

Independent Analyst

Sheldon has 24 years of investment experience holding various positions in companies based in the United States and Chile. His core competencies include BRIC and G-10 equity markets, swing and position trading and technical analysis.