Ethereum price skyrockets to new all-time high following Altair upgrade

- Ethereum price reached a new record high at $4,407 after the recent retracement below $4,000.

- The Ethereum network underwent its third upgrade in seven months.

- The Altair upgrade is the first update on the Beacon Chain before ETH transitions to proof-of-stake.

Ethereum price rallied to a new all-time high on October 29, shortly following an upgrade that occurred on the blockchain. The Altair upgrade went live on October 28 and is one of the pivotal updates for ETH 2.0, changing the network’s infrastructure.

Ethereum price surges in anticipation of ETH 2.0

Ethereum price dropped below $4,000 earlier this week as the cryptocurrency market witnessed a correction. However, ETH quickly rebounded and reached a new record high at $4,407 on October 29.

The Ethereum blockchain underwent an upgrade on October 28, called Altair, one of the first upgrades to the Ethereum Beacon Chain since its launch in 2020.

This upgrade marks one of the most significant events for Ethereum as the Beacon Chain introduces the network to the proof-of-stake consensus mechanism.

Altair was deployed with over 95% validators participating at the time of the upgrade, indicating that network users took time to update their machines to run the latest software connecting them to the Ethereum network.

One of the major aspects of Altair was to increase the penalties for inactive or offline nodes. As Ethereum 2.0 relies on staking–stakers must lock up at least 32 ETH to provide security to the network–participants must stay online to receive block rewards; otherwise, their stake will be slashed.

Validators that have not updated their node could see their balances slowly reduced. Eventually, they may cross a threshold and be ejected.

Tim Beiko, the coordinator for Ethereum’s protocol developer, stated that Altair is a critical step closer toward ETH 2.0. He added that the upgrade shows that a complete transition toward proof-of-stake is possible.

Ethereum price targets $4,600

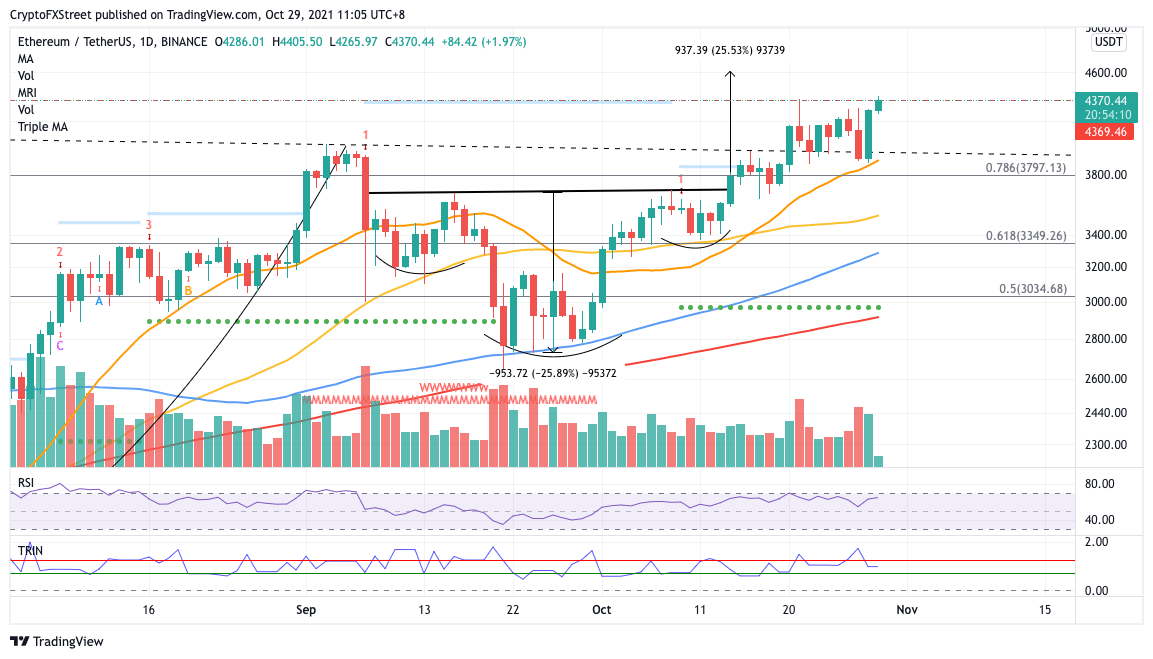

Ethereum price has formed an inverse head-and-shoulders pattern on the daily chart and has nearly reached the technical pattern’s bullish target. ETH could rally toward $4,600 in the near term before further retracements occur.

The second-largest cryptocurrency by market capitalization has room to climb 5% higher toward $4,611, the optimistic target given by the governing chart pattern.

The Relative Strength Index (RSI) indicates that Ethereum price is not yet in overbought territory, which could add fuel to ETH’s rally.

ETH/USDT daily chart

The first line of defense for Ethereum price is at the October 25 high at $4,240, then at the same day’s low at $4,062. Additional support may emerge at $3,973, then at the 21-day Simple Moving Average (SMA) at $3,921.

Author

Sarah Tran

Independent Analyst

Sarah has closely followed the growth of blockchain technology and its adoption since 2016.