Ethereum price shows an impressive recovery rally, but is the sell-off over?

- Ethereum price recovers 7% of losses accrued over the weekend.

- An influx of volume is occurring on intra-hour timeframes.

- Invalidation of the broader bearish thesis is a breach above $1,810.

Ethereum price retaliates against the bearish onslaught that occurred late last week.

Ethereum price fights back

Ethereum price shows commendable retaliation after last week's last-minute mudslide. Since August 26, the decentralized smart contract token fell 16% to a low of $1,420. As the opening New York bell rang on Monday, August 29, the bulls stepped back in with considerable force, inducing a volatile price hike.

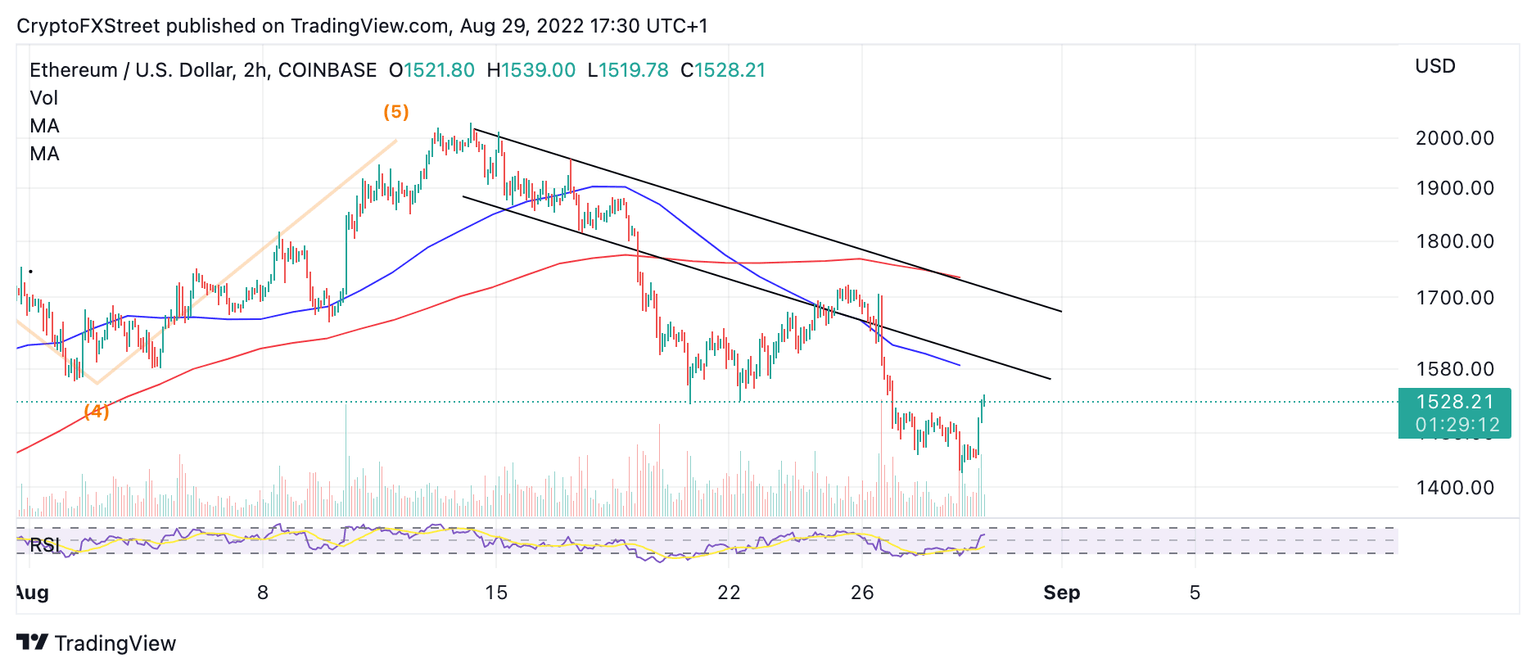

Ethereum price currently trades at $1,526. The 7% bullrun kicked off during August's final days is accompanied by an influx of volume on intra-hour time frames. Speculation persists as the upcoming Merge in September could significantly impact the smart contract token's price.

ETH/USD 2-hour chart

Nonetheless, the bulls might need more gains before qualifying the steep downtrend as over. The bearish thesis from last week still targets $1,300. The recently breached 8- and 21-day simple moving averages hover above the ETH price near $1,588 and $1,788. Price action near these levels will be vital in measuring the bulls’ strength.

For now, an invalidation of the bearish outlook can occur if the bulls can conquer $1,810. Doing so could induce the next rally targeting $2,200, resulting in a 40% increase from the current Ethereum price.

In the following video, our analysts deep dive into the price action of Ethereum, analyzing key levels of interest in the market - FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.