- Ethereum withstands some bearish pressure as bulls defend $3,900.

- ETH price has seen bulls preparing for a recovery of 15% by the end of this week.

- Expect bears to be squeezed out and possible opportunities to reach new all-time highs before Christmas.

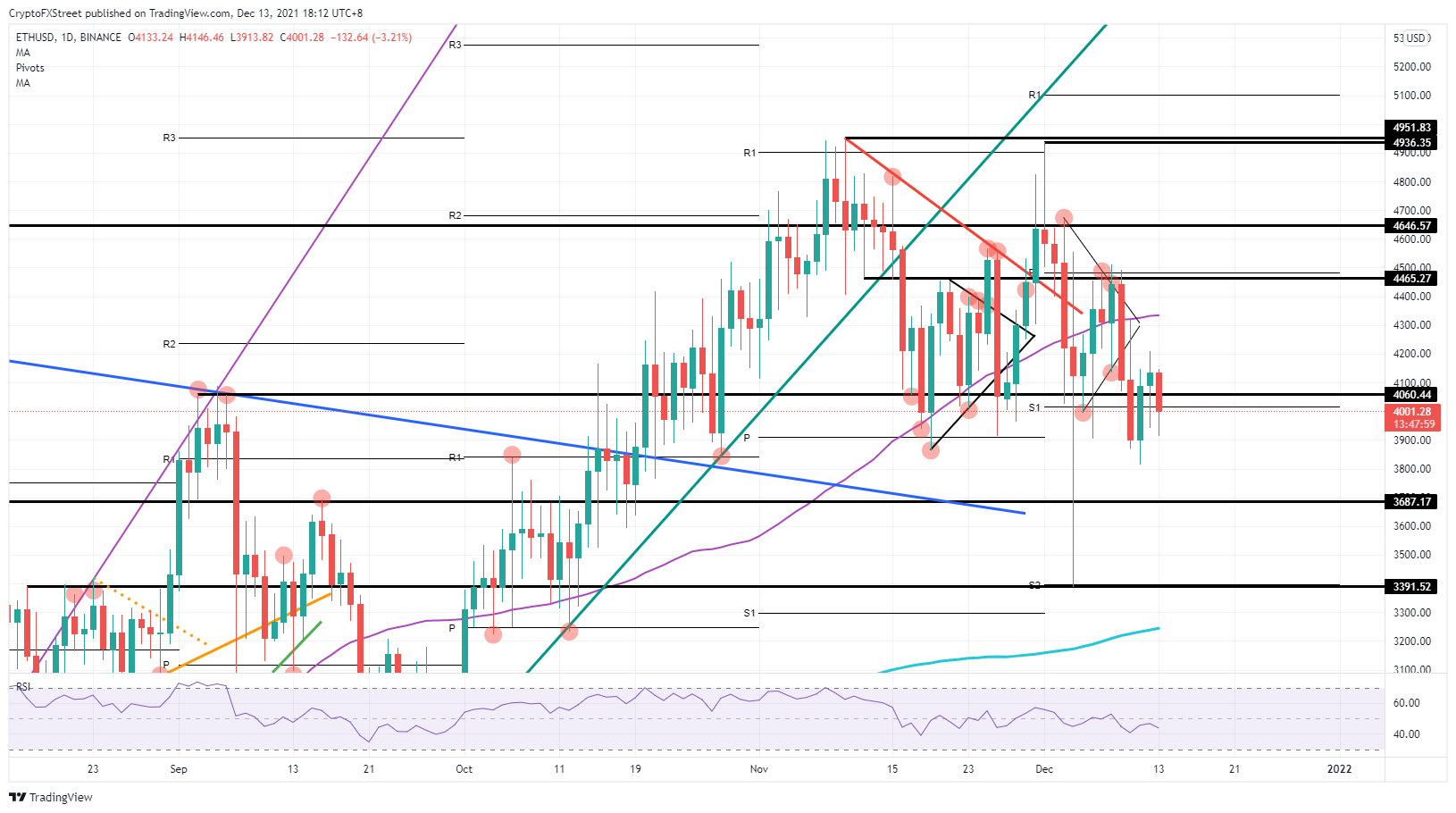

Ethereum (ETH) price underwent a bearish breakout from a pennant pattern last week. Bulls were picking up ETH coins below $3,900, and with European equities firmly in the green this morning, expect some risk-on sentiment to set the tone in cryptocurrencies in the coming days. For that reason, bulls have found they have the trend on their side and look set to push price action from $4,000 back to $4,646 in just a couple of days.

Ethereum price could see bulls pushing price back up towards $4,646

Ethereum price sees bears trying their last attempt to push price to the downside but looking to fail as they face headwinds from European equities shooting higher this morning. This element is a tailwind which could see ETH bulls regaining the advantage above the monthly S1 support level at $4,000.A daily close above $4,060 would see more buying volume coming in from investors, and as long as current tailwinds remain, expect bulls to squeeze bears out of their positions, and continue the recovery.

ETH price will likely see some nervousness around $4,465 and the monthly pivot, which will be difficult to get through as it represents a historical level, is where a monthly pivot is located and a triple top from the beginning of December. As long as tailwinds persist, expect bulls to find enough fresh impetus to push the price above, and reach that $4,646 level.

ETH/USD daily chart

With many central bank meetings scheduled for this week – for example, the US Federal Reserve and the European Central Bank – expect markets to be susceptible to any hawkish tones or hints to further monetary policy tightening to come for 2022. That could spell fear in the market and see riskier assets like equities and cryptocurrencies selling off, which would see a sharp correction in Ethereum price action, breaking below $3,900 and continuing its nosedive towards $3,687 and $3,391.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Dozens of crypto-related ETFs await SEC approval, among them those related to XRP, Litecoin, and Solana

Eric Balchunas, Senior ETF Analyst for Bloomberg, highlights 72 crypto-related ETFs awaiting SEC approval. The diversity of these ETFs encompasses major cryptocurrencies, such as XRP, Litecoin, and Solana, as well as meme-based memecoins.

Aptos price extends gains on broader crypto market recovery, presence in Osaka expo

APT token rises for the second consecutive day amid a widespread crypto recovery and expectations of growing adoption. Aptos powers the official digital wallet of Expo 2025 in Osaka, processing over 588,000 transactions with 133,000 new accounts.

Bitcoin bullish momentum builds as premium exceeds 9% for first time in three months

Bitcoin price is extending its gains, trading above $94,000 at the time of writing on Wednesday, following a two-day rally of 9.75% so far this week. BTC rally gathers momentum as trade war fears ease, following US President Donald Trump’s downplaying of tensions with China.

Solana and Sui surge, igniting interest in DeFi as TVL rebounds

Altcoins like Solana (SOL) and Sui gain strength on Wednesday, buoyed by several factors, including a significant recovery in the networks' Total Value Locked (TVL) in Decentralized Finance (DeFi).

Bitcoin Weekly Forecast: BTC holds steady, Fed warns of tariffs’ impact, as Gold hits new highs

Bitcoin price consolidates above $84,000 on Friday, a short-term support that has gained significance this week. The world's largest cryptocurrency by market capitalization continued to weather storms caused by US President Donald Trump's incessant trade war with China after pausing reciprocal tariffs for 90 days on April 9 for other countries.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.