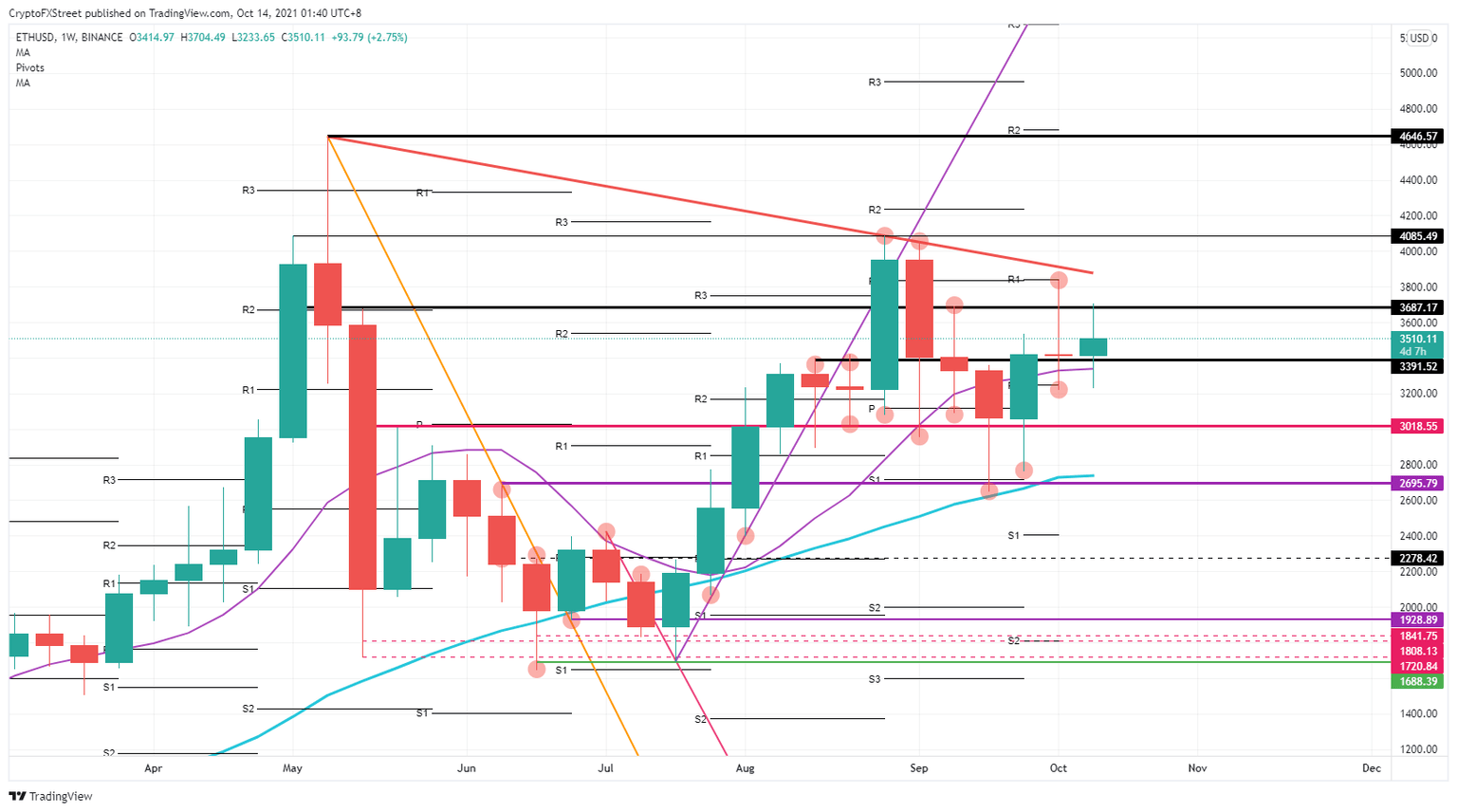

Ethereum price ready to break top line and target $4,085

- Ethereum price saw bulls entering at the monthly pivot near $3,429.

- Price action to the upside got rejected at the monthly R1 resistance level at $3,836 and just a few bucks shy of the red descending top line.

- With bulls taking the upper hand this week, expect a further continuation with a break of the red descending trend line and a retest of $4,085.

Ethereum (ETH) price is on the verge of breaking higher after the first week of October offered bulls an entry-level around $3,429 with the monthly pivot and the 55-day Simple Moving Average (SMA). This week bulls are slowly but steadily reclaiming the resistance level at $3,687. Expect a squeeze against the red descending top line next week that will break and give bullish returns toward $4,085.

Ethereum price offers 25% returns in the coming week

Ethereum price this week saw further bullish momentum building up as buyers of ETH price joined the restoration of the rally around $3,429. With the monthly pivot and just above the 55-day SMA, bulls had two reasons to enter or add to their long positions in Ethereum price action. The reclaiming of $3,687 this week was already a small victory and saw some profit-taking.

ETH price needs to close above $3,687 to keep the momentum going and attract more buyers to join the rally. This way, momentum gets built up for a squeeze and pop to the upside to break the red descending trend line that has been capping Ethereum price action for five months now.

With the pop above, a retest of the red descending trend line should give room for bulls to join the rally next week in the test for support on the red descending trend line and build-up for the next stage toward $4,085 or $4,646.

ETH/USD weekly chart

In case bears can defend $3,687 and reject bulls from any further advancing to the upside, bulls will start counting their eggs and take their profit. ETH price action will reverse quite rapidly and could spell more downside to come with a retracement back to $2,695. Should earnings season show disappointing numbers in the stock markets while global markets are going full risk-off, expect this headwind to push ETH price action toward $2,278.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.