Ethereum price provides last buy opportunity before ETH skyrockets to $5,600

- Ethereum price is undergoing a retracement after rallying 22% in under five days.

- This correction will provide interested investors the last opportunity before ETH rallies 33% to $5,662.

- A breakdown of the range low at $3,909 will invalidate this bullish thesis.

Ethereum price rallied exponentially for a few days and came close to retesting its all-time high. This run-up is a perfect example of a liquidity run and is in preparation for the next leg-up that will likely set up a new high.

Ethereum price eyes record levels

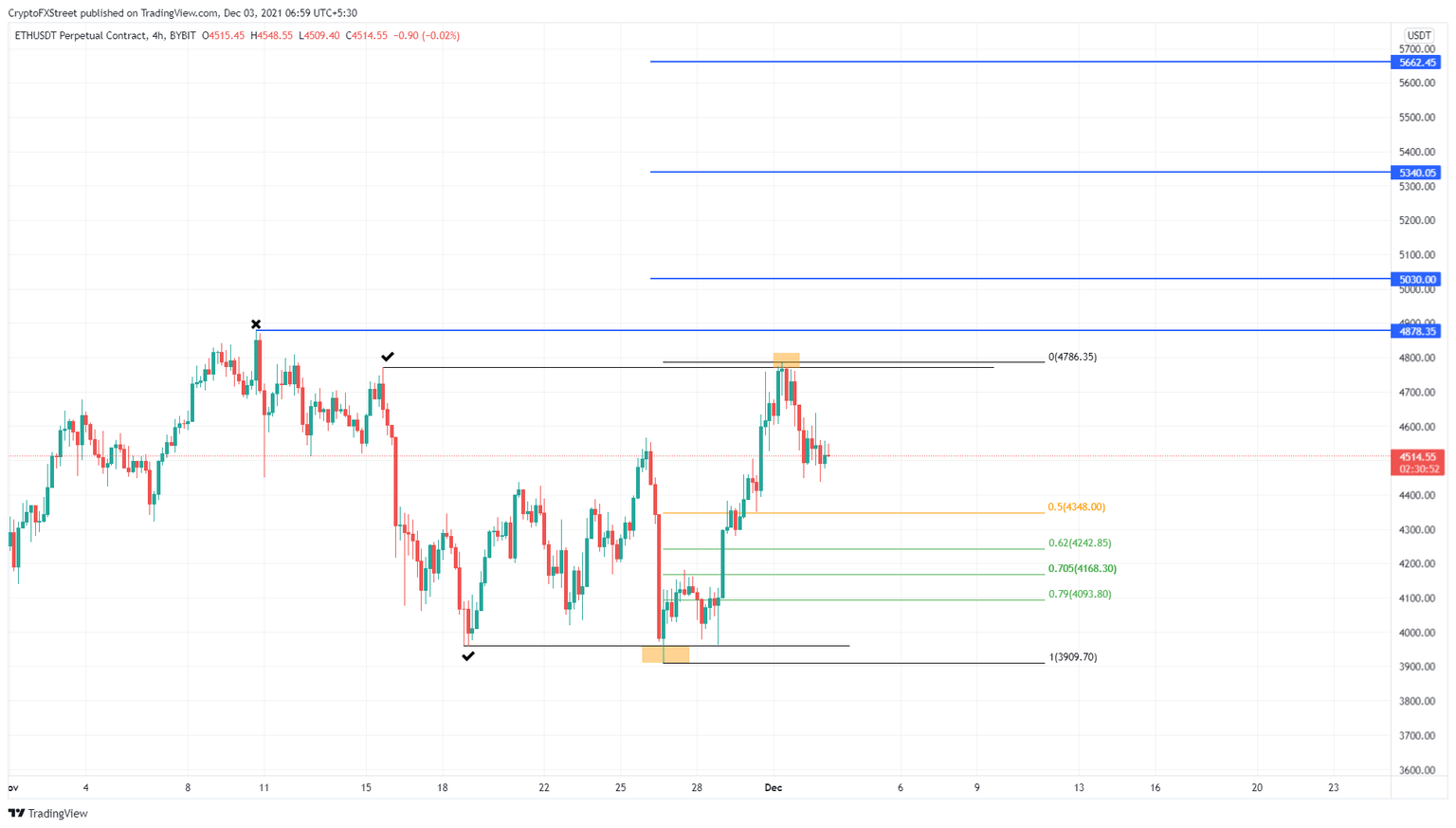

Ethereum price collected liquidity resting below the November 18 swing low at $3,960 on November 25, which marked the start of an upswing. Since this point, ETH has climbed 22%, and in doing so, the altcoin has managed to collect liquidity resting above the November 16 swing high at $4,771.

Therefore, investors need to watch Ethereum price for an explosive move that sets up a new all-time high. After the recent run-up, ETH has declined 5% and is likely to continue until it dips into the buy zone, extending from $4,093 to $4,242.

This move will trigger a run-up that will aim to retest the current record high at $4,878 and hope to set up a new one at the $5,000 psychological level. If the bullish momentum persists, Ethereum price could extend and tag $5,340.

In a highly bullish case, however, investors could expect Ethereum price to set up a swing high at $5,662. This move would constitute a 33% ascent from $4,242.

ETH/USDT 4-hour chart

While the above narrative is rather bullish, it is contingent on the fact that the Ethereum price does not dip below the buy zone, extending from $4,093 to $4242. Shattering this area will likely lead to a retest of the range low at $3,909.

If ETH produces a daily close below this level, it will invalidate the bullish thesis. In this situation, Ethereum price will eye the October 22 and October 28 swing low at $3,889 and the liquidity resting below it.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.