Ethereum Price Prediction: Why volatility could fade during the upcoming Merge

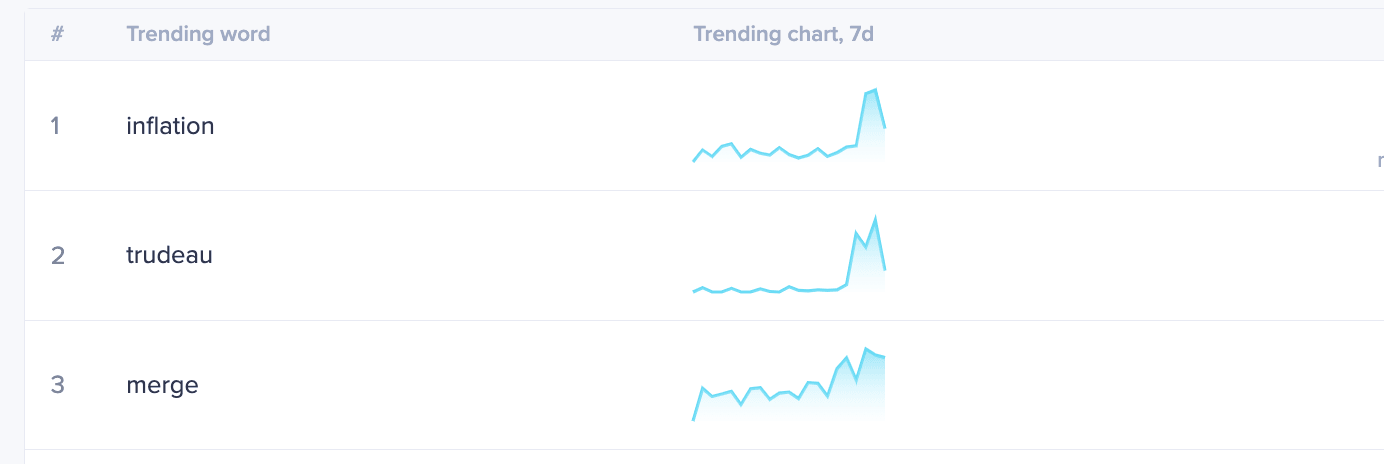

- Ethereum Merge is ranked third in trending words on all social media platforms.

- ETH price has stepped back into supportive territory on the Relative Strength Index.

- Ethereum price may not show the volatility day traders are hoping for amidst the upcoming Merge event.

Ethereum price could display stagnant price action as Ethereum Merge conversations and speculations persist.

Ethereum price looks triangle bound

Ethereum price is on everyone's mind as the upcoming Merge event provokes considerable speculation about where the price is going. According to Santiment's Social Media Indicators' Ethereum Merge is currently ranked third in popular discussions on all social media platforms. Despite the hype and speculation that Ethereum's big day will yield a massive move, the technicals could be suggesting that nothing spectacular is set to happen at all.

Santiment’s Social Media Indicators

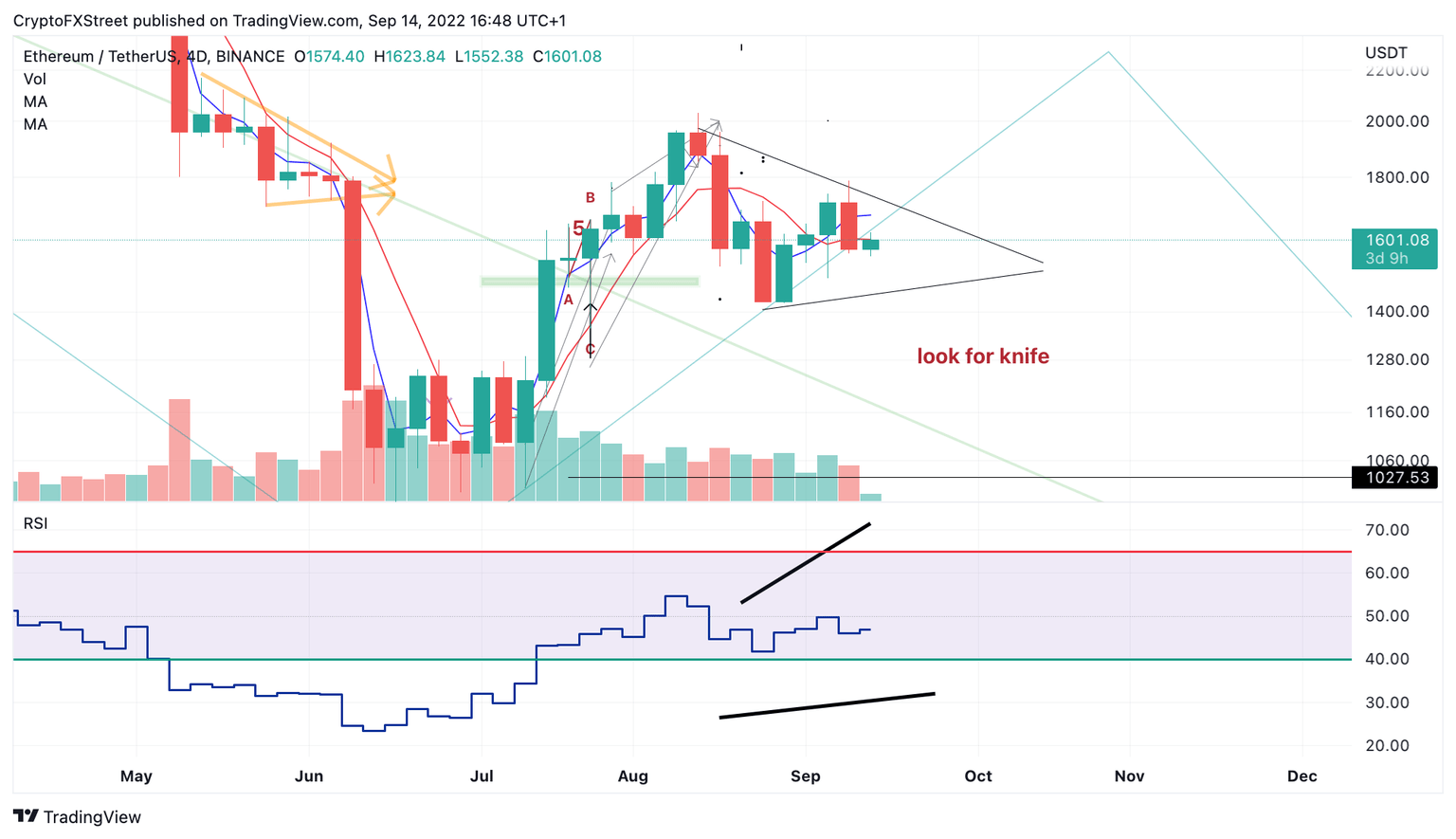

Ethereum price currently auctions at $1,595 after losing 13% of market value upon the US Consumer Price Index report. On larger time frames, the selloff is relatively spare in terms of volume and size of the candlestick. Additionally, the Relative Strength Index has stair-stepped its way back into supportive territory, hinting that a large selloff may not be the next move.

ETH USDT

A triangle consolidation could be forming based on the tapering volume and RSI reading. If this is correct, the Ethereum price could witness mundane range-bound price fluctuations as the Merge approaches. A breach of the swing low at $1,419 would invalidate the triangle idea and could induce a capitulation event towards $1,270.

In the following video, our analysts deep dive into the price action of Ethereum, analyzing key levels of interest in the market. -FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.