Ethereum Price Prediction: What to expect post-Merge

- The Ethereum Merge implementation has been finalized this week.

- Ethereum price has recently breached the August low at $1,419.

- Invalidation of the bearish thesis is a closing candle above $1,596.

Ethereum price could head south to capitulate the bulls holding on to their trades from last month. Key levels have been identified.

Ethereum price looks dicey

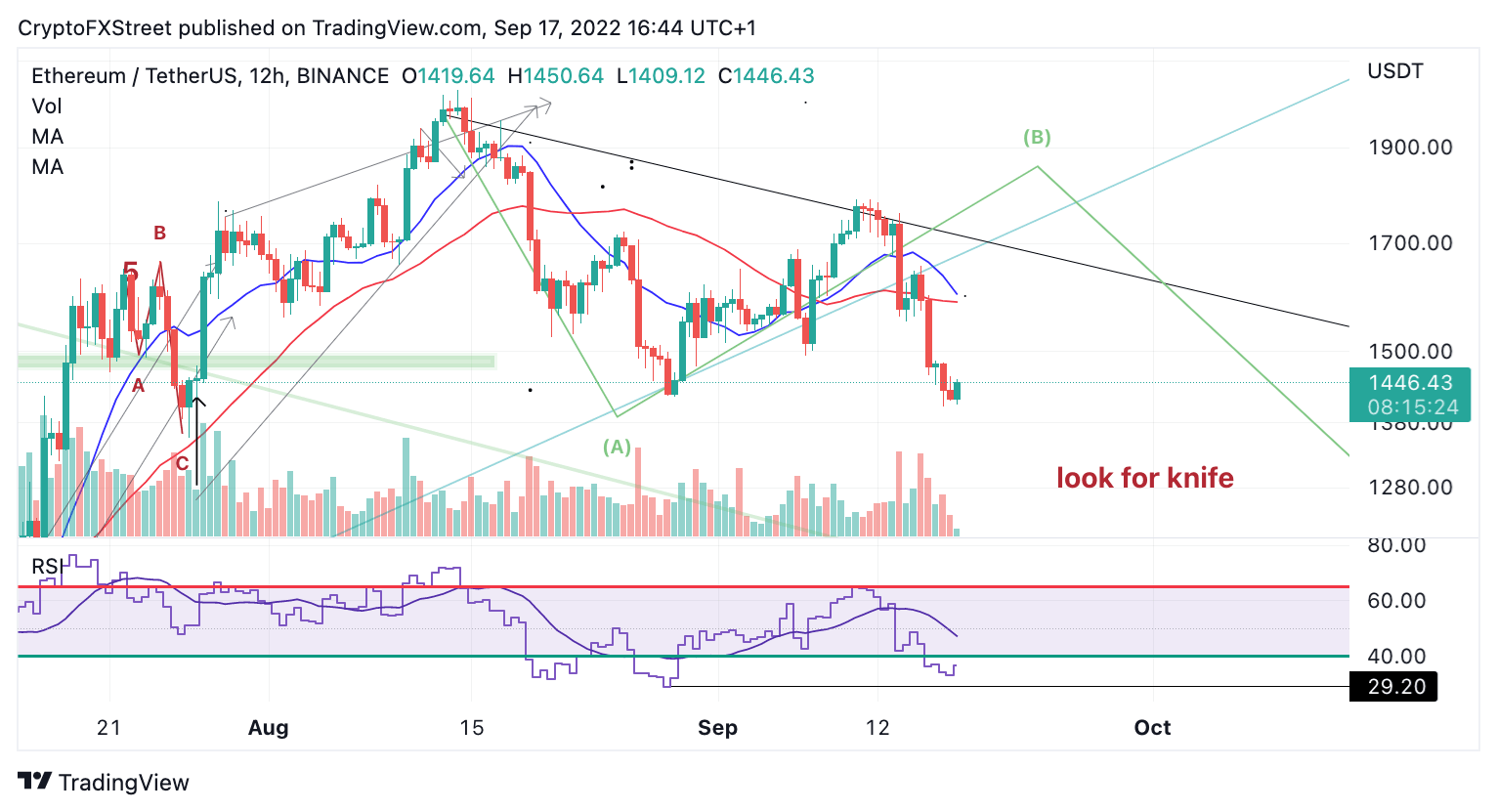

Ethereum price shows mixed signals despite the optimistic market sentiment surrounding the successful Merge implementation. On Friday, September 16, the bears produced a breach through the August 29th swing low at $1419, wiping out all profit made this month. A persistent pick in bearish volume is shown on the 12-hour chart, which suggests there could be further decline to shake out the bulls still holding on to their positions

Ethereum price currently auctions at $1,442. The 8-day exponential and 21-day simple moving averages currently compress near the $1,600 price level. Classical price action theory suggests this signal could likely turn into a bearish death cross of the moving averages in the coming days. If market conditions persist, Ethereum price could continue heading south with a probable landing zone at the 200-week moving average priced at $1,270.

ETH USDT 12-Hour Chart

The technicals may come as a surprise as the Ethereum Merge has been anticipated to yield positive returns for the decentralized smart contract token in the crypto arena. The bullish scenario is not impossible. However, the bulls need to re-hurdle the compressing moving averages at $1,596 to sustain the momentum needed for a retracement towards $2,000.

In the following video, our analysts deep dive into the price action of Ethereum, analyzing key levels of interest in the market. -FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.