Ethereum Price Prediction: The long game could see ETH climb 30%

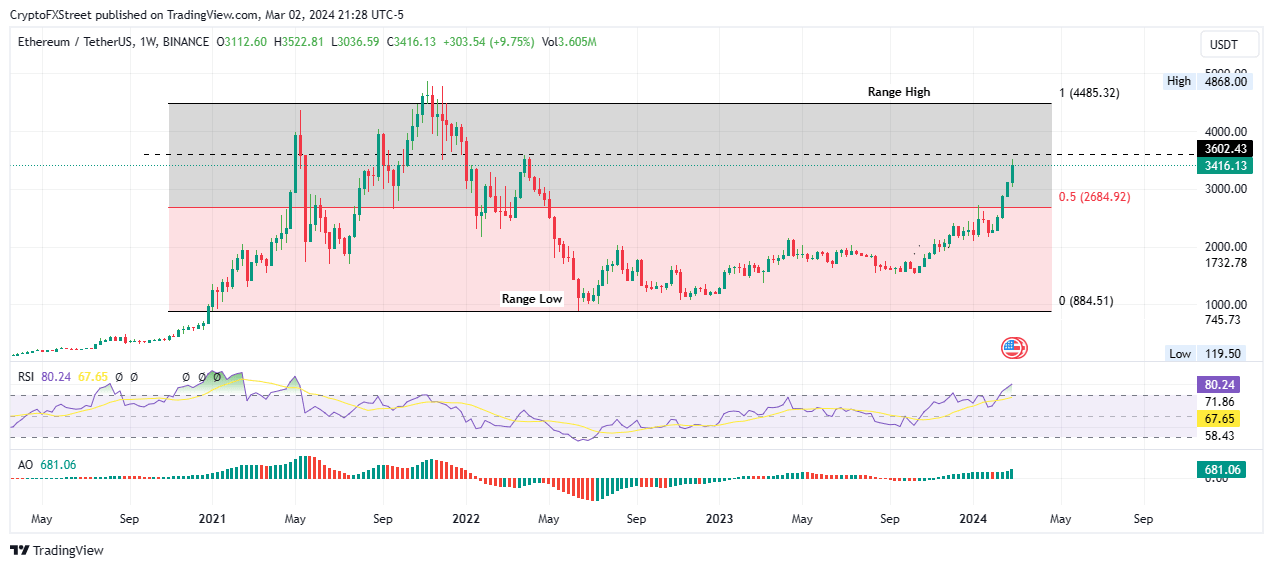

- Ethereum price has defended its range low of $884.51 since early 2021 while the $4,485.32 peak capped the upside.

- If ETH manages to close above $3,602.43, it could catalyze a continuation to the January 2021 peak.

- A break and close below the midrange of the channel at $2,684.92 would invalidate the bullish thesis.

Ethereum (ETH) price is trading with a bullish bias, having breached the midline of the market range between the January low around $884.51 and the November high of the year 2021 around $4,485.32.

Also Read: Ethereum Layer 2 transaction volume surges driven by system upgrades, increasing partnerships

Ethereum price could retake the November 2021 highs if bulls play the long game

Ethereum (ETH) price is above the 50% Fibonacci retracement level of $2,684.92 after a bullish bounce above the $2,000 psychological level in November 2023.

With momentum still rising, ETH price could extend the gains, shattering the $3,602.43 blockade before an extension to the local top around $4,485.32. A weekly candlestick close above $3,602.43 would pave way for more gains.

In a highly bullish case, the gains could see the largest altcoin by market capitalization reclaim the $4,868.00 range high. Such a move would denote a 30% climb above current levels.

Bulls continue to remain well within the ETH market, as seen with the large volumes of green histogram bars of the Awesome Oscillator (AO) in positive territory. This is despite Ether being massively overbought and could play in favor of the upside.

ETH/USDT 1-week chart

On the other hand, if the $3,602.43 level holds as a resistance in the weekly timeframe, the Ethereum price could retest the midpoint of the market range at $2,684.92, with a break and close below it invalidating the bullish thesis.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.