- The CFTC chairman has recently heaped praise on Ethereum.

- The price has currently found support at the 50-day SMA.

The Ethereum community got a pleasant surprise this Wednesday when CFTC chairman Heath Tabert heaped praises on the smart contract platform. The regulator compared Bitcoin and Ethereum by analogizing it with email and the internet. According to Tabert, while Bitcoin and email are “one-trick ponies,” Ethereum can have a much broader impact like the internet.

The technical picture

After rising steadily from $320 to $390, the price has encountered resistance and has dropped slightly to $378. Currently, the 50-day SMA has managed to keep the price up. The MACD shows that the market momentum is still bullish, so it could be possible that the price is going through a short-term retracement before making another charge towards the $390 resistance line.

ETH/USD daily chart

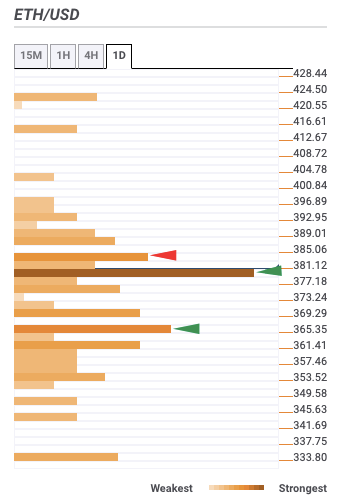

If the bulls break past the $390 resistance line, they should have enough momentum to make a break for the $485 resistance and enter the $500-zone. As per the daily confluence detector, there aren’t any strong resistance levels between $390 and $485. The confluence detector also shows that the smart contract giant is sitting on top of healthy support, aka, the 50-day SMA.

ETH daily confluence detector

To add further credence to our bullish hypothesis, there has been a significant rise in the number of whales holding a considerable portion of Ethereum. As per Santiment’s holders distribution chart, the number of addresses holding 10,000 - 100,000 ETH went up from 961 to 971 from October 8 to October 14. Similarly, the number of addresses holding 100,000 - 1 million tokens rose from 160 to 165 between October 5 and October 14.

Ethereum holders distribution

The flipside: Can the bears push the price down

The bears can take control if they manage to break below the 50-day SMA ($370), proving itself to be a strong support wall. Breaking below this will throw ETH down to the 100-day SMA ($350). These two levels should be strong enough to absorb any selling pressure, capping off the downside at $350. Any break below that will drop the price to the 200-day SMA ($280).

Key price levels to watch

ETH needs to break above the $390 resistance barrier to charge for the $500 zone. Upon conquering the $390 line, the buyers will next need to break past the $485 resistance.

On the downside, the bears can take control by breaking below the 50-day SMA ($370) and following that, the next healthy support lies at the 100-day SMA ($350). These two levels should be strong enough to absorb any selling pressure.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Cardano Price Forecast: Sign of robust bullish reversal emerges despite dwindling DeFi TVL volume

Cardano rebounds to test resistance at $0.69 as technical indicator flashes a buy signal. A minor increase in the derivative Open Interest to $831 million suggests growing trader interest in ADA.

Crypto Today: Bitcoin's downside risks escalate as BTC spot ETF outflows extend

The cryptocurrency market is consolidating losses after starting the week amid high volatility. Bitcoin attempted to steady the uptrend above $106,000 but lost steam, resulting in a reversal to $105,204 at the time of writing on Tuesday.

Bitcoin falls below $106,000 as risk-off sentiment persists

Bitcoin price faces rejection around its $106,406 resistance level on Tuesday, hinting at a potential correction ahead. Market sentiment sours as growing Israel-Gaza tensions weigh on riskier assets, such as BTC.

Coinbase asset roadmap adds Ethena, ENA targets $0.34 breakout before listing

Ethena records its fourth consecutive positive day, signaling increased bullish momentum. Coinbase announces the addition of Ethena to the asset roadmap, making it tradable on the platform soon.

Bitcoin: BTC dips as profit-taking surges, but institutional demand holds strong

Bitcoin (BTC) is stabilizing around $106,000 on Friday, following three consecutive days of correction that have resulted in a near 3% decline so far this week. The correction in BTC prices was further supported by the profit-taking activity of its holders, which has reached a three-month high.

[06.39.33, 15 Oct, 2020]-637383228900792556.png)