Ethereum Price Prediction: Rejections at key resistance forces ETH to consolidate – Confluence Detector

- The confluence detector shows a lack of healthy support levels on the downside.

- The whales have been accumulating their holdings, which is a positive sign.

Between September 2 and September 5, Ethereum dropped from $475.85 to $335. Since then, the smart contract giant went through a consolidation period before finding support at the 100-day SMA and bouncing up from $342 to $389 between October 7 and October 12. Since then, the buyers seemed to have lost steam near the $385 resistance line and has entered another consolidation period.

ETH/USD daily chart

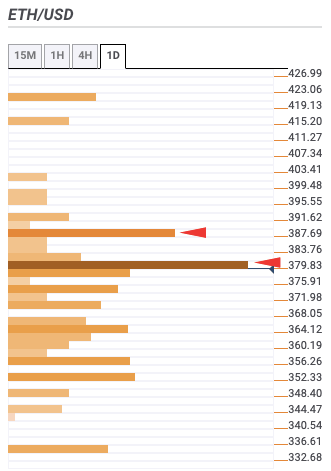

The MACD shows decreasing bullish momentum, which is a very worrying sign. Plus, to give further credence to our bearish outlook, the daily confluence detector shows a clear of strong support on the downside. The 50-day SMA, 100-day SMA and 200-day SMA can act as sound walls against the price drop; however, they may not be able to absorb a sudden spike in selling pressure. As per the daily confluence detector, a severe downturn can cause the price to plummet down to the 200-day SMA ($280).

ETH confluence detector

The Flipside: Can the bulls take over?

The bulls will need to break above the $385 resistance line before it continues to inflict heavy damage on the price. Even if they manage to break past that, there is another strong resistance at $390, limiting any upward movement. However, if they do manage to break past these two obstacles, they can take the price up to $425.

The bulls should also be encouraged by the action of the whales. As per Santiment’s holders distribution, it looks like the whales have opted to strengthen their holdings instead of dumping their coins. As per the metric, the number of addresses holding 10,000-100,000 tokens went up from 961 to 971 between October 8 and 16.

ETH holders distribution

Key price levels to watch

As per the daily confluence detector and repeated rejections at $385, the lack of healthy support should give the bears enough firepower to push the price down to the 100-day SMA. ($354.85), if the 50-day SMA doesn't hold strong. Further selling pressure will drop the price down to the 200-day SMA ($280).

To reverse this, the buyers will need to overcome two immediate resistance levels at $385 and $390 to have a positive breakout from the latest consolidation period. If this does happen, ETH should be able to reach up to $425.

Author

Rajarshi Mitra

Independent Analyst

Rajarshi entered the blockchain space in 2016. He is a blockchain researcher who has worked for Blockgeeks and has done research work for several ICOs. He gets regularly invited to give talks on the blockchain technology and cryptocurrencies.

-637384199204445527.png&w=1536&q=95)

%20%5B09.54.16%2C%2016%20Oct%2C%202020%5D-637384200195388538.png&w=1536&q=95)