Ethereum Price Prediction: Is the pre-Merge honeymoon rally coming to an end?

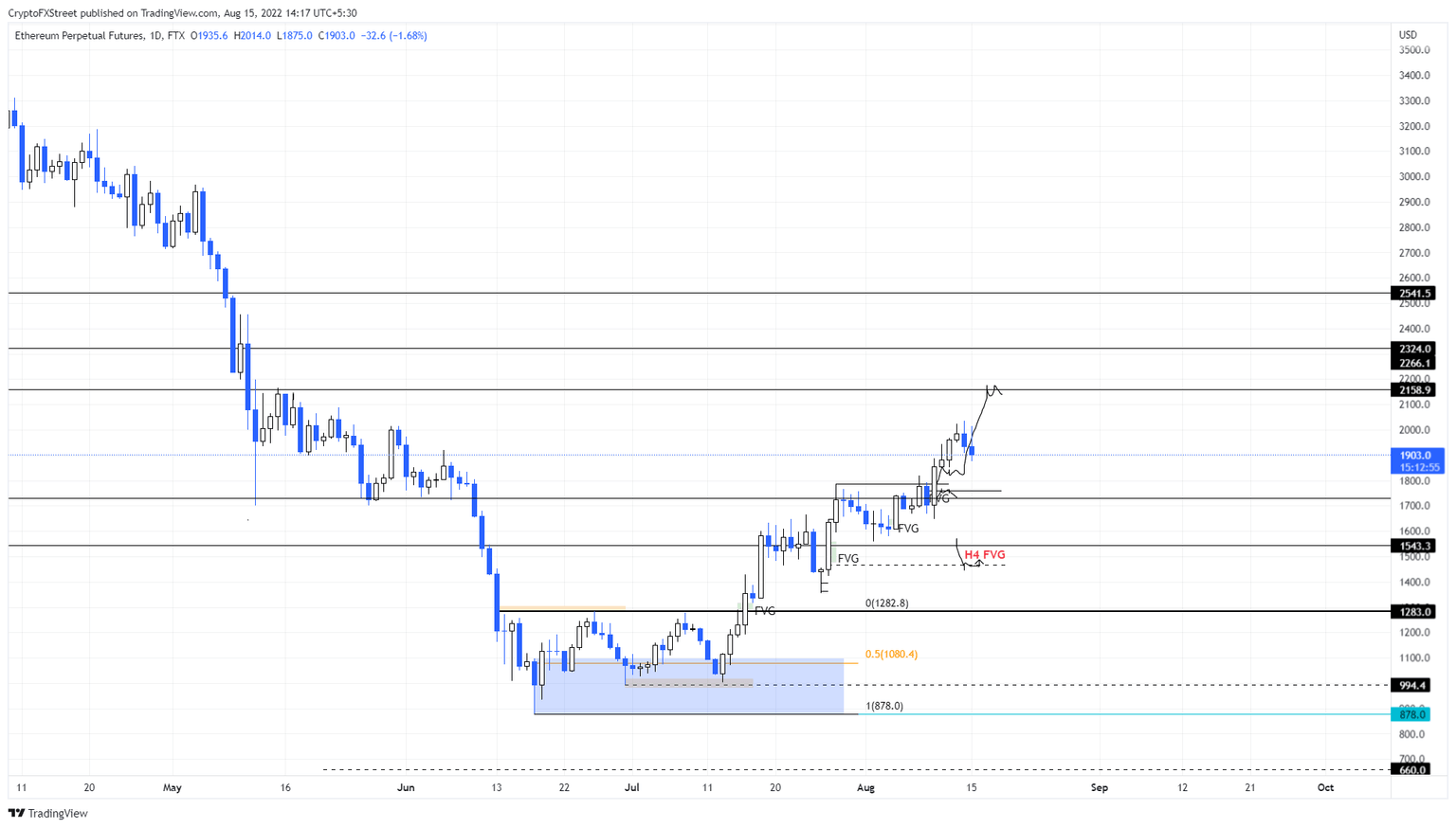

- Ethereum price shows signs of weakness and could retrace to the $1,730 support level.

- Any dips up to $1,540 are likely bullish retracements and are meant to be bought, especially with the fast-approaching Merge update.

- A daily candlestick close that flips the $1,270 support level into a resistance barrier will invalidate this bullish outlook.

Ethereum price has rallied 102% in the last 33 days, and one can attribute this to the upcoming software upgrade — the Merge. This update will shift the ETH blockchain from an energy-intensive Proof-of-Work (PoW) to an environment-friendly Proof-of-Stake (PoS).

As a result of the speculation, investors have also caused Ethereum-centric coins like Ethereum Classic (ETC), Optimism (OP), Ethereum Name Service (ENS), Polygon (MATIC) and others to explode.

While this upswing has been extremely profitable, there are many questions, at least from a speculators’ perspective, that are left unanswered. Some of these questions are:

- What will happen to Ethereum price after the Merge?

- Should I hold Ethereum Classic and other ETH-centric altcoins after the Merge?

Let’s try to answer these questions.

Should I hold ETH post-Merge?

Before we get into what will happen to Ethereum price after the Merge upgrade, let us understand what is happening right now.

The most popular ETH trade is to long spot and short long-dated futures. This is a delta-neutral trade, where the trader constructs their position in such a way that the total delta is neutral regardless of the direction.

In ETH’s case, investors are trying to extract the value, i.e., the ETH PoW airdrop. Moreover, Glassnode’s report adds credence to this outlook and states that market participants’ positions show that they are preparing for a “sell-the-news” event.

With roughly a month to the forecasted Merge upgrade, investors should consider booking profits and prepare for the worst, at least from their futures positions, be it ETH or other ETH-centric altcoins.

Arthur Hayes, the founder and ex-CEO of BitMEX, states that post-Merge, investors are likely to close their hedges – their short positions – on long-dated ETH futures, which will result in a large-scale buy-back, adding momentum to the upward movement of spot ETH price.

Hayes further asks what happens if the upgrade goes smoothly, while hedgers cover their short positions and speculators who believe the triple-halving narrative enter long positions.

Now the pressure is on the buy side, and market makers are short futures and must go long spot. A reversal of their positioning pre-merge. This is a positive feedback loop that leads to higher spot prices should the merge go smoothly on Sept 15th.

To conclude, the spot price of Ethereum should face a significant upthrust if, and only if, the Merge goes without a hitch. On the other hand, if there is a hiccup, then the contentious ETH PoW hardfork is likely to siphon more value.

After the Merge, Ethereum’s Beacon chain will split into ETH1 or ETH PoW and ETH2 or ETH PoS. The former fork, which is run by miners, will be a minority blockchain with a 5% to 95% value split compared to ETH2.

Will ETC, OP, MATIC and ETH1 dump?

The scenario mentioned above answers the second question, i.e., the majority of the miners will be supporting the ETH1 as opposed to Ethereum Classic (ETC) or other ETH-related coins, as mentioned above. A confirmation of this could be seen in hash rate decline across the board for ETC and other PoW storage coins like Filecoin (FIL), Arweave (AR), etc. Hence, these altcoins have a high probability of undoing the gains accrued over the last few weeks.

As for the ETH PoW airdrop, investors are likely to capture 5% of the value present in ETH1 and are more than likely to sell the tokens at the first sign of weakness. However, as history has it, this chain is likely to survive and become a ghost chain like other PoW coin forks such as Ethereum Classic (ETC), Bitcoin Cash (BCH) and Bitcoin SV (BSV), to name a few.

How high can Ethereum price go?

Ethereum price shows a pause in its rally around the $2,020 level after an 18% ascent since August 10. The start of a retracement could knock ETH down to the $1,730 support level. In total, this move would constitute a 9% pullback.

Although there are roughly 30 days left before the Merge, investors can expect the spot Ethereum price to ride higher. Therefore, the move to $1,730 will be a buy-the-dip retracement. In some cases, ETH might crash to an intermediate support level at $1,600.

Regardless of where Ethereum price stabilizes, the next level to watch for is $2,324.

ETH/USDT 1-day chart

On the other hand, a breakdown of the $1,600 or the $1,540 support levels will indicate that a steep correction is en route for Ethereum price. Only a daily candlestick close that flips the $1,270 support level into a resistance barrier will invalidate this bullish outlook.

In such a case, ETH is likely to head for the $1,080 support level, where buyers can step in and buy the smart contract token at a discount.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.